Advancements in Network Infrastructure

The continuous advancements in network infrastructure in China are playing a pivotal role in shaping the virtual desktop-infrastructure market. With the rollout of high-speed internet and 5G technology, organizations are now able to support more robust virtual desktop solutions. These technological improvements facilitate faster data transmission and enhance the overall user experience. As a result, the virtual desktop-infrastructure market is likely to witness increased adoption rates, as businesses leverage these advancements to improve operational efficiency. Furthermore, the ability to support high-definition applications and real-time collaboration tools through enhanced network capabilities may further drive the demand for virtual desktop solutions in various sectors.

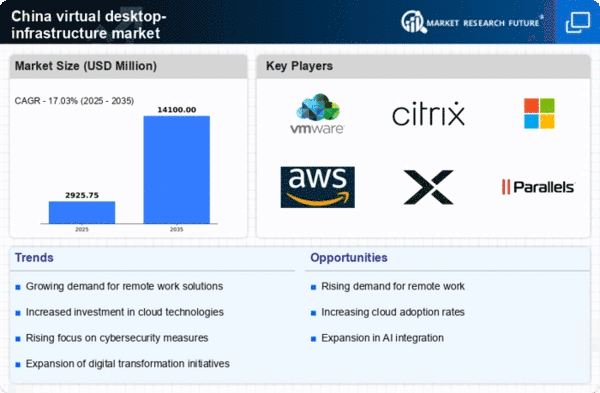

Rising Demand for Remote Work Solutions

The virtual desktop-infrastructure market in China is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for secure and efficient remote access to desktop environments has become paramount. According to recent data, approximately 60% of enterprises in China are investing in virtual desktop solutions to facilitate remote work. This trend is driven by the desire to enhance productivity while ensuring data security. The virtual desktop-infrastructure market is thus positioned to benefit from this shift, as companies seek to provide employees with seamless access to applications and data from any location. Furthermore, the integration of advanced technologies, such as cloud computing, is likely to further bolster this demand, making virtual desktop solutions an essential component of modern workplace strategies.

Increased Investment in IT Infrastructure

Investment in IT infrastructure is a key driver for the virtual desktop-infrastructure market in China. As businesses recognize the importance of modernizing their IT systems, there is a growing trend towards allocating budgets for virtual desktop solutions. Recent reports suggest that IT spending in China is projected to grow by 8% annually, with a significant portion directed towards virtual desktop infrastructures. This investment is aimed at improving scalability, flexibility, and cost-effectiveness in IT operations. The virtual desktop-infrastructure market stands to gain from this trend, as organizations seek to optimize their IT environments and enhance their ability to adapt to changing business needs.

Growing Focus on Data Security and Compliance

Data security and compliance are becoming critical concerns for organizations in China, thereby driving the virtual desktop-infrastructure market. With the increasing frequency of cyber threats and stringent regulatory requirements, businesses are prioritizing secure access to sensitive information. The virtual desktop-infrastructure market offers solutions that enhance data protection by centralizing data storage and minimizing the risk of data breaches. Recent statistics indicate that over 70% of companies in China are implementing virtual desktop solutions to comply with data protection regulations. This focus on security not only mitigates risks but also instills confidence among clients and stakeholders, making virtual desktop infrastructures an attractive option for organizations aiming to safeguard their data.

Government Initiatives Supporting Digital Transformation

In China, government initiatives aimed at promoting digital transformation are significantly influencing the virtual desktop-infrastructure market. The Chinese government has launched various programs to encourage the adoption of digital technologies across industries, which includes the implementation of virtual desktop solutions. These initiatives are designed to enhance operational efficiency and competitiveness among businesses. For instance, the 'Made in China 2025' strategy emphasizes the importance of integrating advanced IT solutions, including virtual desktop infrastructures, into manufacturing and service sectors. As a result, the virtual desktop-infrastructure market is likely to see increased investments and support from both public and private sectors, fostering innovation and growth in this domain.