Growing Medical Device Market

The expanding medical device market in China is a crucial driver for the pupillometer market. With a robust healthcare infrastructure and increasing investments in medical technology, the demand for diagnostic devices is on the rise. The Chinese medical device market is projected to reach approximately $100 billion by 2026, with a significant portion attributed to ophthalmic devices. This growth is fueled by the rising number of eye care specialists and the increasing adoption of advanced diagnostic tools in clinical settings. Consequently, the pupillometer market is likely to benefit from this trend, as healthcare providers seek to enhance their diagnostic capabilities and improve patient outcomes.

Rising Demand for Eye Care Solutions

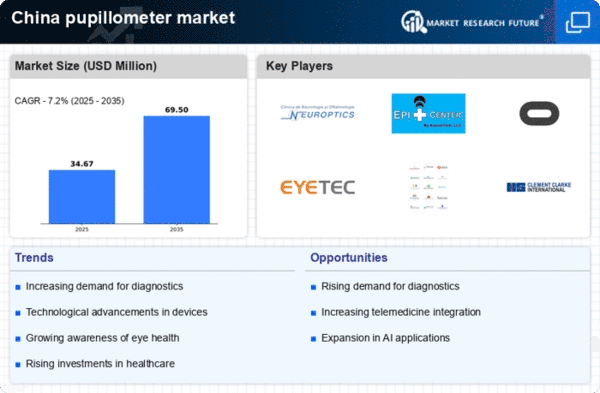

The increasing prevalence of eye-related disorders in China is driving the demand for advanced diagnostic tools, including pupillometers. As the population ages, the incidence of conditions such as glaucoma and diabetic retinopathy rises, necessitating effective monitoring and diagnosis. The pupillometer market is expected to benefit from this trend, as healthcare providers seek reliable instruments to assess pupil responses and diagnose underlying issues. In 2025, the market is projected to grow at a CAGR of approximately 8%, reflecting the urgent need for innovative eye care solutions. This growth is further supported by the expansion of healthcare facilities and the integration of advanced technologies in ophthalmology, which enhances the overall quality of patient care.

Government Initiatives for Eye Health

Government initiatives aimed at improving eye health in China are playing a pivotal role in the growth of the pupillometer market. Programs focused on increasing public awareness about eye health and promoting regular eye examinations are likely to drive demand for diagnostic tools. The Chinese government has allocated substantial funding towards eye care initiatives, which includes the procurement of advanced medical devices like pupillometers for hospitals and clinics. This financial support is expected to enhance accessibility to eye care services, thereby increasing the utilization of pupillometers. As a result, the market may experience a growth rate of around 10% over the next few years, reflecting the positive impact of these initiatives on the healthcare landscape.

Technological Integration in Healthcare

The integration of cutting-edge technology in healthcare practices is significantly influencing the pupillometer market in China. Innovations such as digital imaging and artificial intelligence are enhancing the functionality of pupillometers, making them more efficient and user-friendly. These advancements allow for more accurate measurements and quicker diagnoses, which are crucial in a fast-paced medical environment. As hospitals and clinics increasingly adopt these technologies, the demand for sophisticated pupillometers is likely to rise. The market is expected to see a surge in sales, with estimates suggesting a potential increase of 15% in the adoption of technologically advanced pupillometers by 2026. This trend indicates a shift towards more precise and reliable eye care diagnostics.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare in China is influencing the pupillometer market positively. As healthcare providers and patients alike recognize the importance of early detection and prevention of eye diseases, the demand for diagnostic tools such as pupillometers is expected to rise. This trend is supported by educational campaigns that emphasize the significance of regular eye check-ups and the role of technology in monitoring eye health. The market may witness a growth rate of around 12% as more individuals seek proactive measures to maintain their eye health. This focus on prevention aligns with broader healthcare trends in China, where there is a growing emphasis on holistic and preventive approaches to health management.