July 2024: Engineering students of the University of Kansas have successfully endorsed their small satellite, which they refer to as ‘CubeSat Market’, into space. NASA’s Firefly aerospace rocket has flown this satellite for the first time through the ELAna 43 mission of NASA. The KUbeSat-1, which was barely two weeks old at the moment, became KU's first satellite to orbit around Earth. This time, it was possible because NASA was partnering with eight CubeSats, and it launched using firefly aerospace’s Alpha rocket.

KUbeSat-1 is essentially a three-unit nanosatellite that is not larger than a loaf of bread and weighs about three pounds. This was also the first time Kansas was becoming a part of this program. The CubeSat Market, however, originated in order to aid nonprofit organizations in accomplishing their missions. Lastly, KUbeSat-1 is significant because it uses cosmic rays in order to carry out its measurement, which was historically done on land. KUbeSat-1 possesses a new significance that will have immense benefits in the field of astrophysics.

The second package, the High-Altitude Calibration Instrument Version X focuses on signals that are emitted in the atmospherically high band caused due to cosmic interactions. The expected life span in orbit is 1-2 years but practical outlooks suggest it is more to be around 1 year. The information gained from the mission is intended for academic work as well as for creating more advanced payloads in the future.

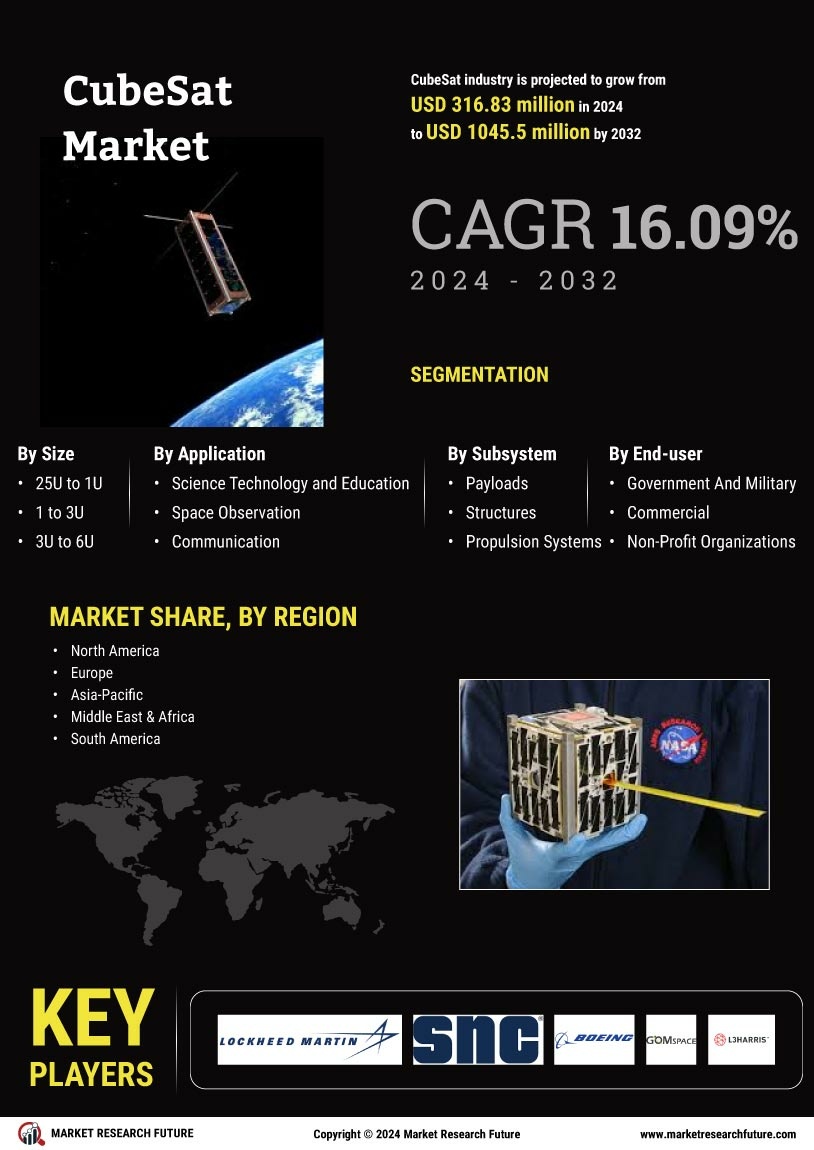

CubeSat Market Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help CubeSat Market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the CubeSat industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

The major players in the market include Lockheed Martin Corporation, Sierra Nevada Corporation, The Boeing Company, GomSpace, L3Harris Technologies, OHB SE, Capella Space, Clyde Space Ltd, Airbus S.A.S, Tyvak Nano-Satellite Systems Inc., Busek Co. Inc., CU Aerospace L.L.C., Maxar Technologies, EnduroSat, and Planet Labs Inc. The Boeing Company is focused on leveraging business opportunities in the global market. The company develops innovative products and solutions by investing extensively in R&D to increase its global market share. It also focuses on strategic contracts, and partnerships with other players in the value chain to offer combined solutions to increase its regional presence.

Key Companies in the CubeSat Market include

Lockheed Martin Corporation

Sierra Nevada Corporation

The Boeing Company

GomSpace

L3Harris Technologies

OHB SE

Capella Space

Clyde Space Ltd

Airbus S.A.S

Tyvak Nano-Satellite Systems Inc.

Busek Co. Inc.

CU Aerospace L.L.C.

Maxar Technologies

EnduroSat

Planet Labs Inc

CubeSat Industry Developments

September 2022: Airbus and In-Space Missions collaborated on the design and development of the Prometheus 2 satellites. It has passed environmental and vibration testing. The Defense Science and Technology Laboratory (Dstl) owns the Prometheus 2 cubesats on behalf of the Ministry of Defense (MOD). Airbus Defence and Space co-funded them, with In-Space Missions Ltd leading the construction.

August 2022: Capella Space, a leading Earth observation company, has announced several new capabilities for its next-generation satellites. This new generation of Capella satellites, dubbed "Acadia" technology, will expand the existing Capella constellation to provide the highest quality imagery, best ground-range resolution, and fastest order-to-delivery speeds of any commercial SAR provider.

August 2021: The Lockheed Martin In-space Upgrade Satellite System (LINUSS) successfully completed environmental testing, demonstrating how small CubeSats can regularly upgrade satellite constellations to add timely new capabilities and extend spacecraft design lives.