North America : Market Leader in Innovation

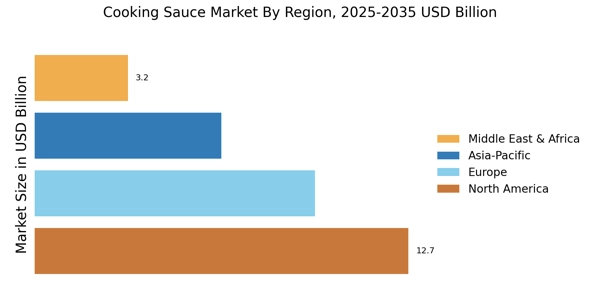

North America is the largest market for cooking sauces, holding approximately 40% of the global share. The region's growth is driven by increasing consumer demand for convenience foods, health-conscious options, and diverse flavor profiles. Regulatory support for food safety and labeling standards further catalyzes market expansion. The U.S. is the primary contributor, followed by Canada, which is experiencing a growing trend towards organic and natural sauces.

The competitive landscape in North America is robust, featuring key players like Kraft Heinz, McCormick & Company, and Conagra Brands. These companies are investing in product innovation and marketing strategies to capture the evolving consumer preferences. The presence of established brands and a strong distribution network enhances market accessibility, making it a dynamic environment for both established and emerging players.

Europe : Culinary Diversity and Growth

Europe is a significant player in the cooking sauce market, accounting for approximately 30% of the global share. The region's growth is fueled by a rich culinary heritage, increasing interest in international cuisines, and a shift towards healthier eating habits. Regulatory frameworks, such as the EU's food safety regulations, promote transparency and quality, further driving market growth. Germany and the UK are the largest markets, with Italy closely following, showcasing a diverse range of sauce preferences.

Leading countries in Europe are characterized by a competitive landscape with major players like Unilever, Barilla, and Nestle. These companies are focusing on product diversification and sustainability initiatives to meet consumer demands. The presence of artisanal brands and local producers also enriches the market, offering unique flavors and organic options that appeal to health-conscious consumers.

Asia-Pacific : Rapid Growth and Urbanization

Asia-Pacific is rapidly emerging as a key market for cooking sauces, holding around 20% of the global share. The region's growth is driven by urbanization, changing lifestyles, and increasing disposable incomes, leading to a higher demand for convenient cooking solutions. Countries like China and India are at the forefront, with a growing preference for diverse flavors and international cuisines. Regulatory support for food safety and quality standards is also enhancing consumer confidence in packaged sauces.

The competitive landscape in Asia-Pacific is evolving, with both local and international players vying for market share. Key companies include McCormick & Company and local brands that cater to regional tastes. The market is characterized by innovation in flavor profiles and packaging, as companies strive to meet the unique preferences of consumers in this diverse region. The rise of e-commerce is also transforming distribution channels, making products more accessible to consumers.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is witnessing significant growth in the cooking sauce market, accounting for approximately 10% of the global share. The growth is driven by increasing urbanization, a young population, and rising disposable incomes, leading to a demand for convenient cooking solutions. Regulatory frameworks are gradually improving, focusing on food safety and quality, which is essential for market expansion. Countries like South Africa and the UAE are leading the market, with a growing interest in diverse culinary options.

The competitive landscape in MEA is characterized by a mix of local and international players. Companies like General Mills and Campbell Soup Company are expanding their presence, while local brands are gaining traction by offering products that cater to regional tastes. The market is also seeing an increase in the availability of international sauces, reflecting the region's growing culinary diversity and consumer interest in global flavors.