Innovations in Biotechnology

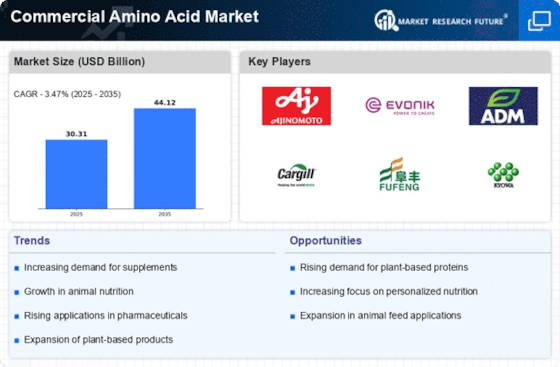

The Commercial Amino Acid Market is being transformed by innovations in biotechnology. Advances in fermentation technology and genetic engineering are enabling more efficient production of amino acids, reducing costs and improving yield. These innovations are likely to enhance the competitiveness of amino acid producers, allowing them to meet the growing demand across various sectors, including food, pharmaceuticals, and cosmetics. The market is expected to see a shift towards more sustainable production methods, with biotechnological advancements facilitating the use of renewable resources. By 2025, the impact of these innovations could lead to a market growth rate of approximately 6%, as companies increasingly adopt biotechnological solutions to optimize their production processes.

Expansion in Animal Feed Industry

The Commercial Amino Acid Market is also benefiting from the expansion in the animal feed sector. Amino acids are vital for animal nutrition, promoting growth and improving feed efficiency. The increasing demand for high-quality animal protein, driven by rising meat consumption, is propelling the need for amino acids in animal feed formulations. In 2025, the market for amino acids in animal feed is anticipated to surpass USD 2 billion, indicating a robust growth trajectory. This trend is further supported by the growing awareness of animal health and the need for sustainable farming practices, which necessitate the inclusion of amino acids to enhance the nutritional profile of feed, thereby improving livestock productivity.

Rising Popularity of Sports Nutrition

The Commercial Amino Acid Market is witnessing a surge in popularity due to the growing interest in sports nutrition. Athletes and fitness enthusiasts increasingly seek amino acid supplements to enhance performance, recovery, and muscle growth. The sports nutrition segment is projected to account for a significant share of the amino acid market, with an estimated value of USD 1.2 billion by 2025. This growth is likely driven by the increasing awareness of the benefits of amino acids in muscle repair and energy production. Furthermore, the trend towards personalized nutrition is expected to bolster the demand for tailored amino acid formulations, catering to specific athletic needs and dietary preferences.

Growing Demand for Plant-Based Proteins

The Commercial Amino Acid Market is experiencing a shift towards plant-based proteins, driven by changing consumer preferences and dietary trends. As more individuals adopt vegetarian and vegan diets, the demand for plant-derived amino acids is likely to increase. This trend is reflected in the rising popularity of plant-based protein supplements, which are often fortified with essential amino acids to meet nutritional needs. By 2025, the market for plant-based amino acids is projected to reach USD 800 million, indicating a significant growth opportunity. This shift not only aligns with health-conscious consumer behavior but also addresses environmental concerns associated with animal agriculture, thereby positioning plant-based amino acids as a sustainable alternative in the market.

Increasing Application in Pharmaceuticals

The Commercial Amino Acid Market is experiencing a notable surge in demand due to its increasing application in pharmaceuticals. Amino acids serve as critical building blocks for protein synthesis and are essential in the formulation of various medications. The market for amino acids in pharmaceuticals is projected to grow significantly, driven by the rising prevalence of chronic diseases and the need for effective therapeutic solutions. In 2025, the market for amino acids in this sector is expected to reach approximately USD 1.5 billion, reflecting a compound annual growth rate of around 7%. This growth is likely attributed to the expanding research and development activities aimed at discovering new drug formulations that incorporate amino acids, thereby enhancing their therapeutic efficacy.