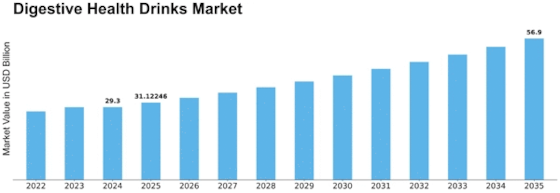

Digestive Health Drinks Size

Digestive Health Drinks Market Growth Projections and Opportunities

The demand for digestive health drinks is rising sharply for a variety of reasons, such as shifting consumer awareness of health concerns, the need for functional drinks, and increased consumer attention. One of the primary drivers is the increasing awareness of the link between digestive health and overall wellbeing. Less and less visitors are concerned about how crucial it is to maintain a healthy gut flora to support healthy digestion and protect delicate tasks. This awareness has led to an increase in the demand for digestive health drinks that contain probiotics, prebiotics, and other beneficial ingredients known to support digestive health. Fluently available digestion health potables can help improve gut health as visitors attend to concerns like stress, erratic eating schedules, and food repurposing. Probiotic strains, which support the balance of beneficial bacteria in the stomach and facilitate simpler digestion and overall gastrointestinal health, are commonly included in these potables. The growing demand for functional drinks has a substantial influence on the assiduity for digestive health drinks. Drinks that are refreshing and provide both new health advantages are becoming fewer and less common. Digestive health drinks, which provide a tasty and convenient way to include elements that are beneficial to the digestive system into daily routines, promote this trend. As functional drinks are implied to target specific health conditions, they are an attractive choice for visitors who wish to take control of their digestive health. Product expression innovation is a key factor influencing the demand for digestive health drinks. To make their goods more appealing, manufacturers are always coming up with new tastes, ingredients, and ways to distribute them. The goal of promoting digestive health holistically is achieved by the use of probiotic-infused drinks, fiber-rich foods, and enzyme-rich meals. Furthermore, the development of sugar-free or low-sugar options meets the preferences of health-conscious consumers who prioritize digestibility above overall sugar consumption. Digital platforms and e-commerce are having a significant impact on the digestive health drink sector. Customers now have an easy way to research, evaluate, and purchase a range of digestive health drinks from various companies thanks to online channels. E-commerce platforms also provide businesses with a forum for direct customer interaction, the sharing of informative material regarding digestive health, and the admission of valuable customer feedback. Online shopping's accessibility and ease of use help the industry flourish by bringing digestive health drinks to a wider range of consumers. The market for digestive health drinks is significantly shaped by consumer education and mindfulness movements. As more people recognize the link between digestive health and general well-being, businesses use marketing campaigns to highlight the advantages of their goods. Consumer knowledge is improved by educational information regarding the importance of probiotics, prebiotics, and other digestive-friendly ingredients, which promotes loyalty and confidence. By demystifying digestive health and encouraging the use of functional potables as a forward-thinking heartiness approach, these industry titans help to drive the market's growth. Important factors to take into account are the nonsupervisory geography and the health claims made about digestive health drinks. Regulations pertaining to the marketing and labeling of goods that make particular health claims must be negotiated by businesses. Consumer confidence is built on adherence to standards and open information regarding the advantages of digestive health drinks. Businesses that adapt and follow industry norms will probably be able to maintain a competitive edge as the nonsupervisory landscape changes. The market for digestive health drinks is being impacted by the globalization of healthy trends, as people all over the world are becoming more interested in preserving their digestive health. Beyond indigenous limits, probiotic-rich beverages are accepted as a daily healthy habit. International cooperation and scientific knowledge sharing aid in the creation of digestive health drinks that satisfy a variety of aesthetic inclinations and healthful routines.

Leave a Comment