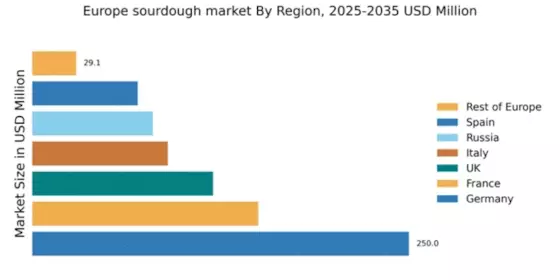

Germany : Strong Demand and Tradition Drive Sales

Germany holds a commanding market share of 250.0, representing a significant portion of the European sourdough market. Key growth drivers include a rising consumer preference for artisanal and organic products, alongside a growing trend towards healthier eating. Regulatory support for local bakeries and initiatives promoting traditional baking methods further bolster this market. The robust infrastructure in cities like Berlin and Munich facilitates efficient distribution and production, enhancing market accessibility.

UK : Artisanal Trends Shape Consumer Choices

The UK sourdough market is valued at 120.0, reflecting a growing interest in artisanal bread. Key growth drivers include the increasing popularity of home baking and a shift towards organic ingredients. Demand is particularly strong in urban areas like London and Manchester, where consumers seek high-quality, locally sourced products. Government initiatives promoting healthy eating and food education are also influencing consumption patterns, while the competitive landscape features both local bakeries and international brands.

France : Culinary Tradition Fuels Market Growth

With a market value of 150.0, France showcases a deep-rooted appreciation for sourdough, driven by its culinary heritage. The growth is supported by increasing consumer awareness of health benefits associated with sourdough. Cities like Paris and Lyon are key markets, where artisanal bakeries thrive. Regulatory policies favoring traditional baking methods and local sourcing enhance market dynamics, while major players like La Brea Bakery are establishing a strong presence in the region.

Russia : Growing Interest in Artisanal Bread

Russia's sourdough market, valued at 80.0, is witnessing a gradual rise in consumer interest towards artisanal products. Key growth drivers include a shift in consumer preferences towards healthier options and the influence of Western baking trends. Major cities like Moscow and St. Petersburg are pivotal markets, with local bakeries gaining traction. The competitive landscape is evolving, with both domestic and international players entering the market, supported by favorable government policies promoting local food production.

Italy : Tradition Meets Modern Demand

Italy's sourdough market, valued at 90.0, reflects a blend of tradition and modern consumer preferences. The growth is driven by an increasing demand for authentic, high-quality bread, particularly in regions like Tuscany and Lombardy. Regulatory support for artisanal baking and local sourcing initiatives enhance market conditions. The competitive landscape features both established brands and local bakeries, with a focus on quality and heritage, catering to a discerning consumer base.

Spain : Cultural Shift Towards Artisanal Bread

Spain's sourdough market, valued at 70.0, is experiencing growth fueled by a cultural shift towards artisanal and organic products. Key cities like Barcelona and Madrid are leading this trend, with consumers increasingly seeking healthier options. Government initiatives promoting local food production and sustainability are also influencing market dynamics. The competitive landscape includes both local bakeries and international brands, creating a diverse offering for consumers.

Rest of Europe : Varied Preferences Shape Local Trends

The Rest of Europe, with a market value of 29.1, showcases diverse sourdough preferences across various countries. Growth drivers include increasing health consciousness and a rising interest in artisanal baking. Local regulations supporting small-scale producers and traditional methods are enhancing market conditions. Key markets include cities in Scandinavia and Eastern Europe, where local bakeries are gaining popularity. The competitive landscape is characterized by a mix of local and international players, catering to unique regional tastes.