Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare infrastructure significantly influence The China Molecular Diagnostics Transplant Market. The Chinese government has implemented various policies to promote research and development in molecular diagnostics, including substantial funding for biotechnology firms. The 13th Five-Year Plan emphasizes the importance of precision medicine, which encompasses molecular diagnostics as a core component. This strategic focus is expected to bolster the development of innovative diagnostic solutions tailored for transplant patients. Furthermore, the establishment of national health programs aimed at improving organ transplant success rates underscores the government's commitment to advancing this sector, potentially leading to increased investments and market expansion.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in China is a pivotal driver for The China Molecular Diagnostics Transplant Market. Conditions such as diabetes, cardiovascular diseases, and various cancers necessitate advanced diagnostic solutions for effective management and treatment. According to the National Health Commission, chronic diseases account for approximately 80% of total deaths in China, highlighting the urgent need for innovative diagnostic tools. This growing health burden propels the demand for molecular diagnostics, particularly in transplant scenarios where precise genetic matching and monitoring are crucial. As healthcare providers seek to enhance patient outcomes, the integration of molecular diagnostics into transplant protocols is likely to expand, thereby fostering market growth.

Increasing Investment in Biotechnology Sector

The surge in investment within China's biotechnology sector is a crucial driver for The China Molecular Diagnostics Transplant Market. Venture capital and private equity funding have been increasingly directed towards companies specializing in molecular diagnostics, reflecting a growing confidence in the potential of these technologies. The Chinese biotechnology market is expected to reach USD 200 billion by 2025, with molecular diagnostics playing a significant role in this expansion. This influx of capital is likely to accelerate research and development efforts, leading to the introduction of novel diagnostic solutions tailored for transplant applications. As the market matures, the availability of advanced diagnostics is expected to improve patient outcomes and drive further investment.

Technological Innovations in Molecular Diagnostics

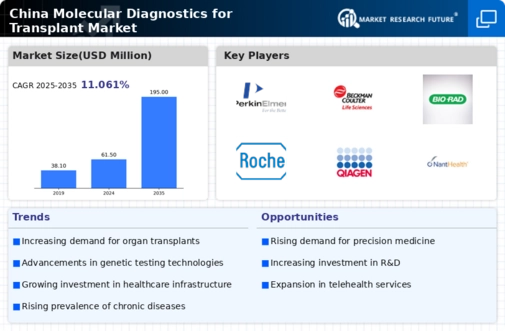

Technological advancements in molecular diagnostics are transforming the landscape of The China Molecular Diagnostics Transplant Market. Innovations such as next-generation sequencing (NGS) and real-time PCR are enhancing the accuracy and speed of diagnostic tests, which are critical in transplant settings. These technologies enable healthcare providers to perform comprehensive genetic analyses, facilitating better donor-recipient matching and post-transplant monitoring. The market for NGS in China is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years, driven by the increasing demand for precise diagnostics in transplantation. Such advancements are likely to enhance the overall efficacy of transplant procedures, thereby propelling market growth.

Growing Awareness and Acceptance of Molecular Diagnostics

There is a notable increase in awareness and acceptance of molecular diagnostics among healthcare professionals and patients in China, which serves as a significant driver for The China Molecular Diagnostics Transplant Market. Educational campaigns and professional training programs have contributed to a better understanding of the benefits of molecular testing in transplant procedures. As healthcare providers recognize the value of precise diagnostics in improving transplant outcomes, the adoption of these technologies is likely to rise. Market data indicates that the use of molecular diagnostics in organ transplantation has increased by over 30% in recent years, reflecting a shift towards more personalized and effective treatment approaches.