Research Methodology on Contraband Detectors Market

Introduction

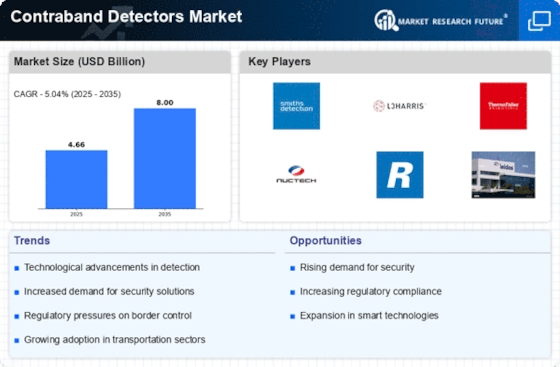

Contraband detectors are becoming an increasingly important tool to detect illegal items, such as drugs and firearms from entering various places. Contraband detectors are used in various places such as airports, prisons, seaports, public transportation hubs and other public spaces. With the surge in drug abuse and criminal activities, the need for contraband detectors is becoming ever more necessary. For this purpose, countries are investing in sophisticated contraband detectors. The report on Global Contraband Detectors Market by MarketResearchFuture.com (MRFR) states that the contraband detectors market is likely to progress at a steady CAGR during 2023-2030.

Research Methodology

To evaluate the current situation, potential and future trends of the global contraband detectors market, an extensive research methodology was adopted.

The methodology included the following activities:

Primary Research

In-depth interviews were conducted with the key stakeholders in the industry including key opinion leaders, contraband detector suppliers and manufacturers and government agencies. The interviews focused on their understanding of the current industry size, volume and pricing dynamics; technology trends and drivers impacting the industry; the leading players and their presence across geographies; the various application areas; and future trends impacting the industry.

Secondary Research

Secondary research involves collecting data from secondary sources such as company websites, industry magazines, white papers, paid databases and other relevant sources. The data collected is used to calculate the market size, market volume and pricing dynamics.

Desk Research

Desk research involved collecting and extrapolating data from existing studies, reports and databases. The data is used to validate assumptions as well as draw correlations between different variables.

Data Analysis

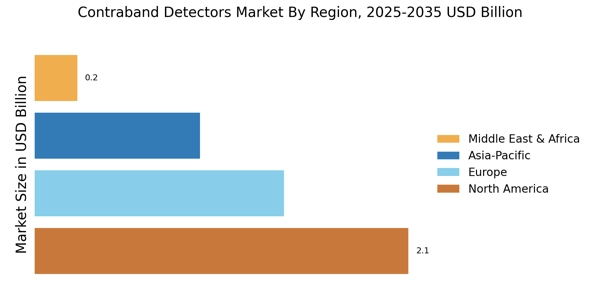

A comprehensive analysis is conducted on the data collected to calculate the global contraband detectors market size, market volume and pricing dynamics. The analysis is detailed and included market segmentation based on geography, product type and end users.

Data Synthesis

The various elements of the research were synthesized to provide a comprehensive report on the global contraband detectors market. The data is checked for accuracy, consistency and reliability to ensure a high-quality report.

Conclusion

Overall, a comprehensive research methodology was adopted for this report. Primary and secondary research was used to gain a comprehensive understanding of the market and its various segments. Desk research is used to validate assumptions and gather additional data. The data is analyzed and synthesized to present an accurate report on the worldwide contraband detectors market.