Focus on Preventive Healthcare

The phytoestrogen supplements market is being driven by a growing emphasis on preventive healthcare among Chinese consumers. As awareness of the importance of maintaining health and preventing diseases increases, more individuals are turning to dietary supplements as a proactive measure. Phytoestrogens are perceived as a natural way to support hormonal health and overall wellness, aligning with this preventive approach. Market trends indicate that the demand for supplements aimed at preventing health issues has grown by approximately 18% in the past year. This focus on preventive healthcare is likely to sustain the growth of the phytoestrogen supplements market, as consumers seek to enhance their quality of life through natural means.

Rising Interest in Plant-Based Diets

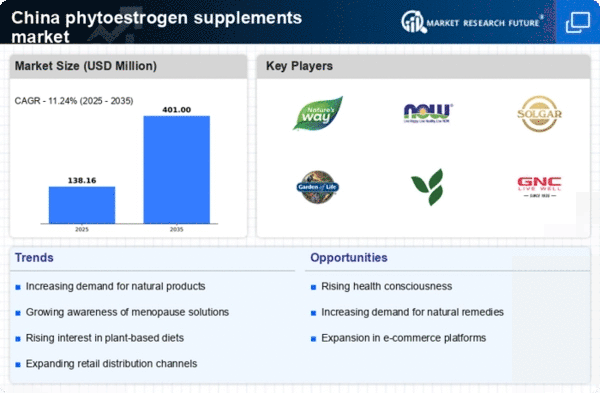

The phytoestrogen supplements market is benefiting from the increasing interest in plant-based diets among Chinese consumers. As more individuals adopt vegetarian or vegan lifestyles, the demand for plant-derived supplements has surged. Phytoestrogens, which are naturally occurring in many plant foods, align well with this dietary trend. Market analysis indicates that the sales of phytoestrogen supplements have increased by approximately 20% in the last year, driven by consumers seeking to enhance their diets with natural sources of these beneficial compounds. This shift towards plant-based nutrition is likely to continue influencing the phytoestrogen supplements market, as consumers become more health-conscious and environmentally aware.

Aging Population and Hormonal Changes

China's demographic shift towards an aging population is significantly impacting the phytoestrogen supplements market. As the population ages, there is a growing prevalence of hormonal changes, particularly among women experiencing menopause. This demographic trend has led to an increased demand for supplements that can help manage these changes. Reports suggest that nearly 30% of women in their 50s and 60s are actively seeking natural remedies to alleviate menopausal symptoms. Consequently, poised for growth as manufacturers develop targeted products. as manufacturers develop targeted products to cater to this demographic, addressing their specific health needs and preferences.

Increasing Awareness of Health Benefits

experiencing growth due to rising awareness among consumers. due to rising awareness among consumers regarding the health benefits associated with phytoestrogens. These compounds, found in various plants, are believed to alleviate menopausal symptoms, support hormonal balance, and promote overall well-being. In China, educational campaigns and health initiatives have contributed to a greater understanding of these benefits, leading to increased demand. Market data indicates that the sales of phytoestrogen supplements have surged by approximately 15% annually, reflecting a shift in consumer preferences towards natural health solutions. This trend is likely to continue as more individuals seek alternatives to synthetic hormone therapies, thereby driving the phytoestrogen supplements market further.

Growing E-commerce and Online Retail Channels

The phytoestrogen supplements market is experiencing a transformation due to the rapid growth of e-commerce and online retail channels in China. With the increasing penetration of the internet and mobile devices, consumers are more inclined to purchase health supplements online. This trend has facilitated access to a wider range of phytoestrogen products, allowing consumers to compare options and make informed choices. Data suggests that online sales of health supplements, including phytoestrogens, have risen by over 25% in recent years. As e-commerce continues to expand, it is expected to play a crucial role in shaping the phytoestrogen supplements market, providing convenience and accessibility to consumers.