- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

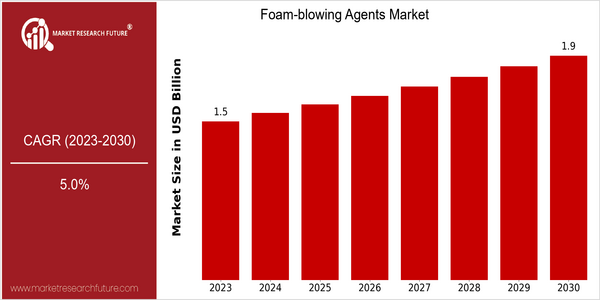

| Year | Value |

|---|---|

| 2023 | USD 1.5 Billion |

| 2030 | USD 1.9 Billion |

| CAGR (2023-2030) | 5.0 % |

Note – Market size depicts the revenue generated over the financial year

The foam blowing agent market is estimated to be worth approximately $1.4 billion in 2023, and is projected to reach $1.8 billion by 2023, at a CAGR of 5%. The steady growth of the market shows the increasing demand for foam blowing agents, which are used in the production of foam products used in the construction, automobile and packaging industries. The expected growth of the foam blowing agent market can be attributed to the increasing demand for lightweight materials and the growing emphasis on energy-efficient manufacturing processes. Also, several factors are driving the growth of the market, including the technological development of the foam blowing agent, which has improved the performance and environmental properties of foam blowing agents. The development of water-based and bio-based alternatives is gaining popularity due to the increasing trend towards a reduction in greenhouse gas emissions. The major players in the market, such as BASF, The Chemours Company, Arkema, and Eternal Chemistry, are actively involved in strategic initiatives, such as strategic alliances and R & D, to develop and expand their product offerings. The launch of new foam blowing agents that are more eco-friendly is an indication of the shift in the industry towards sustainable solutions, which will boost market growth.

Regional Market Size

Regional Deep Dive

Foaming Agents Market is characterized by different dynamics across different regions, based on the varying industrial applications, regulatory frameworks, and technological advancements. In North America, the market is characterized by a strong manufacturing base and an increased demand for eco-friendly products. In Europe, the market is characterized by the increasing focus on sustainable practices, while the Asia-Pacific region is expected to witness a significant rise in demand for these products, owing to the rapid industrialization and urbanization. The Middle East and Africa are expected to be characterized by growth in the construction and oil & gas sectors, while Latin America is expected to be characterized by the gradual adoption of foaming agents in various industries. Each region offers unique opportunities and challenges, which shape the overall market scenario.

Europe

- The European Union's Green Deal is driving significant changes in the foam-blowing agents market, promoting the use of low-global warming potential (GWP) agents and phasing out high-GWP substances.

- Companies such as BASF and Arkema are leading the charge in developing innovative foam-blowing agents that comply with these regulations, which is likely to reshape product offerings and market dynamics in the region.

Asia Pacific

- Rapid urbanization and industrial growth in countries like China and India are leading to increased demand for foam-blowing agents in construction and automotive applications, creating a robust market environment.

- Local manufacturers are increasingly collaborating with international firms to enhance their product portfolios, which is expected to drive innovation and competitiveness in the region.

Latin America

- Brazil's growing construction sector is driving demand for foam-blowing agents, particularly in the production of insulation materials, which is expected to boost market growth.

- Local regulations are gradually aligning with global sustainability trends, encouraging manufacturers to adopt greener blowing agents, which will likely enhance market competitiveness.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced stricter regulations on the use of certain blowing agents, pushing manufacturers to innovate and adopt more environmentally friendly alternatives, such as hydrofluoroolefins (HFOs).

- Key players like DuPont and Honeywell are investing in research and development to create sustainable foam-blowing agents, which is expected to enhance their market position and meet the growing demand for eco-friendly solutions.

Middle East And Africa

- The UAE's Vision 2021 initiative is promoting sustainable development, which is influencing the adoption of eco-friendly foam-blowing agents in construction and insulation applications.

- Companies like SABIC are investing in sustainable technologies, which is expected to enhance the availability of innovative foam-blowing agents in the region.

Did You Know?

“Did you know that the transition to low-GWP foam-blowing agents could potentially reduce greenhouse gas emissions by up to 90% compared to traditional agents?” — International Institute of Refrigeration

Segmental Market Size

The Foaming Agents category plays a crucial role in the production of various foam products, especially in the construction, automobile and packaging industries. This category is currently undergoing steady growth, which is driven by an increased demand for lightweight materials and improved insulating properties. A major reason for this growth is the growing need for energy-efficient building materials and stricter regulations aimed at reducing greenhouse gas emissions, which encourage the use of environmentally friendly foaming agents. The Foaming Agents market is currently in its mature stage of development, with companies such as BASF and Dow leading the way in terms of innovation and application. North America and Europe are the main users of these foaming agents, primarily in the construction and automobile industries. This growth is being fueled by trends such as the growing focus on sustainability and energy efficiency. The introduction of new water-based and bio-based foaming agents is also driving the category’s development towards more sustainable and efficient products.

Future Outlook

From 2023 to 2030, the foam-blowing agents market is expected to grow at a CAGR of 5.0% from $1.5 billion to $1.9 billion. In the construction, automobile and packaging industries, the demand for green and sustainable materials is increasing. In order to meet the increasing restrictions on the use of harmful substances, manufacturers are increasingly turning to new foam-blowing agents that meet the requirements of the environment and at the same time ensure performance. A major technological advancement, such as the development of water-blown and bio-based blowing agents, is expected to drive the penetration of the market. The shift towards sustainable products is not only driven by the regulatory environment, but also reflects the preferences of consumers for greener products. Also, the construction industry, especially in emerging economies, is expanding, and energy-saving insulating materials are the main materials that use foam blowing agents. The market is changing, and the industry must be agile to adapt to the trend, and take advantage of the trend of technological innovation.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.00% (2023-2030) |

Foam blowing agents Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.