Evolving Regulatory Frameworks

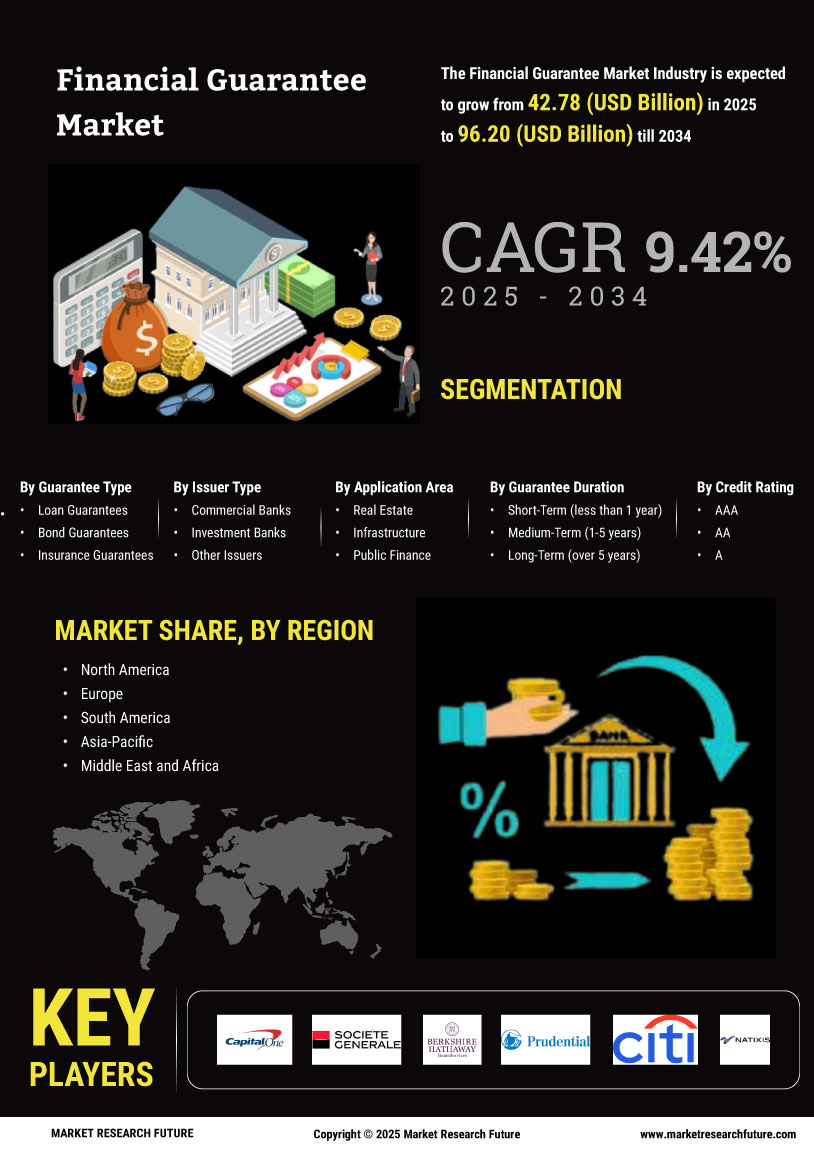

The Financial Guarantee Market is significantly influenced by evolving regulatory frameworks that aim to enhance financial stability and transparency. Regulatory bodies are increasingly mandating the use of financial guarantees in various sectors, including real estate and public finance. This shift appears to be driven by a desire to mitigate risks associated with defaults and enhance investor confidence. As of 2025, regulations are becoming more stringent, requiring companies to secure financial guarantees for larger transactions. This trend may lead to an increase in demand for financial guarantee products, as businesses seek to comply with these regulations while ensuring their financial obligations are met.

Rising Awareness of Credit Risk

The Financial Guarantee Market is witnessing a growing awareness of credit risk among investors and businesses. As financial markets become more interconnected, the potential for defaults has heightened, prompting stakeholders to seek protective measures. This awareness is likely to drive demand for financial guarantees, as they provide a safety net against credit risks. In 2025, it is estimated that the market for credit risk management solutions will expand by approximately 6%, indicating a robust interest in financial guarantees as a risk mitigation tool. Consequently, the Financial Guarantee Market may experience increased activity as entities prioritize securing their financial interests.

Global Economic Recovery and Growth

The Financial Guarantee Market is poised for growth as economies recover and expand. Economic indicators suggest a positive trajectory, with GDP growth rates projected to rise in various regions. This recovery is likely to stimulate investment activities, leading to an increased demand for financial guarantees. In 2025, the market is expected to grow by approximately 4%, driven by heightened business confidence and a resurgence in capital expenditures. As companies seek to secure financing for new projects, the Financial Guarantee Market may benefit from this renewed economic vigor, positioning itself as a critical player in facilitating financial transactions.

Increased Infrastructure Investments

The Financial Guarantee Market is experiencing a surge in demand due to heightened investments in infrastructure projects. Governments and private entities are allocating substantial budgets to enhance transportation, energy, and communication systems. This trend is likely to drive the need for financial guarantees, as stakeholders seek assurance against potential defaults. In 2025, infrastructure spending is projected to reach unprecedented levels, with estimates suggesting a growth rate of approximately 5% annually. Such investments necessitate robust financial backing, thereby propelling the Financial Guarantee Market forward. Furthermore, the complexity of these projects often requires multi-layered financial guarantees, which could lead to an expansion of service offerings within the industry.

Technological Advancements in Financial Services

The Financial Guarantee Market is being transformed by technological advancements that enhance the efficiency and accessibility of financial services. Innovations such as blockchain and artificial intelligence are streamlining the underwriting processes for financial guarantees, making them more attractive to businesses. In 2025, the adoption of these technologies is expected to increase, potentially reducing costs and improving turnaround times for guarantee issuance. This technological integration may lead to a broader customer base, as smaller enterprises gain access to financial guarantees that were previously unattainable. As a result, the Financial Guarantee Market could see a diversification of its client portfolio.