Rising Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is emerging as a significant driver in the Electronic Filters Market. As more devices become interconnected, the demand for efficient electronic filters to manage data flow and reduce noise is increasing. IoT applications, ranging from smart home devices to industrial automation, require reliable filtering solutions to ensure optimal performance. The market for electronic filters in IoT applications is expected to grow rapidly, with projections suggesting a potential increase of 15% in the coming years. This trend underscores the importance of electronic filters in facilitating seamless communication between devices and enhancing overall system efficiency.

Growing Demand in Telecommunications

The Electronic Filters Market is significantly influenced by the growing demand in the telecommunications sector. With the expansion of 5G networks and the increasing reliance on mobile communication, the need for high-quality electronic filters has never been more critical. These filters play a vital role in ensuring signal integrity and reducing interference, which are essential for maintaining high-speed data transmission. The telecommunications segment is projected to account for a substantial share of the market, with estimates indicating a growth rate of around 8% annually. As the industry evolves, the integration of advanced filtering technologies will likely become a focal point for telecommunications providers.

Increased Focus on Energy Efficiency

The Electronic Filters Market is witnessing a heightened focus on energy efficiency, driven by both regulatory pressures and consumer demand. As industries strive to reduce their carbon footprint, the need for energy-efficient electronic filters is becoming paramount. These filters not only improve the performance of electronic devices but also contribute to lower energy consumption. The market is likely to see a shift towards filters that meet stringent energy efficiency standards, with growth projections indicating a rise of approximately 10% in demand for such products. This trend reflects a broader commitment to sustainability within the electronics sector, positioning energy-efficient filters as a key driver in the industry.

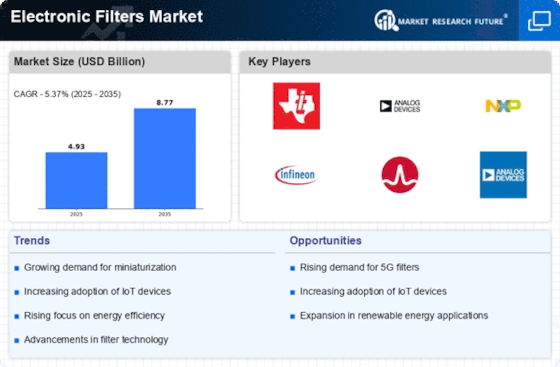

Miniaturization of Electronic Components

The trend towards miniaturization in the Electronic Filters Market is reshaping the landscape of electronic devices. As manufacturers strive to create smaller, more compact products, the demand for miniaturized electronic filters is on the rise. This trend is particularly evident in the consumer electronics sector, where space constraints necessitate the use of smaller components without compromising performance. The market for miniaturized filters is expected to witness substantial growth, with estimates suggesting an increase in demand by over 20% in the next few years. This shift not only enhances product design but also contributes to energy efficiency, making miniaturized filters a key driver in the industry.

Technological Advancements in Electronic Filters

The Electronic Filters Market is experiencing a surge in technological advancements that enhance filter performance and efficiency. Innovations such as adaptive filtering and digital signal processing are becoming increasingly prevalent. These advancements allow for improved noise reduction and signal clarity, which are critical in applications ranging from telecommunications to consumer electronics. The market is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years, driven by the need for high-performance filters in various electronic devices. As technology continues to evolve, manufacturers are likely to invest in research and development to create more sophisticated filtering solutions, thereby expanding their market presence.