Culinary Trends Favoring Cheese

The natural cheese market in Europe is significantly impacted by evolving culinary trends that favor cheese as a key ingredient. The rise of gourmet cooking and the popularity of cheese-centric dishes in restaurants and home kitchens are driving demand. In 2025, it is projected that cheese consumption in Europe will increase by approximately 10%, with natural cheese being a preferred choice among chefs and home cooks alike. This trend is further supported by the growing interest in cheese pairings and artisanal cheese boards, which highlight the versatility of natural cheese. The natural cheese market stands to gain from this culinary renaissance, as consumers seek high-quality, flavorful cheese to enhance their dining experiences.

Innovations in Cheese Production

Technological advancements in cheese production are significantly influencing the natural cheese market in Europe. Innovations such as improved fermentation techniques and the use of non-GMO ingredients are enhancing product quality and consistency. In 2025, it is estimated that around 20% of cheese producers in Europe will adopt these innovative practices, leading to a more diverse range of natural cheese products. This evolution not only caters to changing consumer preferences but also allows producers to differentiate their offerings in a competitive market. The natural cheese market is thus poised for growth as these innovations attract a broader consumer base, including those seeking unique flavors and textures.

Increased Focus on Local Sourcing

The natural cheese market in Europe is witnessing a shift towards local sourcing, as consumers become more conscious of the origins of their food. This trend is driven by a desire to support local economies and reduce carbon footprints associated with long-distance food transportation. In 2025, it is anticipated that locally sourced cheese will represent about 25% of the natural cheese market. This preference for local products encourages cheese makers to emphasize regional specialties and traditional production methods, thereby enriching the diversity of offerings. The natural cheese market is likely to thrive as consumers increasingly value the connection between food and local culture, fostering a sense of community and authenticity.

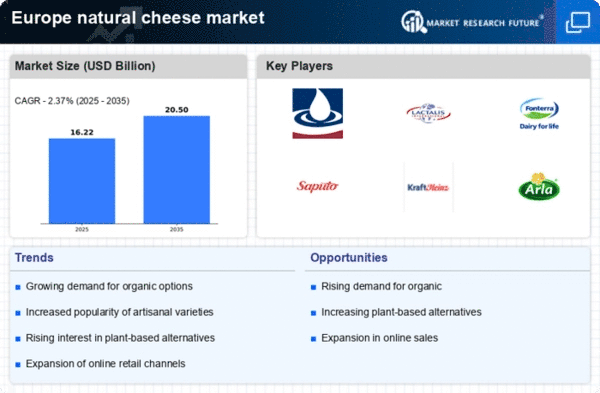

Rising Demand for Organic Products

The natural cheese market in Europe experiences a notable increase in demand for organic products. Consumers are increasingly prioritizing health and sustainability, leading to a shift towards organic cheese options. In 2025, organic cheese sales are projected to account for approximately 15% of the total cheese market in Europe. This trend is driven by a growing awareness of the benefits of organic farming practices, which are perceived to yield healthier and more flavorful products. As a result, producers are adapting their offerings to meet this demand, thereby enhancing their market presence. The natural cheese market is likely to benefit from this shift, as consumers seek transparency in sourcing and production methods, further driving the growth of organic cheese varieties.

Growing Popularity of Plant-Based Alternatives

The natural cheese market in Europe is experiencing a notable impact from the rising popularity of plant-based alternatives. While traditional cheese remains a staple, the increasing demand for vegan and dairy-free options is reshaping consumer preferences. In 2025, it is estimated that plant-based cheese products will capture around 10% of the overall cheese market. This trend is driven by health considerations, dietary restrictions, and ethical concerns regarding animal welfare. The natural cheese market must adapt to this changing landscape by potentially incorporating plant-based ingredients or offering hybrid products that appeal to both traditional and health-conscious consumers. This evolution presents both challenges and opportunities for producers in the natural cheese sector.