Expansion of IoT Ecosystem

The expansion of the Internet of Things (IoT) ecosystem in China is a significant driver for the telecom api market. As more devices become interconnected, the need for robust APIs to facilitate communication between these devices grows. Telecom APIs enable seamless data exchange and integration, which is essential for the functioning of smart cities, connected vehicles, and industrial automation. The IoT market in China is projected to reach $300 billion by 2025, indicating a substantial opportunity for telecom APIs to support this growth. This trend highlights the critical role of telecom APIs in enabling the IoT landscape, thereby driving market expansion.

Rising Demand for Digital Services

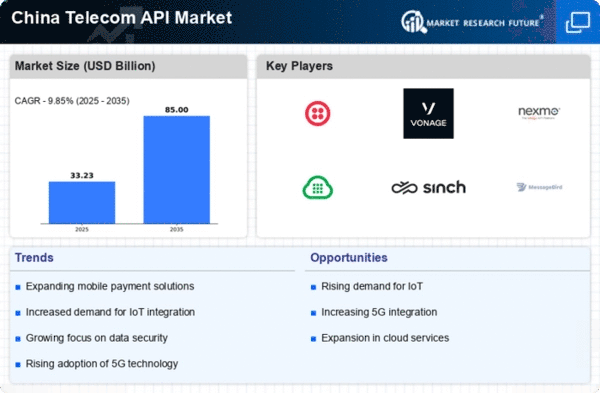

The telecom api market in China experiences a notable surge in demand for digital services, driven by the increasing reliance on mobile applications and online platforms. As businesses and consumers alike seek seamless connectivity and enhanced user experiences, telecom APIs play a crucial role in facilitating these services. The market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the growing integration of telecom APIs in various sectors, including finance, healthcare, and e-commerce. This trend indicates that companies are increasingly leveraging telecom APIs to enhance their service offerings, thereby driving growth in the telecom api market.

Government Initiatives and Regulations

Government initiatives in China significantly influence the telecom api market, as regulatory frameworks evolve to support digital transformation. The Chinese government has implemented policies aimed at fostering innovation and competition within the telecommunications sector. For instance, the promotion of 5G technology is expected to enhance the capabilities of telecom APIs, enabling faster and more reliable services. Additionally, regulations that encourage data sharing and interoperability among telecom providers are likely to create new opportunities for API development. These initiatives suggest a supportive environment for the telecom api market, potentially leading to increased investment and innovation.

Increased Focus on Customer Experience

In the competitive landscape of telecommunications in China, companies are increasingly prioritizing customer experience, which significantly impacts the telecom api market. Businesses are utilizing APIs to enhance service delivery, streamline operations, and provide personalized experiences to their customers. By integrating telecom APIs into their platforms, companies can offer features such as real-time notifications, automated customer support, and tailored service packages. This focus on customer-centric solutions is likely to drive the adoption of telecom APIs, as organizations seek to differentiate themselves in a crowded market. The emphasis on customer experience suggests a growing reliance on telecom APIs to meet evolving consumer expectations.

Adoption of Advanced Analytics and Data Management

The telecom api market in China is witnessing a shift towards advanced analytics and data management solutions. As telecom operators collect vast amounts of data, the need for APIs that facilitate data analysis and management becomes increasingly apparent. These APIs enable businesses to harness data insights for decision-making, operational efficiency, and targeted marketing strategies. The integration of analytics capabilities into telecom APIs is expected to enhance their value proposition, making them indispensable for companies aiming to leverage data for competitive advantage. This trend indicates a growing recognition of the importance of data-driven strategies in the telecom api market.