Supportive Regulatory Frameworks

Supportive regulatory frameworks and funding initiatives are playing a vital role in the growth of the Electrochemical Biosensors Market. Governments and regulatory bodies are increasingly recognizing the importance of biosensors in healthcare and environmental applications, leading to the establishment of favorable policies and funding opportunities. For instance, various grants and subsidies are being offered to encourage research and development in biosensor technologies. This support not only accelerates innovation but also facilitates the commercialization of new products. As a result, the market is expected to benefit from enhanced investment in biosensor research, leading to the introduction of advanced electrochemical biosensors that meet regulatory standards and address market needs effectively.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as diabetes, cardiovascular disorders, and cancer is a primary driver for the Electrochemical Biosensors Market. As these conditions require continuous monitoring and management, the demand for reliable and efficient biosensors is surging. According to recent estimates, the prevalence of diabetes alone is projected to reach 700 million by 2045, necessitating advanced monitoring solutions. This trend is likely to propel the development and adoption of electrochemical biosensors, which offer rapid and accurate results. Furthermore, the integration of these biosensors into wearable devices enhances patient compliance and facilitates real-time health monitoring, thereby expanding their application in both clinical and home settings.

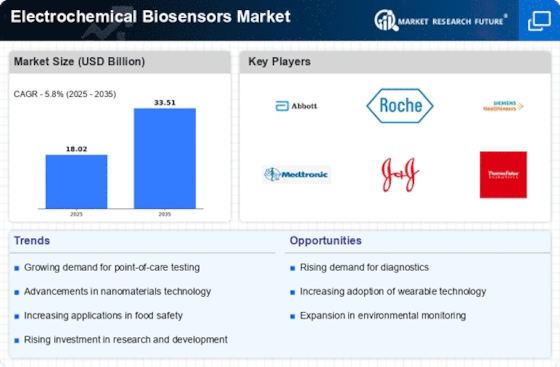

Technological Innovations in Biosensing

Technological advancements in biosensing technologies are significantly influencing the Electrochemical Biosensors Market. Innovations such as miniaturization, improved sensitivity, and the development of multiplexed biosensors are enhancing the capabilities of electrochemical biosensors. For instance, the introduction of nanomaterials has been shown to improve the performance of these sensors, allowing for the detection of multiple biomarkers simultaneously. The market for electrochemical biosensors is expected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next few years, driven by these technological improvements. Additionally, the integration of artificial intelligence and machine learning in data analysis is likely to further enhance the functionality and applicability of these biosensors in various fields, including healthcare and environmental monitoring.

Increasing Focus on Personalized Medicine

The shift towards personalized medicine is emerging as a crucial driver for the Electrochemical Biosensors Market. As healthcare moves towards tailored treatment plans based on individual patient profiles, the need for precise and rapid diagnostic tools becomes paramount. Electrochemical biosensors Market facilitate this shift by providing real-time data on biomarker levels, enabling healthcare providers to make informed decisions. The market for personalized medicine is projected to reach USD 2.5 trillion by 2030, indicating a substantial opportunity for electrochemical biosensors to play a pivotal role in this transformation. Furthermore, the ability of these biosensors to be integrated into mobile health applications enhances their appeal, allowing for continuous monitoring and adjustment of treatment regimens.

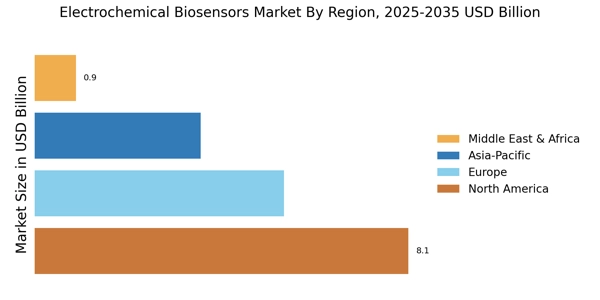

Growing Demand for Environmental Monitoring

The increasing awareness of environmental issues and the need for sustainable practices are driving the Electrochemical Biosensors Market in the environmental monitoring sector. Electrochemical biosensors Market are being utilized to detect pollutants and hazardous substances in water, air, and soil, providing critical data for environmental protection efforts. The market for environmental biosensors is expected to witness significant growth, with a projected CAGR of around 10% over the next five years. This growth is attributed to the rising regulatory pressures and public demand for cleaner environments. As industries and governments seek to comply with environmental regulations, the adoption of electrochemical biosensors for monitoring purposes is likely to expand, thereby enhancing their market presence.