Research Methodology on the Connected Aircraft Market

1. Introduction:

Market Research Future (MRFR) is a leading provider of market intelligence reports and analysis. Our research division is renowned for providing comprehensive and accurate reports on various industries across the globe. The Connected Aircraft Market research report provides a detailed analysis of the factors driving the market, the opportunities and trends in the market, and the segmentation of the Connected Aircraft Market with forecasts for 2023 to 2030. The research methodology used in this report used in-depth primary and secondary research methods.

2. Objectives:

This research report has the following objectives:

- To provide an overview of the Connected Aircraft Market

- To provide a market size forecast for the Connected Aircraft Market

iii. To study the dynamics of the Connected Aircraft Market

- To analyze the market segmentation of the Connected Aircraft Market

- To identify key drivers and restraints of the Connected Aircraft Market

- To identify strategies adopted by different companies in the Connected Aircraft Market

3. Research Design:

The research methodology used for this report is a triangulated approach which combines primary, secondary and in-depth interviews, analysis of the supply chain, and a historical study, to gather the data which was then extrapolated to arrive at a picture of the current and future nature of the Connected Aircraft Market. Primary research was conducted through on-field interviewing& primary surveys completed among participants that gave an insight into the Connected Aircraft Market. Secondary research involved the analysis of current trends, market size, industry events, published articles, and reports.

4. Variables for Analysis:

The research variables for this report focused on the potential factors and trends of the Connected Aircraft industry. This report analyzed the market size of the Connected Aircraft Market in terms of revenue, growth rate, market share, and segmentation. In addition, the key players in the industry, their strategies, business models, and product offerings were studied.

5. Sources of Data:

Data collected during the research process has been sourced and collated from primary and secondary sources. These include interviews with industry experts, surveys of key stakeholders, reports, press releases and industry databases such as industry reports, journals, news articles, white papers, etc.

6. Data Collection Procedures:

Some of the methods used during the data collection process include the following:

- Primary Data Collection: Primary data was collected by interviewing industry experts and key stakeholders through structured interviews, questionnaires, and surveys.

- Secondary Data Collection: Secondary data was collected by using market research reports, industry studies, journals, white papers, press releases, etc.

7. Quantitative & Qualitative Analysis:

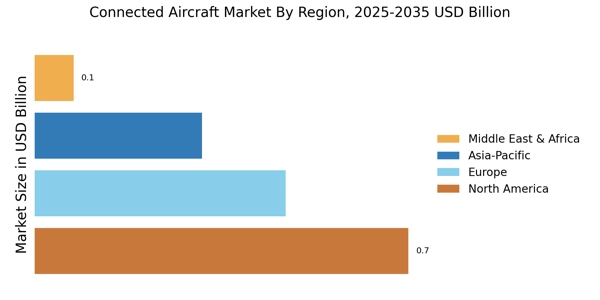

Quantitative and qualitative analysis techniques were used to analyze the collected data and come up with findings that are relevant and provide insight into the market dynamics. The qualitative analysis consisted of the identification of the key driving and restraining factors affecting the Connected Aircraft Market, while the quantitative analysis focused on the market size, market share, and market growth rate.

8. Calculation of Market Size:

For the market size calculation, the bottom-up and top-down approaches were used. This was done by analyzing the Connected Aircraft Market segmentation, region segmentation, market growth rate and market share. The data collected from these analyses were then used to calculate the size of the Connected Aircraft Market.

9. Assumptions:

The following assumptions have been made while preparing the research report:

- The market analysis was based on the assumption that the market growth rates and market share assumptions provided by key stakeholders of the Connected Aircraft Market are accurate.

- The report is based on the historical data which has been collected and extrapolated to reach a picture of the current and future trends of the Connected Aircraft Market.

- The forecast period for the report is from 2023 to 2030.

10. Conclusion:

The research methodology used for this research report has been a triangulated approach that involved an in-depth analysis of the primary and secondary sources that provided an accurate picture of the current and future market for the Connected Aircraft Market. The data collected has been analyzed to identify key drivers and restraints, trends and opportunities in the Connected Aircraft Market. The research has also studied the market segmentation, region segmentation, and market size and the factors driving the market to provide the reader with an accurate picture of the current and future trends of the Connected Aircraft Market.