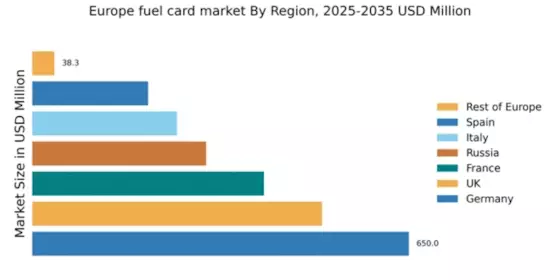

Germany : Strong Infrastructure and Demand Growth

Germany holds a dominant position in the European fuel card market, with a market value of $650.0 million, representing approximately 30% of the total market share. Key growth drivers include a robust logistics sector, increasing fuel prices, and a shift towards digital payment solutions. Regulatory policies promoting sustainability and efficiency in transportation further enhance demand. The government's investment in infrastructure, particularly in electric vehicle charging stations, is also noteworthy.

UK : Evolving Market with Competitive Edge

The UK fuel card market is valued at $500.0 million, accounting for about 23% of the European market. Growth is driven by the rise in e-commerce and delivery services, leading to increased fuel consumption. Government initiatives aimed at reducing carbon emissions are also influencing market dynamics. The competitive landscape is characterized by a mix of local and international players, with a focus on innovative payment solutions and customer service enhancements.

France : Sustainability and Innovation Focus

France's fuel card market is valued at $400.0 million, representing around 18% of the European market. Key growth drivers include a strong emphasis on sustainability and the adoption of alternative fuels. The French government has implemented policies to encourage the use of low-emission vehicles, which is boosting demand for fuel cards. Additionally, urbanization and the expansion of logistics networks are contributing to market growth.

Russia : Fuel Cards Gaining Traction

Russia's fuel card market is valued at $300.0 million, making up about 14% of the European market. The growth is driven by increasing fuel consumption in the transportation sector and the expansion of retail networks. Government initiatives aimed at modernizing the transport infrastructure are also significant. However, regulatory challenges and economic fluctuations pose risks to market stability.

Italy : Infrastructure Development and Demand

Italy's fuel card market is valued at $250.0 million, representing approximately 11% of the European market. Growth is fueled by investments in transportation infrastructure and a rising number of logistics companies. The Italian government is promoting the use of fuel cards through tax incentives and regulatory support. Key cities like Milan and Rome are central to market activities, with a competitive landscape featuring both local and international players.

Spain : Growing Demand in Logistics Sector

Spain's fuel card market is valued at $200.0 million, accounting for about 9% of the European market. The growth is driven by the booming logistics and delivery sectors, alongside government initiatives to promote fuel efficiency. Major cities like Madrid and Barcelona are key markets, with a competitive landscape that includes both established players and new entrants. The focus on digital solutions is reshaping the market dynamics.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe fuel card market is valued at $38.26 million, representing a small fraction of the overall market. Growth varies significantly across countries, influenced by local regulations and market maturity. Emerging markets are beginning to adopt fuel cards, driven by increasing fuel consumption and logistics needs. However, the competitive landscape is fragmented, with many small players and limited brand recognition.