Digital Shipyard Market Summary

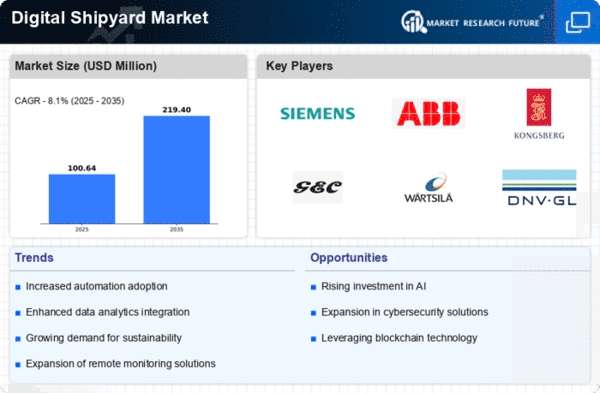

As per MRFR analysis, the Digital Shipyard Market Size was estimated at 93.1 USD Million in 2024. The Digital Shipyard industry is projected to grow from 100.7 USD Million in 2025 to 219.4 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8.1 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Digital Shipyard Market is poised for substantial growth driven by technological advancements and sustainability initiatives.

- The integration of advanced technologies is transforming operational efficiencies in ship design and construction management.

- Sustainability remains a focal point, with increasing emphasis on eco-friendly practices across the industry.

- Collaboration and data sharing among stakeholders are enhancing project outcomes and innovation.

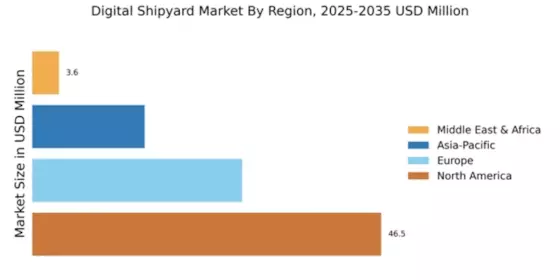

- The growing demand for customization and adherence to regulatory compliance are key drivers propelling market expansion in North America and Asia-Pacific.

Market Size & Forecast

| 2024 Market Size | 93.1 (USD Million) |

| 2035 Market Size | 219.4 (USD Million) |

| CAGR (2025 - 2035) | 8.1% |

Major Players

Siemens AG (DE), ABB Ltd (CH), Kongsberg Gruppen (NO), General Electric Company (US), Wärtsilä Corporation (FI), DNV GL (NO), Thales Group (FR), Hewlett Packard Enterprise (US), Rolls-Royce Holdings plc (GB)