Rising Demand for Customization

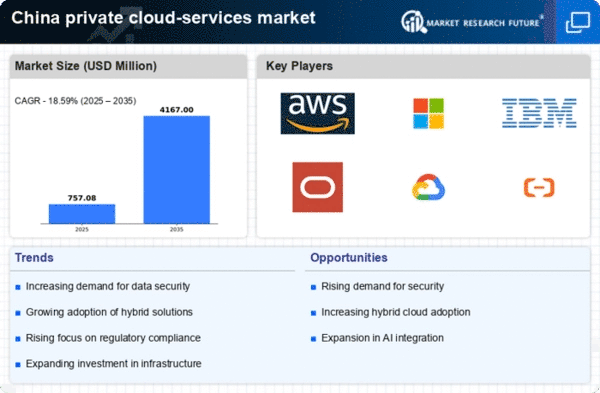

The private cloud-services market in China experiences a notable surge in demand for tailored solutions. Organizations increasingly seek customized cloud environments that align with their specific operational needs and regulatory requirements. This trend is driven by the necessity for businesses to maintain competitive advantages while ensuring compliance with local data protection laws. As of 2025, the market is projected to grow at a CAGR of approximately 20%, reflecting the growing inclination towards personalized cloud services. Companies are investing in private cloud infrastructures that allow for greater flexibility and control over their data, which is crucial in a landscape where data sovereignty is paramount. This customization trend not only enhances operational efficiency but also fosters innovation, as businesses can deploy applications that are uniquely suited to their strategic objectives.

Emergence of Advanced Technologies

The private cloud-services market in China is significantly influenced by the emergence of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies are being integrated into private cloud solutions, enhancing their capabilities and performance. Organizations are leveraging AI and ML to optimize resource allocation, improve security measures, and automate processes within their private cloud environments. This integration is expected to drive market growth by approximately 21% by 2025, as businesses seek to harness the power of these technologies to gain a competitive edge. The ability to analyze vast amounts of data in real-time and make informed decisions is becoming increasingly vital, positioning private cloud services as a key enabler of digital transformation in various industries.

Government Initiatives and Support

The private cloud-services market in China benefits significantly from government initiatives aimed at promoting digital transformation. The Chinese government has implemented various policies to encourage the adoption of cloud technologies across industries. These initiatives include financial incentives, tax breaks, and support for research and development in cloud computing. As a result, many enterprises are transitioning to private cloud solutions to leverage these benefits. The government's focus on enhancing cybersecurity and data privacy further propels the demand for private cloud services, as organizations seek to comply with stringent regulations. By 2025, it is anticipated that government support will contribute to a market growth rate of around 18%, as more businesses recognize the advantages of private cloud infrastructures in achieving compliance and operational excellence.

Increased Focus on Data Sovereignty

In the context of the private cloud-services market, data sovereignty has emerged as a critical driver in China. Organizations are increasingly aware of the implications of data localization laws, which mandate that data generated within the country must be stored and processed domestically. This awareness has led to a heightened demand for private cloud solutions that ensure compliance with these regulations. As businesses prioritize data sovereignty, they are investing in private cloud infrastructures that provide enhanced control over their data. The market is projected to expand by approximately 22% by 2025, as companies recognize the importance of safeguarding sensitive information while adhering to local laws. This trend not only addresses compliance concerns but also enhances trust among customers, thereby fostering a more robust business environment.

Growing Need for Scalability and Flexibility

The private cloud-services market in China is witnessing a growing need for scalability and flexibility among enterprises. As businesses expand and evolve, their IT infrastructure must adapt to changing demands. Private cloud solutions offer the agility required to scale resources up or down based on operational needs. This flexibility is particularly appealing to organizations in sectors such as finance and healthcare, where rapid changes in data processing requirements are common. By 2025, it is estimated that the demand for scalable private cloud services will drive market growth by approximately 19%. Companies are increasingly recognizing that private cloud infrastructures not only support current operational needs but also position them for future growth, enabling them to respond swiftly to market changes and customer demands.