Rising Demand for Data Centers

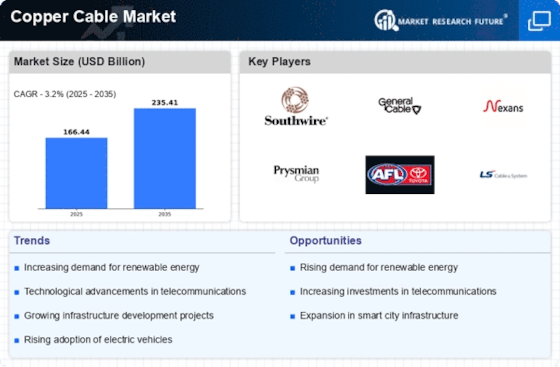

The Copper Cable Market is significantly influenced by the rising demand for data centers. With the proliferation of digital services and cloud computing, data centers require robust infrastructure, including high-quality copper cabling for data transmission. In 2025, the demand for copper cables in data centers is projected to grow by approximately 7%, driven by the need for faster and more reliable connectivity. This trend indicates that the Copper Cable Market will continue to expand as businesses invest in upgrading their data infrastructure to support increasing data traffic and storage needs.

Increasing Infrastructure Development

The Copper Cable Market is experiencing a surge due to the increasing infrastructure development across various sectors. Governments and private entities are investing heavily in building new roads, bridges, and urban facilities, which necessitates the use of copper cables for electrical wiring and telecommunications. In 2025, the demand for copper cables is projected to rise by approximately 5%, driven by these infrastructure projects. This trend is particularly evident in emerging economies, where urbanization is accelerating. The need for reliable communication networks and power distribution systems further fuels the demand for copper cables, making it a critical component in modern infrastructure development.

Expansion of Renewable Energy Projects

The Copper Cable Market is likely to benefit from the expansion of renewable energy projects. As countries strive to meet energy efficiency goals and reduce carbon footprints, investments in solar and wind energy are increasing. Copper cables are essential for connecting renewable energy sources to the grid, facilitating energy transmission. In 2025, the renewable energy sector is expected to account for a significant portion of the copper cable demand, with projections indicating a growth rate of around 6%. This trend suggests that the Copper Cable Market will play a pivotal role in supporting the transition to sustainable energy solutions.

Technological Innovations in Cable Manufacturing

The Copper Cable Market is witnessing advancements in manufacturing technologies that enhance the efficiency and quality of copper cables. Innovations such as improved alloy compositions and advanced insulation materials are being developed, which may lead to better performance and durability of cables. These technological improvements are expected to increase the market's competitiveness, as manufacturers strive to meet the evolving needs of various industries. In 2025, the market is anticipated to see a rise in demand for high-performance copper cables, particularly in sectors like telecommunications and construction, where reliability is paramount.

Growth in Electric Vehicle Charging Infrastructure

The Copper Cable Market is poised for growth due to the expansion of electric vehicle (EV) charging infrastructure. As the adoption of electric vehicles accelerates, the need for reliable and efficient charging stations becomes critical. Copper cables are essential for the electrical connections in these charging stations, ensuring safe and effective power delivery. In 2025, the market for copper cables in the EV sector is expected to grow by around 8%, reflecting the increasing investments in charging infrastructure. This trend suggests that the Copper Cable Market will play a vital role in supporting the transition to electric mobility.