Consumer Preference for Organic Products

There is a notable shift in consumer preferences towards organic products across Europe, which significantly influences the Europe Bio Fertilizers Market. As consumers become more health-conscious and environmentally aware, the demand for organic produce has surged. This trend is reflected in the increasing sales of organic food, which reached over 40 billion euros in 2025. Farmers, in response, are increasingly adopting bio fertilizers to meet this demand, as these products are essential for organic farming practices. The growing consumer base for organic products is likely to propel the bio fertilizers market, as producers seek to enhance crop quality and yield while adhering to organic standards. This consumer-driven demand is expected to sustain the growth trajectory of the bio fertilizers market in Europe.

Environmental Concerns and Soil Degradation

The increasing awareness of environmental issues and soil degradation is a significant driver for the Europe Bio Fertilizers Market. Soil health has deteriorated due to excessive use of chemical fertilizers, leading to a decline in agricultural productivity. In response, there is a growing emphasis on sustainable practices that restore soil health, with bio fertilizers being a key component. The European Commission has reported that soil degradation affects nearly 60% of European soils, prompting initiatives to promote organic amendments. This situation presents a substantial opportunity for bio fertilizers, as they contribute to soil restoration and enhance nutrient cycling. The urgency to address soil health challenges is likely to drive the adoption of bio fertilizers, positioning them as a vital solution in European agriculture.

Government Initiatives and Funding Programs

Government initiatives and funding programs aimed at promoting sustainable agriculture are pivotal for the Europe Bio Fertilizers Market. Various European countries have introduced financial incentives and grants to encourage farmers to adopt bio fertilizers. For instance, the Common Agricultural Policy (CAP) provides support for environmentally friendly practices, including the use of bio fertilizers. In 2025, funding for sustainable agricultural practices in Europe exceeded 10 billion euros, highlighting the commitment to fostering eco-friendly farming. These initiatives not only alleviate the financial burden on farmers but also stimulate market growth by making bio fertilizers more accessible. As governments continue to prioritize sustainability, the bio fertilizers market is expected to thrive, driven by increased adoption rates among farmers seeking financial support.

Technological Innovations in Bio Fertilizers

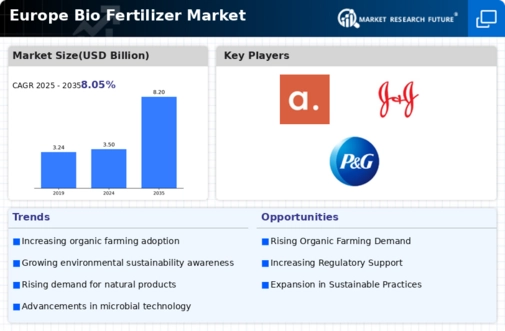

Technological advancements play a crucial role in shaping the Europe Bio Fertilizers Market. Innovations in microbial formulations and delivery systems have enhanced the efficacy of bio fertilizers, making them more appealing to farmers. For example, the development of encapsulated bio fertilizers allows for controlled release, improving nutrient availability to crops. In 2025, the market saw a rise in the adoption of these advanced products, with a reported increase of 15% in their usage among European farmers. This trend indicates a growing recognition of the benefits of bio fertilizers, which not only improve soil health but also increase crop productivity. As technology continues to evolve, it is likely that the bio fertilizers market will expand further, driven by the need for efficient and sustainable agricultural practices.

Regulatory Support for Sustainable Agriculture

The Europe Bio Fertilizers Market benefits from robust regulatory frameworks that promote sustainable agricultural practices. The European Union has implemented various policies aimed at reducing chemical fertilizer usage and enhancing organic farming. For instance, the EU's Green Deal emphasizes the need for sustainable food systems, which includes the promotion of bio fertilizers. This regulatory support is likely to drive market growth as farmers seek compliant solutions that align with environmental goals. In 2025, the market for bio fertilizers in Europe was valued at approximately 1.5 billion euros, reflecting a growing trend towards eco-friendly agricultural inputs. As regulations tighten around chemical fertilizers, the demand for bio fertilizers is expected to increase, further solidifying their role in sustainable agriculture.