Crypto Asset Management Market Summary

As per Market Research Future analysis, the Crypto Asset Management Market Size was estimated at 1.764 USD Billion in 2024. The Crypto Asset Management industry is projected to grow from 2.214 USD Billion in 2025 to 21.46 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 25.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Crypto Asset Management Market is experiencing robust growth driven by institutional interest and technological advancements.

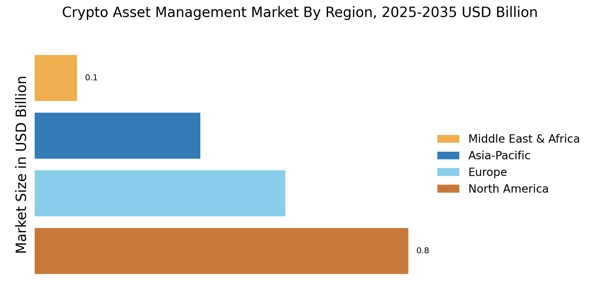

- Institutional investment in cryptocurrencies is on the rise, particularly in North America, indicating a shift in market dynamics.

- Advanced technologies, including blockchain innovations, are being integrated into asset management solutions, enhancing operational efficiency.

- Regulatory compliance is becoming increasingly critical, especially in the Asia-Pacific region, as firms navigate evolving legal landscapes.

- The market is driven by increased adoption of cryptocurrencies and the emergence of decentralized finance (DeFi), which are reshaping investment strategies.

Market Size & Forecast

| 2024 Market Size | 1.764 (USD Billion) |

| 2035 Market Size | 21.46 (USD Billion) |

| CAGR (2025 - 2035) | 25.5% |