Rising Demand in Beverage Industry

The China pectinase market is experiencing a notable surge in demand, particularly within the beverage sector. As consumers increasingly favor fruit-based drinks, manufacturers are seeking efficient methods to enhance juice extraction and clarity. Pectinase enzymes play a crucial role in breaking down pectin, thus improving yield and quality. In 2025, the beverage segment accounted for approximately 35% of the total pectinase consumption in China, reflecting a growing trend towards natural and healthier beverage options. This shift is likely to continue, driven by consumer preferences for organic and minimally processed products, which could further bolster the pectinase market in the coming years.

Growth in the Fruit Processing Sector

The fruit processing industry in China is a significant driver for the pectinase market. With the increasing production of fruits such as apples, pears, and citrus, there is a corresponding rise in the need for pectinase to facilitate juice extraction and improve product quality. In 2025, the fruit processing sector represented around 40% of the total pectinase usage in China. This growth is attributed to the expanding domestic and international demand for fruit juices and purees, which necessitates the use of pectinase for optimal processing. As the industry evolves, the adoption of advanced enzymatic solutions is expected to enhance efficiency and product appeal.

Increasing Focus on Health and Nutrition

The growing emphasis on health and nutrition among Chinese consumers is a pivotal driver for the pectinase market. As awareness of the benefits of natural ingredients rises, food manufacturers are increasingly incorporating pectinase to enhance the nutritional profile of their products. In 2025, approximately 30% of pectinase sales were attributed to health-focused food products, including functional beverages and dietary supplements. This trend is expected to persist, as consumers continue to seek products that align with their health-conscious lifestyles. Consequently, the demand for pectinase is likely to grow, as manufacturers strive to meet the evolving preferences of health-oriented consumers.

Regulatory Support for Enzyme Applications

Regulatory frameworks in China are increasingly supportive of enzyme applications, which is beneficial for the pectinase market. The government has implemented policies that promote the use of food-grade enzymes in various applications, including food processing and preservation. In 2025, the regulatory environment facilitated a 20% increase in the adoption of pectinase among food manufacturers, as compliance with safety standards became more streamlined. This supportive regulatory landscape not only encourages innovation but also enhances consumer confidence in enzyme-treated products. As regulations continue to evolve, the pectinase market is poised for further expansion, driven by increased acceptance and utilization across the food industry.

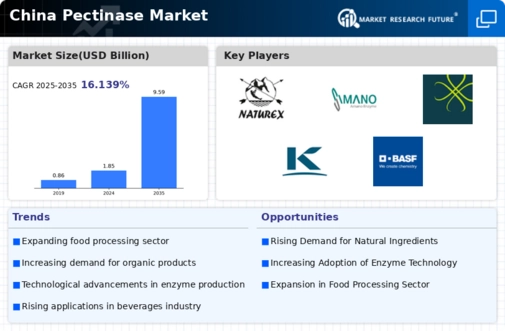

Technological Advancements in Enzyme Production

Technological innovations in enzyme production are significantly influencing the China pectinase market. The development of more efficient fermentation processes and the use of genetically modified microorganisms have led to higher yields and lower production costs. In 2025, advancements in enzyme technology contributed to a 15% reduction in production costs for pectinase manufacturers. This trend not only enhances the profitability of enzyme production but also encourages wider adoption across various sectors, including food and beverage. As companies invest in research and development, the market is likely to witness the introduction of novel pectinase formulations tailored to specific applications, further driving growth.