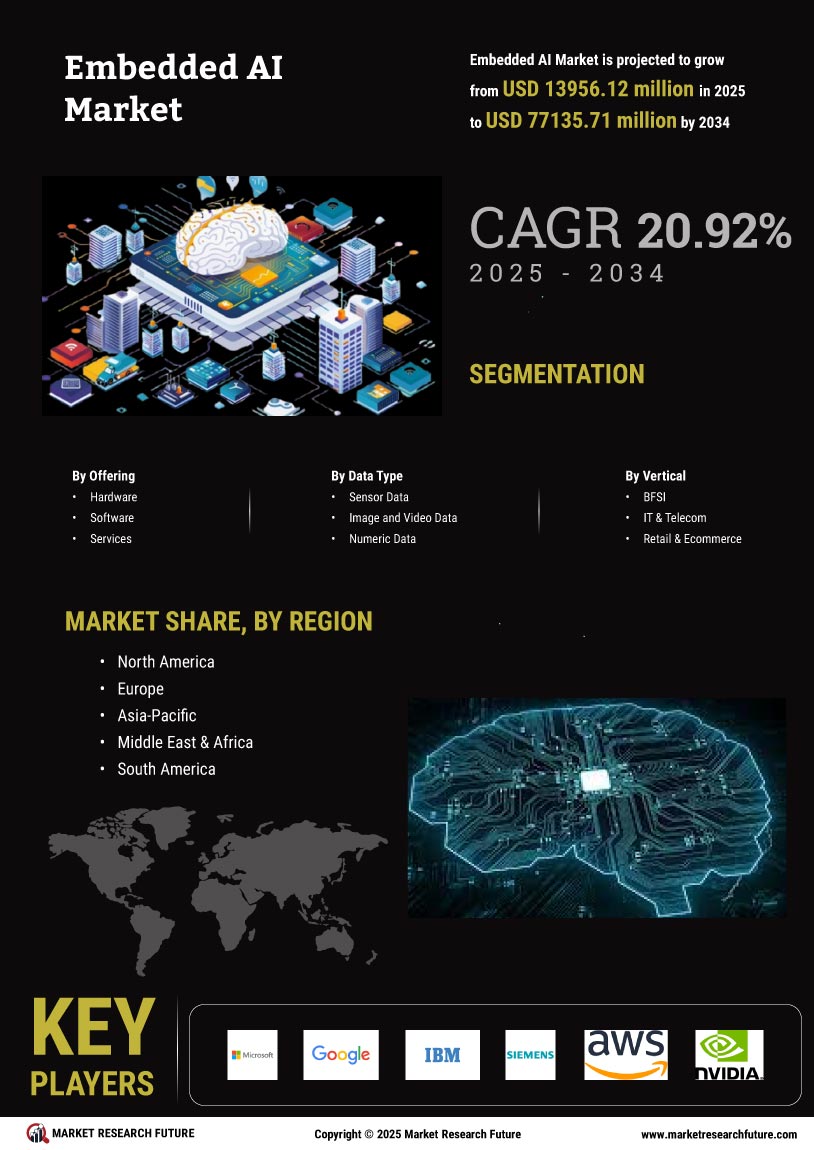

Rising Demand for Smart Devices

The Embedded AI Market Industry experiences a notable surge in demand for smart devices, which integrate artificial intelligence capabilities directly into hardware. This trend is driven by consumer preferences for enhanced functionality and automation in everyday products. As of 2025, the market for smart home devices is projected to reach approximately 100 billion dollars, indicating a robust growth trajectory. The integration of AI into these devices allows for improved user experiences, personalized services, and energy efficiency. Consequently, manufacturers are increasingly investing in embedded AI technologies to meet consumer expectations and remain competitive. This rising demand not only propels innovation but also fosters collaboration among tech companies, leading to the development of more sophisticated embedded AI solutions.

Increased Focus on Edge Computing

The Embedded AI Market Industry is witnessing a shift towards edge computing, which allows data processing to occur closer to the source rather than relying on centralized cloud systems. This trend is driven by the need for real-time data analysis and reduced latency in applications such as autonomous vehicles and smart manufacturing. By 2025, the edge computing market is anticipated to surpass 40 billion dollars, highlighting its growing importance. Embedded AI Market systems that leverage edge computing can operate more efficiently, as they minimize bandwidth usage and enhance data security. This shift not only improves the performance of AI applications but also aligns with the increasing demand for IoT devices, further propelling the Embedded AI Market Industry forward.

Regulatory Support for AI Integration

The Embedded AI Market Industry benefits from increasing regulatory support aimed at promoting the integration of artificial intelligence across various sectors. Governments are recognizing the potential of AI to drive economic growth and improve public services. As of 2025, several countries have implemented policies that encourage research and development in AI technologies, including embedded systems. This regulatory environment fosters innovation and investment, as companies seek to align their products with emerging standards. Furthermore, the establishment of ethical guidelines for AI usage enhances consumer trust, which is crucial for the widespread adoption of embedded AI solutions. Consequently, this supportive regulatory landscape is likely to accelerate the growth of the Embedded AI Market Industry.

Advancements in Machine Learning Algorithms

The Embedded AI Market Industry is significantly influenced by advancements in machine learning algorithms, which enhance the capabilities of embedded systems. These algorithms enable devices to learn from data, adapt to user behavior, and make intelligent decisions in real-time. As of 2025, the market for machine learning in embedded systems is expected to grow at a compound annual growth rate of over 20%. This growth is attributed to the increasing complexity of applications across various sectors, including automotive, healthcare, and industrial automation. The ability to process data locally reduces latency and improves performance, making embedded AI solutions more attractive to manufacturers. As a result, companies are prioritizing the integration of advanced machine learning techniques into their embedded systems, thereby driving the overall growth of the Embedded AI Market Industry.

Growing Investment in Research and Development

The Embedded AI Market Industry is experiencing a surge in investment directed towards research and development initiatives. Companies are increasingly allocating resources to innovate and enhance their embedded AI offerings, recognizing the competitive advantage that advanced technologies provide. As of 2025, the global investment in AI research is projected to exceed 50 billion dollars, reflecting the critical role of R&D in driving market growth. This influx of funding enables organizations to explore new applications, improve existing technologies, and develop more efficient embedded systems. Additionally, partnerships between academia and industry are fostering knowledge exchange, leading to breakthroughs in embedded AI capabilities. This growing emphasis on R&D is likely to propel the Embedded AI Market Industry into new frontiers, unlocking potential applications across diverse sectors.