- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

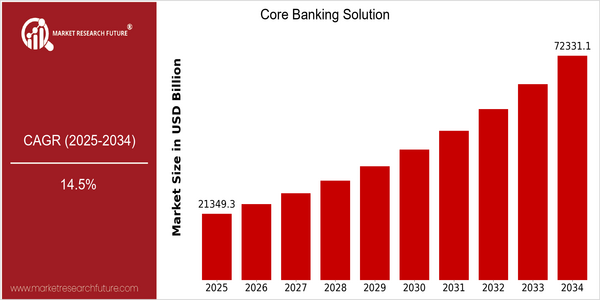

| Year | Value |

|---|---|

| 2025 | USD 21349.35 Billion |

| 2034 | USD 72331.1 Billion |

| CAGR (2025-2034) | 14.5 % |

Note – Market size depicts the revenue generated over the financial year

The core banking solutions (CBS) market is expected to grow significantly, with a forecast of $21.34 billion in 2025 and a huge $ 72,331.1 billion by 2034. The CAGR over the nine-year period is 14.5%, which reflects the growing demand for efficient banking solutions that enhance customer experience and improve operational efficiency. The development of the market is largely influenced by the trend towards digital transformation in the banking sector, driven by the need for real-time processing, improved customer engagement and the integration of advanced solutions such as artificial intelligence and machine learning. The emergence of cloud-based solutions, which offer scalability and cost savings, and the increasing importance of regulatory compliance and risk management are also contributing to the growth of the market. The main players in the core banking solutions market, such as FIS, Temenos and Oracle, are investing in new technologies and establishing strategic alliances to strengthen their positions. Recent collaborations between financial institutions and technology companies are aimed at accelerating the digital transformation of banking operations and meeting the evolving needs of customers. The core banking solutions market will play a major role in shaping the future of financial services.

Regional Market Size

Regional Deep Dive

The core banking solutions market is experiencing a major transformation in different geographical regions, driven by technological advancements, regulatory changes and changing customer preferences. In North America, the market is characterized by a strong emphasis on digital banking and customer-centric solutions, while in Europe, the market is characterized by an increase in regulatory compliance and transformation initiatives. In the Asia-Pacific region, cloud-based solutions are gaining traction due to the rising penetration of smartphones and the growing middle class. In the Middle East and Africa, the banking sector is focusing on financial inclusion and mobile banking innovations, while in Latin America, fintechs are collaborating with banks to improve banking services. Each region presents unique opportunities and challenges, which influence the overall market dynamics.

Europe

- The European Union's PSD2 regulation is driving banks to adopt open banking practices, fostering innovation and collaboration with fintech companies like Revolut and N26.

- Sustainability initiatives are gaining traction, with banks increasingly integrating ESG (Environmental, Social, and Governance) criteria into their core banking solutions to meet regulatory expectations and customer demands.

Asia Pacific

- The rapid adoption of cloud computing in countries like India and China is enabling banks to deploy scalable core banking solutions, enhancing operational efficiency and customer experience.

- Fintech partnerships are on the rise, with companies like Ant Financial collaborating with traditional banks to offer innovative payment solutions and financial services to underserved populations.

Latin America

- The fintech boom in Latin America is leading to increased collaboration between traditional banks and tech startups, with companies like Nubank revolutionizing the banking experience for consumers.

- Regulatory frameworks are evolving, with countries like Brazil implementing open banking regulations that encourage competition and innovation in the core banking sector.

North America

- The rise of neobanks and digital-first banking solutions is reshaping the competitive landscape, with companies like Chime and Varo leading the charge in customer acquisition and service innovation.

- Regulatory changes, such as the implementation of the Dodd-Frank Act, are pushing traditional banks to enhance their compliance frameworks, leading to increased investments in core banking solutions.

Middle East And Africa

- Mobile banking is becoming a primary channel for financial services in Africa, with companies like M-Pesa leading the way in providing accessible banking solutions to unbanked populations.

- Government initiatives, such as the UAE's Financial Services Regulatory Authority's push for fintech innovation, are encouraging banks to adopt modern core banking solutions to enhance service delivery.

Did You Know?

“Over 80% of banks globally are expected to invest in core banking solutions to enhance their digital capabilities by 2025.” — Accenture

Segmental Market Size

The Core Bank Solution (CBS) is a critical element in the banking industry. It facilitates banking operations across all channels. The current growth of this market is a result of the increasing demand for digital banking services and the need for improved customer experiences. The main reasons for this are the innovation of fintech companies, which are forcing the traditional banks to modernize their systems, and the regulatory pressures that require compliance with evolving standards, such as the Payment Services Directive (PSD2) in Europe. The adoption of the CBS is currently at a mature stage, with strong players like Temenos and FIS providing solutions to banks all over the world. North America and Europe are at the forefront of the trend to adopt the CBS, which is used to improve efficiency and service. The most important applications are real-time transactions, customer relationship management and risk management. The development of cloud computing and the use of artificial intelligence are driving the growth of the market. New technological trends, such as API frameworks and the use of blockchain, will shape the future of the CBS, enabling banks to offer more agile and secure services.

Future Outlook

The core banking solutions (CBS) market is expected to grow at a significant CAGR of 14.5% from 2025 to 2034, a report from BIS Research has found. The growing demand for digital banking services, the need for better customer experience, and digital transformation initiatives by financial institutions will fuel this growth. The adoption of cloud-based solutions and advanced analytics will also become crucial for banks to optimize their operations and improve their services. The key technological advancements in the field of artificial intelligence (AI), machine learning (ML), and blockchain will play a key role in shaping the future of core banking solutions. These technological developments will not only improve operational efficiency, but also help banks to manage their risks and comply with regulations. The emergence of fintechs and the emergence of open banking will also force traditional banks to adopt more agile and customer-centric core banking solutions. By 2034, it is expected that over 70% of banks will have migrated to cloud-based core banking solutions, which will be a major shift towards more scalable and flexible banking platforms. These trends will continue to shape the future of core banking solutions, which will create new opportunities for growth and innovation.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 12,412.4 Billion |

| Growth Rate | 14.5% (2022-2030) |

Core Banking Solutions Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.