Facility Management Services Market Summary

As per MRFR Analysis, the Facility Management Services Market was valued at 37.29 USD Billion in 2023 and is projected to grow to 55.3 USD Billion by 2035, reflecting a CAGR of 3.34% from 2025 to 2035. The market is driven by the increasing demand for efficiency, sustainability, and technological advancements across various sectors.

Key Market Trends & Highlights

Key trends driving the Facility Management Services Market include sustainability initiatives and technological integration.

- The market is expected to reach 38.54 USD Billion in 2024, with Cleaning Services valued at 10.5 USD Billion.

- The rise of remote work is prompting innovative facility management solutions to accommodate hybrid work patterns.

- Over 30% of facility management firms are projected to adopt innovative technology by 2025.

- Compliance with workplace safety regulations has increased by 40% since 2020, influencing service demand.

Market Size & Forecast

2023 Market Size: USD 37.29 Billion

2024 Market Size: USD 38.54 Billion

2035 Market Size: USD 55.3 Billion

CAGR (2025-2035): 3.34%

Largest Regional Market Share in 2024: North America.

Major Players

Key players include Cushman and Wakefield, CBRE Group, WSP Global, Sodexo, and ISS.

The rapid urbanization and infrastructure development and increased security concerns and the need for surveillance systems and stringent government regulations and compliance are driving the growth of the Facility Management Servies Market.

As per the Analyst at MRFR, the increasing need of urbanization and large-scale infrastructure projects is significantly driving the demand for facility management services. Due to the increase in urban space, with new commercial, residential, and industrial lands, there is a significant need for facility maintenance, building security, energy management, and sustainability solutions.

Governments and private developers are putting in substantial investments in smart cities, green infrastructure, and high-tech urban projects, integrating IoT, AI, and automation to make facility operations efficient. These enhance the need for complex facility management practices, particularly in energy efficiency, predictive maintenance, and seamless digital integration to ensure continued operational effectiveness.

FIGURE 1: FACILITY MANAGEMENT SERVIES MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Facility Management Servies Market Opportunity

SUSTAINABILITY AND GREEN CERTIFICATIONS

Green building certification is used to assess and assure a project's sustainability and environmental performance. This certification is a credential awarded to a building that has complied with specific standards, entirely certifying that a building was designed and built to minimize its environmental impact by using energy- and water-efficient practices, promoting indoor air quality, and managing waste effectively throughout its lifecycle; it defines the commitment to environmentally responsible building practices through a process of assessment that includes aspects such as energy use, water consumption, material selection, and site development.

Facility management companies can capitalize on this growing demand by offering services that help clients achieve and maintain these certifications. This includes implementing energy management systems, improving waste management practices, adopting eco-friendly technologies, and ensuring that buildings operate in an environmentally responsible manner. Not only do these green initiatives help organizations reduce operating costs and comply with environmental regulations, but they also attract environmentally conscious tenants and customers, enhancing a business's brand image and sustainability credentials.

- The U.S. Green Building Council (USGBC) released the beta draft of LEED v5 in April 2024, focusing on decarbonization, health, and resilience. This version aims to enhance building performance and sustainability standards

- Also, The Green Building Initiative's Green Globes certification continued to gain traction in 2024, offering a flexible and cost-effective approach to green building assessment. It evaluates environmental sustainability, health, wellness, and resilience across various building types.

- BREEAM, one of the world's leading sustainability assessment methods for master planning projects, infrastructure, and buildings, continued to expand its influence in 2024. It assesses the sustainability performance of buildings across various categories, including energy, health and well-being, innovation, land use, materials, management, pollution, transport, water, and waste.

Facility Management Servies Market Segment Insights

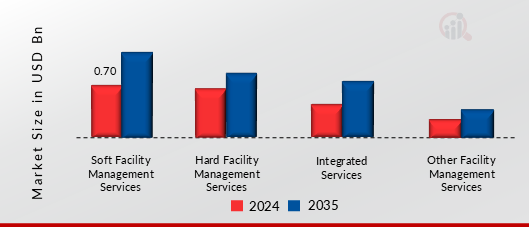

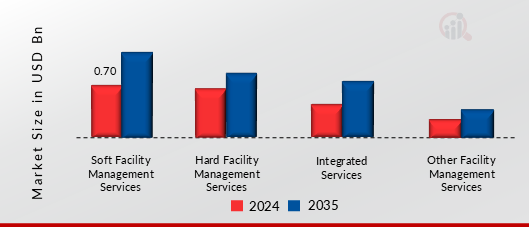

Facility Management Servies by Service Type Insights

Based on Service Type, this segment includes Hard Facility Management Services (HVAC Maintenance & Repair, Electrical & Power Systems Management, Plumbing & Water Management, Fire Safety & Security Systems, Building Automation & Energy Management, Data Center Infrastructure Management (DCIM), Cleanroom Maintenance (Pharmaceutical & Semiconductor Facilities)), Soft Facility Management Services (Housekeeping & Janitorial Services, Waste Management & Recycling, Landscaping & Groundskeeping, Catering & Food Services, Workplace & Space Management, Employee Well-Being & Sustainability Services), Integrated Services, Other Facility Management Services.

The Soft Facility Management Services segment dominated the global market in 2024, while the Hard Facility Management Services segment is projected to be the fastest–growing segment during the forecast period. Soft-end services of FM consist of any service that touches upon the aspects of non-technical maintenance of the operational functionality, safety, and comfort of a building, such as cleaning, security, gardening, catering, reception services, pest control. Such services provide comfort and facilitate an efficient surrounding for the users by bringing hygiene, safety, and convenience factors into consideration.

Soft FM services may also cover front desk operations/space-planning/workplace experience management/ meeting support. Usually, these services are user-oriented and operational in nature since they are provided on a routine basis, daily, weekly, or upon request, to maintain a clean, organized, and safe environment. Typical across any sector, corporate offices, public buildings, retail, hospitality, healthcare, and education, soft FM services tend to be service-oriented and address labor, operational costs and user experience throughout the establishment.

FIGURE 2: FACILITY MANAGEMENT SERVIES MARKET SHARE BY SERVICE TYPE 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Facility Management Servies by Deployment Mode Insights

Based on Deployment Mode, this segment includes On-Site Facility Management, Outsourced Facility Management, Integrated Facility Management (IFM). The On-Site Facility Management segment dominated the global market in 2024, while the Outsourced Facility Management segment is projected to be the fastest–growing segment during the forecast period.

On-site facility management service refers to a service where a dedicated team of professionals is physically present at a company's building or facility, responsible for managing all aspects of its maintenance, operations, and upkeep, including cleaning, security, repairs, maintenance, and overall functionality, essentially ensuring the building runs smoothly and safely for occupants on a day-to-day basis; essentially, they are on location to handle all facility-related tasks as needed.

Facility Management Servies by Organization Size Insights

Based on Organization Size, this segment includes Small & Medium Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment dominated the global market in 2024, while the Small & Medium Enterprises (SMEs) segment is projected to be the fastest–growing segment during the forecast period. Large enterprises require facility management (FM) services to ensure seamless operations, cost efficiency, and workplace optimization across their vast infrastructure, including corporate offices, manufacturing plants, data centers, and logistics hubs. Effective FM enhances operational efficiency, sustainability, compliance, and employee well-being by managing assets, energy use, security, and maintenance.

With the growing complexity of global operations, enterprises rely on integrated FM solutions to streamline processes, reduce downtime, and implement smart building technologies. Additionally, FM plays a critical role in business continuity, risk management, and regulatory compliance, helping large organizations maintain high productivity, reduce costs, and adapt to evolving workplace and environmental standards.

Facility Management Servies by Industry Vertical Insights

Based on Industry Vertical, this segment includes Data Centers, Pharmaceutical Plants, Gigafactories (Battery Manufacturing Facilities), Semiconductor Manufacturing Facilities, IT & Telecom, Healthcare & Life Sciences, Automotive & Aerospace, Industrial & Manufacturing, Retail & Commercial Buildings, Government & Public Sector, Others. The Data Centers segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period.

Data Centers facility management services include implementing smart energy solutions to monitor and reduce power usage, utilizing renewable energy sources to support sustainability goals, maintaining optimal temperature and humidity levels for sensitive equipment, regular maintenance to ensure the reliability of cooling systems, robust access control systems and surveillance to prevent unauthorized entry, using IoT and analytics to predict and prevent equipment failures, ensuring cleanliness and hygiene in critical areas for hardware health etc.

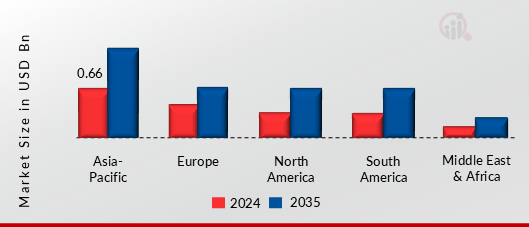

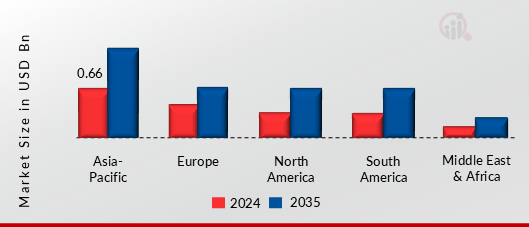

Facility Management Servies Regional Insights

Based on the Region, the global Facility Management Servies are segmented into North America, Europe, Asia-Pacific, South America and Middle East & Africa. The Asia-Pacific dominated the global market in 2024, while the South America is projected to be the fastest–growing segment during the forecast period. Major demand factors driving the Asia-Pacific market are the rapid urbanization and infrastructure development and increased security concerns and the need for surveillance systems and stringent government regulations and compliance. Governments throughout Asia-Pacific are making major investments in construction and infrastructure.

Three main components of infrastructure development are structural engineering, the construction of new buildings, and the renewal of current facilities. The region is a major hub for industrial manufacturing and, in recent years, has become a global focal point for significant investments and business expansions. The rapidly growing construction spending, infrastructure development, increasing emphasis on safety and security of the facility, and stringent government regulations regarding facility management are a few of the factors that are expected to drive market growth.

FIGURE 3: FACILITY MANAGEMENT SERVIES MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, UK, France, Russia, Italy, Spain, China, India, Japan, South Korea, Malaysia, Thailand, Indonesia, Brazil, Argentina, GCC Countries, South Africa and others.

Global Facility Management Servies Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Facility Management Servies Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are Aramark Corporation, Sodexo, CBRE, SIS Group Limited, Compass Group PLC, Cushman & Wakefield, EMCOR Group, Inc., GDI Integrated Facility Services, ISS Facility Services Inc., Quess Corp Ltd. are among others. The Facility Management Servies Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Facility Management Servies Market include

- Aramark Corporation

- Sodexo

- CBRE

- SIS Group Limited

- Compass Group PLC

- Cushman & Wakefield

- EMCOR Group, Inc.

- GDI Integrated Facility Services

- ISS Facility Services Inc.

- Quess Corp Ltd.

Facility Management Servies Market Industry Developments

January 2024: Compass Group PLC has signed an agreement to acquire CH&CO, CH&CO has a highly regarded management team and a long track record of strong performance delivering a bespoke and high-quality food offer through several sector brands.

August 2024: In a significant new alliance, Aramark UK has been named Everton Football Club's (FC) Official Culinary Experience Partner for the new stadium located at Bramley-Moore Dock in north Liverpool. Beginning in 2025, the long-term agreement will be Aramark UK's first collaboration with a Premier League team.

November 2024: Convenience in North America will develop even faster with Sodexo's acquisition of CRH Catering. In addition to expanding its multi-channel capabilities with more micro-markets, vending, office coffee, pantry, fresh food, and on-site food services, Sodexo is strengthening its territorial presence on the East Coast with CRH Catering.

March 2022: Allsec Technologies Limited to Merge Into Quess Corp Limited. The merger is subject to the approval of the respective shareholders and creditors of Quess and Allsec, Stock Exchanges, SEBI, the National Company Law Tribunal and other regulatory authorities as may be required. Till the Scheme becomes effective, Quess and Allsec will continue to function independently.

Facility Management Servies Market Segmentation

Facility Management Servies by Service Type Outlook

-

Hard Facility Management Services

- HVAC Maintenance & Repair

- Electrical & Power Systems Management

- Plumbing & Water Management

- Fire Safety & Security Systems

- Building Automation & Energy Management

- Data Center Infrastructure Management (DCIM)

- Cleanroom Maintenance (Pharmaceutical & Semiconductor Facilities)

-

Soft Facility Management Services

- Housekeeping & Janitorial Services

- Waste Management & Recycling

- Landscaping & Groundskeeping

- Catering & Food Services

- Workplace & Space Management

- Employee Well-Being & Sustainability Services

- Integrated Services

- Other Facility Management Services

Facility Management Servies by Deployment Mode Outlook

- On-Site Facility Management

- Outsourced Facility Management

- Integrated Facility Management (IFM)

Facility Management Servies by Organization Size Outlook

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Facility Management Servies by Industry Vertical Outlook

- Data Centers

- Pharmaceutical Plants

- Gigafactories (Battery Manufacturing Facilities)

- Semiconductor Manufacturing Facilities

- IT & Telecom

- Healthcare & Life Sciences

- Automotive & Aerospace

- Industrial & Manufacturing

- Retail & Commercial Buildings

- Government & Public Sector

- Others

Facility Management Servies Regional Outlook

-

North America

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

USD 1.77 Billion

|

|

Market Size 2025

|

USD 1.90 Billion

|

|

Market Size 2035

|

USD 4.10 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

7.9% (2025-2035)

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2035

|

|

Historical Data

|

2019-2023

|

|

Forecast Units

|

Value (USD Billion)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

By Service Type, By Deployment Mode, By Organization Siza, By Industry Vertical

|

|

Geographies Covered

|

North America, Europe, Asia Pacific, South America, Middle East & Africa

|

|

Countries Covered

|

The US, Canada, Mexico, Germany, UK, France, Russia, Italy, Spain, China, India, Japan, South Korea, Malaysia, Thailand, Indonesia, Brazil, Argentina, GCC Countries, South Africa

|

|

Key Companies Profiled

|

Aramark Corporation, Sodexo, CBRE, SIS Group Limited, Compass Group PLC, Cushman & Wakefield, EMCOR Group, Inc., GDI Integrated Facility Services, ISS Facility Services Inc., Quess Corp Ltd.

|

|

Key Market Opportunities

|

· Sustainability and green certifications

· Supportive government initiatives for the development of smart cities and business hubs

· Inclination towards virtual workplace and demand for personalized services

|

|

Key Market Dynamics

|

· Rapid urbanization and infrastructure development

· Increased security concerns and the need for surveillance systems

· Stringent government regulations and compliance

|

Facility Management Services Market Highlights:

Frequently Asked Questions (FAQ) :

USD 1.77 Billion is the Facility Management Servies Market in 2024

The On-Site Facility Management segment by Deployment Mode holds the largest market share and grows at a CAGR of 7.0 % during the forecast period.

Asia-Pacific holds the largest market share in the Facility Management Servies Market.

Aramark Corporation, Sodexo, CBRE, SIS Group Limited, Compass Group PLC, Cushman & Wakefield, EMCOR Group, Inc., GDI Integrated Facility Services, ISS Facility Services Inc., Quess Corp Ltd. are prominent players in the Facility Management Servies Market.

The Large Enterprises segment dominated the market in 2024.