Flavoured Syrups Size

Flavoured Syrups Market Growth Projections and Opportunities

The size of the market for flavored syrups is influenced by various factors, which in totality affect its growth and dynamics. For instance, an increasing number of people requiring custom-made drinks with special flavors are one of the major drivers behind the escalating demand for flavored syrups. Flavored syrups have evolved as an adaptable ingredient to improve taste profiles in different beverages such as coffee, tea, cocktails and soda as individuals seek to indulge in unique flavor experiences.”

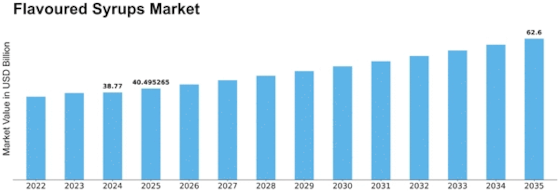

By 2032 the Flavored Syrups Market is expected to achieve a CAGR of 5.1% reaching a value upto USD 54.92 billion. This can be accounted for in terms of enhancing meal flavor which has made businesses earn higher revenues from it. In this forecast period, this projection underlines the economic importance of the market and its sustained expansion.

Switched diet habits and awareness about health also affect the flavoured syrups market. Healthier and natural alternatives are increasingly demanded by consumers as they become more mindful of their sugar consumption and overall well-being. As such, health conscious consumers can find sugar-free versions as well as naturally-sweetened options among flavoured syrups introduced by industry players that endeavor not only to maintain a favorable taste profile but also respond to these changing trends.

Flavoured syrup markets are driven largely by food service sector activity. The use if flavored syrup in cafes restaurants and bars help create signature drinks which improve dining experience generally perceived by customers within these establishments. Speciality coffee shops’ popularity alongside mixology within beverages further contributes towards diversification into many kinds of flavored syrup hence opening up pull factors for market expansion.

Additionally, seasonal tastes together with regional preferences influence how flavoured syrup markets perform. Cultural or culinary-based preferences determine popularity levels of some flavors during specific times or/and regions around the world hence making makers usually adapt their product formulations so as to meet their demands and be competitive and relevant to a wider audience.

The flavoured syrup markets are also affected by government regulations while labelling requirements also play a role. It is imperative for companies seeking to gain the confidence of consumers that they comply with food safety guidelines, reveal information about ingredients used, and offer nutritional labeling. Market participants who adhere proactively to these standards may establish brand equity favorable toward them thus positioning themselves well amongst rivals.

Supermarkets, convenience stores, online platforms among others form part of distribution channels which ensure accessibility and availability of flavored syrups. Product visibility through efficient distribution networks combined with strategic alliances with retailers ensures easy access for customers to their preferred flavors available.

Leave a Comment