Increased Focus on Data Visualization

The growing importance of data visualization in decision-making processes is significantly impacting the graphical user-interface-design-software market in Europe. Organizations are increasingly recognizing the value of presenting complex data in a visually appealing and easily digestible format. This trend is reflected in the market, where data visualization tools are projected to account for around 25% of the total software market by 2026. As businesses strive to make data-driven decisions, the demand for graphical user-interface-design-software that incorporates advanced visualization capabilities is likely to rise. This focus on data representation not only aids in better understanding but also enhances communication and collaboration within teams.

Rising Demand for User-Centric Design

The graphical user-interface-design-software market in Europe is experiencing a notable shift towards user-centric design principles. As organizations increasingly prioritize user experience, the demand for software that facilitates intuitive and engaging interfaces is on the rise. This trend is reflected in the market data, which indicates that user-centric design tools are projected to capture approximately 35% of the overall market share by 2026. Companies are investing in software that allows for rapid prototyping and user testing, ensuring that end-users are at the forefront of the design process. This focus on user-centricity not only enhances customer satisfaction but also drives higher conversion rates, making it a critical driver in the graphical user-interface-design-software market.

Emphasis on Cross-Platform Compatibility

In the current landscape, the emphasis on cross-platform compatibility is becoming a pivotal driver for the graphical user-interface-design-software market in Europe. As businesses aim to reach a broader audience, the need for software that enables seamless functionality across various devices and operating systems is paramount. Recent studies indicate that approximately 60% of users expect applications to perform consistently, regardless of the platform. This expectation is pushing developers to adopt design tools that facilitate cross-platform development, thereby enhancing user engagement and retention. The ability to create interfaces that work flawlessly on both web and mobile platforms is likely to drive growth in the graphical user-interface-design-software market.

Growth of Mobile Application Development

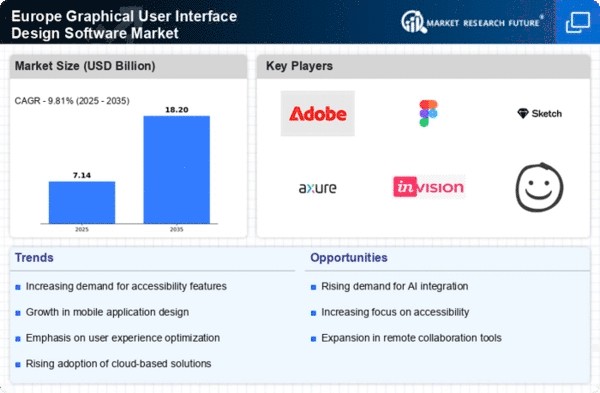

The surge in mobile application development is significantly influencing the graphical user-interface-design-software market in Europe. With mobile devices becoming the primary means of accessing digital content, there is an increasing need for software that supports the creation of responsive and visually appealing mobile interfaces. Market analysis suggests that the mobile application segment is expected to grow at a CAGR of 20% over the next five years. This growth is prompting software developers to seek advanced design tools that can streamline the development process and enhance the overall user experience. Consequently, the demand for graphical user-interface-design-software tailored for mobile applications is likely to expand, positioning it as a key driver in the market.

Adoption of Agile Development Methodologies

The adoption of agile development methodologies is reshaping the landscape of the graphical user-interface-design-software market in Europe. Agile practices promote iterative design and rapid feedback, which are essential for creating effective user interfaces. This shift is encouraging software developers to utilize tools that support agile workflows, enabling them to respond quickly to user feedback and market changes. Recent data suggests that organizations employing agile methodologies experience a 30% increase in project efficiency. As a result, the demand for graphical user-interface-design-software that aligns with agile principles is likely to grow, making it a crucial driver in the market.