Technological Innovations in ECG Devices

Technological advancements in electrocardiograph devices are transforming the Diagnostic Electrocardiograph Market. Innovations such as artificial intelligence integration, enhanced data analytics, and improved sensor technologies are making ECG devices more accurate and user-friendly. These advancements not only enhance diagnostic capabilities but also streamline workflows in clinical settings. The market is witnessing a shift towards digital solutions, with many devices now offering cloud connectivity for real-time data sharing and remote monitoring. This evolution is likely to attract healthcare providers looking for efficient and reliable diagnostic tools, thereby driving growth in the Diagnostic Electrocardiograph Market.

Rising Awareness of Preventive Healthcare

The growing awareness of preventive healthcare is driving the Diagnostic Electrocardiograph Market. As individuals become more informed about the importance of early detection and management of health conditions, the demand for diagnostic tools like electrocardiographs is increasing. Educational campaigns and health initiatives are promoting regular health check-ups, which include cardiovascular assessments. This shift towards preventive care is likely to result in higher utilization rates of ECG devices in both clinical and home settings. Consequently, the Diagnostic Electrocardiograph Market is poised for growth as more individuals prioritize their cardiovascular health.

Growing Demand for Home Healthcare Solutions

The increasing preference for home healthcare solutions is significantly influencing the Diagnostic Electrocardiograph Market. Patients are increasingly seeking convenient and accessible healthcare options, leading to a surge in demand for portable ECG devices that can be used at home. This trend is supported by the rising awareness of preventive healthcare and the need for continuous monitoring of cardiovascular health. As a result, manufacturers are focusing on developing user-friendly, compact devices that cater to this demand. The Diagnostic Electrocardiograph Market is likely to expand as more patients opt for home-based monitoring solutions, reducing the burden on healthcare facilities.

Increasing Prevalence of Cardiovascular Diseases

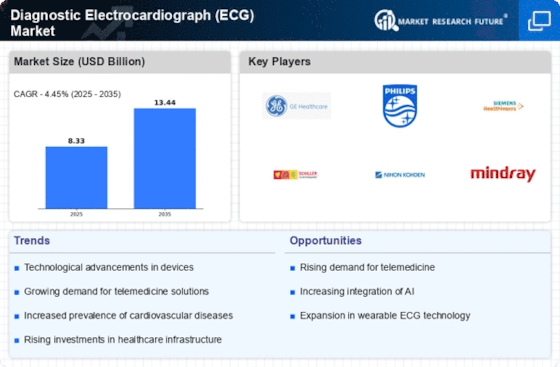

The rising incidence of cardiovascular diseases is a primary driver for the Diagnostic Electrocardiograph Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective diagnostic tools intensifies. According to recent statistics, cardiovascular diseases account for a significant portion of global mortality rates, prompting healthcare providers to seek advanced diagnostic solutions. This trend is likely to propel the adoption of electrocardiographs, as they are essential for early detection and management of heart conditions. The Diagnostic Electrocardiograph Market is expected to witness substantial growth as healthcare systems prioritize cardiovascular health, leading to increased investments in diagnostic technologies.

Regulatory Support for Advanced Diagnostic Tools

Regulatory bodies are increasingly supporting the development and adoption of advanced diagnostic tools, which is positively impacting the Diagnostic Electrocardiograph Market. Initiatives aimed at streamlining the approval process for innovative medical devices are encouraging manufacturers to invest in research and development. This regulatory support is crucial for bringing new technologies to market, ensuring that healthcare providers have access to the latest diagnostic solutions. As regulations evolve to accommodate advancements in technology, the Diagnostic Electrocardiograph Market is expected to benefit from a more favorable environment for innovation and growth.