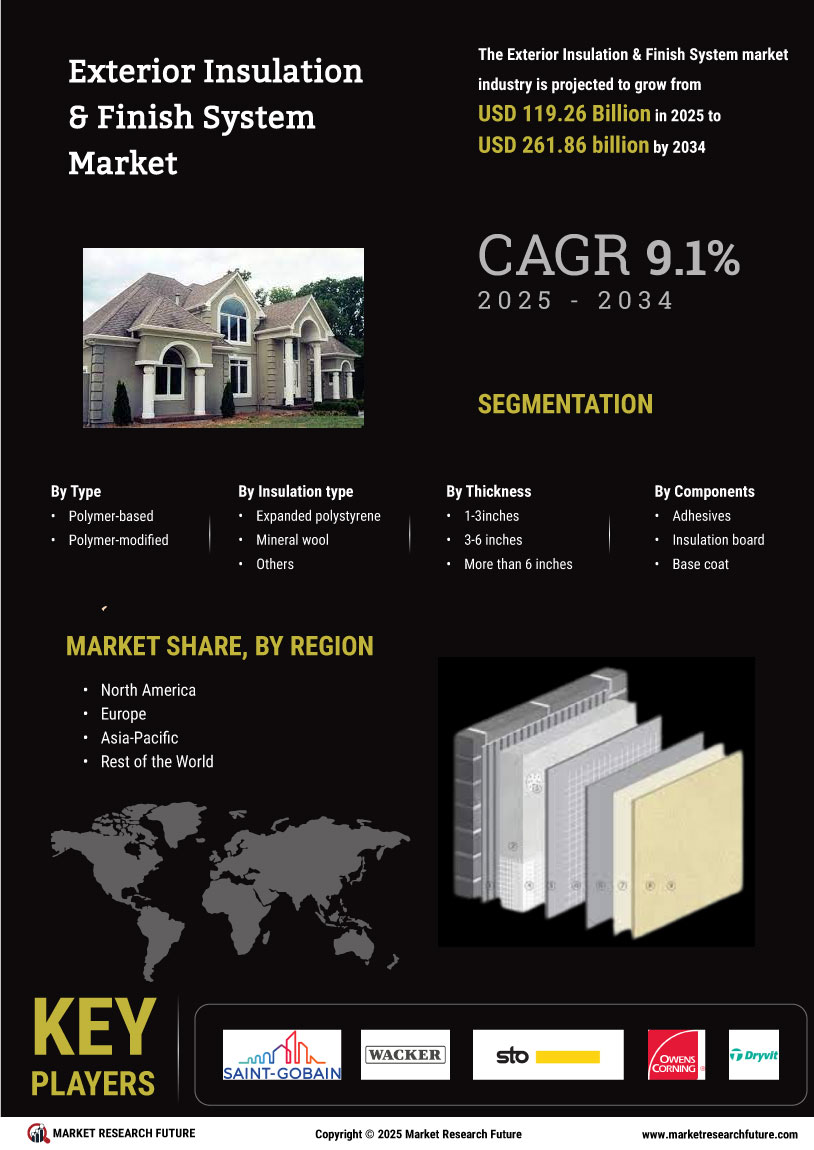

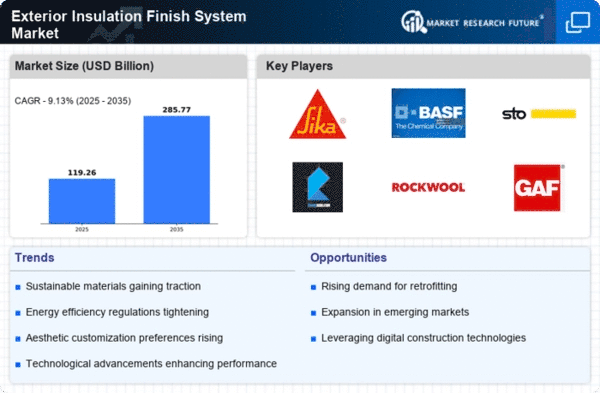

Market Growth Projections

The Global Exterior Insulation and Finish System Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 285.7 USD Billion by 2035, the industry is on a trajectory of significant expansion. This growth is underpinned by various factors, including rising construction activities, technological advancements, and increased awareness of sustainability. The compound annual growth rate of 9.13% from 2025 to 2035 further illustrates the market's potential. These projections indicate a robust future for the industry, driven by evolving consumer preferences and regulatory frameworks.

Rising Construction Activities

The Global Exterior Insulation and Finish System Market Industry benefits from the ongoing expansion of construction activities across various regions. Urbanization and population growth are driving the demand for new residential and commercial buildings, which in turn increases the need for effective insulation solutions. For example, in regions like Asia-Pacific, rapid urban development is leading to a substantial rise in construction projects. This trend is likely to propel the market forward, with estimates suggesting that the industry could reach a value of 285.7 USD Billion by 2035, highlighting the correlation between construction growth and insulation demand.

Growing Demand for Energy Efficiency

The Global Exterior Insulation and Finish System Market Industry is experiencing a surge in demand driven by the increasing emphasis on energy efficiency in building construction. As governments worldwide implement stricter energy codes and standards, the need for effective insulation solutions becomes paramount. For instance, the adoption of exterior insulation systems can reduce energy consumption by up to 30%, making buildings more sustainable. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 109.3 USD Billion in 2024, reflecting a robust shift towards energy-efficient building practices.

Government Initiatives and Incentives

Government initiatives aimed at promoting energy-efficient construction are significantly impacting the Global Exterior Insulation and Finish System Market Industry. Various countries are implementing policies and providing incentives to encourage the adoption of insulation technologies. For instance, tax credits and rebates for energy-efficient upgrades are becoming more common, motivating builders and homeowners to invest in exterior insulation systems. These initiatives not only support market growth but also align with national goals for reducing energy consumption and greenhouse gas emissions. As a result, the market is poised for expansion, driven by favorable regulatory environments.

Technological Advancements in Insulation Materials

Innovations in insulation materials are playing a crucial role in shaping the Global Exterior Insulation and Finish System Market Industry. The development of advanced materials, such as lightweight and high-performance insulation boards, enhances the effectiveness of exterior insulation systems. These advancements not only improve thermal performance but also contribute to the durability and longevity of buildings. As manufacturers continue to invest in research and development, the market is expected to witness significant growth, potentially achieving a compound annual growth rate of 9.13% from 2025 to 2035, driven by these technological improvements.

Increased Awareness of Sustainable Building Practices

The Global Exterior Insulation and Finish System Market Industry is also influenced by the growing awareness of sustainable building practices among architects, builders, and consumers. As environmental concerns gain prominence, stakeholders are increasingly opting for insulation solutions that minimize carbon footprints and enhance energy efficiency. This shift is evident in various green building certifications, which often require the use of exterior insulation systems. Consequently, this trend is likely to drive market growth, as more projects incorporate sustainable practices, aligning with global efforts to combat climate change and promote eco-friendly construction.