Rising Energy Demand

The growing energy demand in China is a significant driver for the smart meters market. As the country continues to industrialize and urbanize, the need for efficient energy management becomes paramount. The International Energy Agency projects that China's energy consumption will increase by 3% annually through 2030. This surge in demand necessitates the implementation of smart metering solutions to monitor and manage energy usage effectively. Smart meters provide utilities with the capability to analyze consumption data, identify peak usage times, and implement demand response strategies. Consequently, the China smart meters market is expected to expand rapidly, as utilities seek to enhance their operational efficiency and meet the rising energy needs of consumers.

Technological Innovations

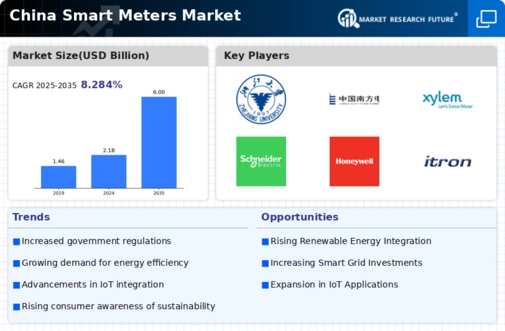

Technological advancements play a crucial role in the evolution of the China smart meters market. Innovations in communication technologies, such as IoT and advanced data analytics, have enhanced the functionality and efficiency of smart meters. These devices now offer real-time data monitoring, enabling consumers to track their energy consumption patterns. Furthermore, the integration of artificial intelligence in smart metering systems allows for predictive analytics, which can optimize energy distribution and reduce operational costs for utility providers. As of 2025, the market is projected to witness a compound annual growth rate of approximately 15%, driven by these technological innovations. This trend indicates a robust future for the China smart meters market, as both consumers and utilities increasingly recognize the benefits of smart metering solutions.

Increased Focus on Sustainability

Sustainability has emerged as a key focus in the China smart meters market, driven by both government initiatives and consumer preferences. The Chinese government has committed to reducing carbon emissions and increasing the share of renewable energy in its energy mix. Smart meters facilitate this transition by enabling better integration of renewable energy sources, such as solar and wind, into the grid. They also empower consumers to make informed decisions about their energy usage, promoting energy conservation. As of 2025, it is anticipated that the market for smart meters will grow in tandem with the country's sustainability goals, with an expected increase in installations by 20% annually. This alignment with sustainability objectives positions the China smart meters market as a vital component in the broader context of environmental stewardship.

Government Policies and Regulations

The China smart meters market is significantly influenced by government policies aimed at enhancing energy efficiency and promoting renewable energy sources. The Chinese government has implemented various regulations that mandate the installation of smart meters across residential and commercial sectors. For instance, the National Energy Administration has set ambitious targets for smart meter deployment, aiming for a nationwide rollout by 2025. This regulatory framework not only encourages utility companies to adopt smart metering technologies but also facilitates investments in infrastructure. As of 2025, it is estimated that over 300 million smart meters will be installed, reflecting a substantial increase in market demand. Such government initiatives are pivotal in shaping the landscape of the China smart meters market.

Growing Urbanization and Smart City Initiatives

Urbanization in China is accelerating, with millions migrating to cities each year. This demographic shift is a significant driver for the smart meters market, as urban areas require advanced infrastructure to manage energy consumption effectively. The Chinese government has launched various smart city initiatives aimed at integrating technology into urban planning and management. Smart meters are integral to these initiatives, providing real-time data that helps city planners optimize energy distribution and reduce waste. By 2025, it is projected that smart meters will be a standard feature in urban developments, contributing to the efficiency and sustainability of smart cities. This trend underscores the importance of the China smart meters market in supporting the country's urbanization efforts.