- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Construction Software Market Size Snapshot

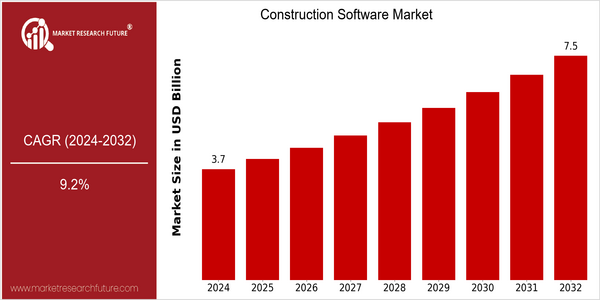

| Year | Value |

|---|---|

| 2024 | USD 3.7 Billion |

| 2032 | USD 7.5 Billion |

| CAGR (2024-2032) | 9.2 % |

Note – Market size depicts the revenue generated over the financial year

The construction industry is expected to grow in the near future, reaching a value of $ 3.7 billion in 2024 and $ 7.5 billion in 2032. This corresponds to a high CAGR of 9.2 percent for the period. In view of the increasing complexity of construction projects, and the need for greater efficiency and cost-effectiveness, the industry is increasingly relying on the use of advanced software solutions. The use of technology is increasing as the construction industry tries to optimize its project management, optimize its operations and improve the collaboration of all parties. Building information modeling (BIM), cloud-based solutions and mobile applications are driving this market growth. The increasing importance of sustainability and compliance with regulations also makes it necessary to invest in the appropriate software. Several companies, such as Autodesk, Procore and Trimble, are working on strategic alliances and product innovations to strengthen their position in the market. These developments highlight the importance of the construction industry in shaping the future of the industry.

Regional Deep Dive

The construction software market is experiencing a high growth across all regions, due to the rising adoption of digital technology and the need for enhanced project management solutions. In North America, the market is characterized by a strong presence of established software companies and a high level of investment in construction technology. In Europe, the market is diverse, with different regulatory frameworks that influence the adoption of construction software. In Asia-Pacific, the market is growing rapidly, driven by the increasing demand for urbanization and the construction of new infrastructure. Middle East and Africa is experiencing a boom in construction, which is increasing the demand for construction software. Latin America is gradually adopting new technology to increase efficiency in construction.

North America

- The new building information modelling (BIM) has changed the way we plan and manage construction projects, with companies like Autodesk at the forefront in providing advanced software solutions.

- In the construction industry, the requirements of regulations on the environment and safety are changing, and this requires companies to use more compliance software, which is influenced by the influence of OSHA.

- Artificial intelligence and machine learning are beginning to be integrated into construction applications, and companies like Procore are introducing innovations to enhance the capabilities of their applications.

Europe

- The European Green Deal is a major factor in the increased adoption of sustainable building practices, which is in turn driving the demand for energy-efficient building design software.

- Germany and Great Britain are investing heavily in digital construction. The UK government's Construction 2025 strategy aims to promote the use of digital tools in construction projects.

- The emergence of collaborative platforms that enable remote work and project management is reshaping the market, with PlanGrid and BIM 360 gaining popularity among construction companies.

Asia-Pacific

- In the rapidly urbanizing countries of Asia, especially China and India, the construction industry is booming. The demand for project management and resource allocation software is also growing.

- Government initiatives such as the Indian government’s Smart Cities Mission are encouraging the use of advanced building technology and are encouraging local companies to adopt new software solutions.

- eSUB Construction Software is growing in popularity in the region.

MEA

- The Vision 2021 is a stimulus for the construction industry in the United Arab Emirates, with substantial investment in infrastructure projects. The need for advanced project management and collaboration tools is therefore crucial.

- The development of smart construction has led to the establishment of a number of cooperations between local companies and world-renowned software companies, which have increased the capabilities of the local construction software.

- The regulatory framework in countries such as Saudi Arabia is evolving to support digital transformation in the construction industry, encouraging the use of software that ensures compliance and efficiency.

Latin America

- Brazil's construction industry is slowly adopting digital tools. The advantages of digital solutions for the management and cost control of projects are increasingly appreciated by local companies.

- The construction industry is being pushed by government-backed programmes such as the PAC in Brazil, which aims to improve the country's aging infrastructural network.

- Moreover, the growing use of cloud computing is making construction software more accessible to small and medium-sized enterprises (SME) in the region, and in doing so is fostering innovation and competition.

Did You Know?

“Almost seventy per cent of construction projects are late and over budget, largely because of poor project management. This shows how critical construction management software is to improving efficiency.” — McKinsey & Company

Segmental Market Size

The construction software market is growing at a fast pace. The need for greater efficiency and collaboration in the execution of construction projects is driving the market. Real-time project management tools are the major drivers of this market. The integration of BIM is also expected to drive the market. The regulations for safety and compliance are also driving the market. These regulations are driving the construction companies to adopt advanced solutions that can reduce the cost of construction and enhance the accountability of the construction projects.

A large number of the leading companies, such as Autodesk and Procore, are already making a significant difference in the way the market is developing. These companies are delivering solutions for various applications, including project management, cost estimation and resource management. The digital transformation that was accelerated by the COVID-19 pandemic has also led to the increased use of cloud platforms and mobile applications. Also, the development of energy-efficient design tools is a result of the green building movement. Artificial intelligence and machine learning are also gaining traction, improving the sector’s ability to make predictions and decisions.

Future Outlook

The construction software market is set to grow at a CAGR of 9.2% between 2024 and 2032. It is a result of the increasing use of digital technology in the construction sector, such as BIM, project management software and cloud-based solutions. It is driven by the need for greater operational efficiency and lower costs. The penetration of construction software is set to rise, and by 2032, it is expected to rise to around 70% of construction companies from about 40% in 2024. This will be especially noticeable in emerging markets, where the development of the built environment is accelerating.

The integration of artificial intelligence and the Internet of Things into building information systems will further shape the market. These are the tools for real-time data analysis, for the forecasting of maintenance needs, and for the improved control of complex construction projects. The government’s support for the digital transformation of the construction industry will also help the market. Modular construction and sustainable building are further trends that will require advanced software solutions and thus also increase the market’s scope. In view of the constantly changing opportunities, the players in the construction industry will have to remain flexible and inventive.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 3.1 Billion |

| Market Size Value In 2023 | USD 3.3 Billion |

| Growth Rate | 9.4% (2023-2032) |

Construction Software Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.