Aging Population

China's demographic shift towards an aging population is a crucial driver for the mobile radiography-systems market. With projections indicating that by 2030, approximately 25% of the population will be over 60 years old, the demand for medical imaging services is likely to increase. Older adults often require more frequent medical evaluations, including imaging studies, to monitor chronic conditions. Mobile radiography systems offer a practical solution for providing timely and efficient imaging services, particularly in home care settings or remote areas. This trend suggests that healthcare providers may increasingly invest in mobile radiography systems to cater to the needs of the elderly, thereby expanding the market's potential. The integration of these systems into geriatric care could enhance patient outcomes and streamline healthcare delivery.

Rising Healthcare Expenditure

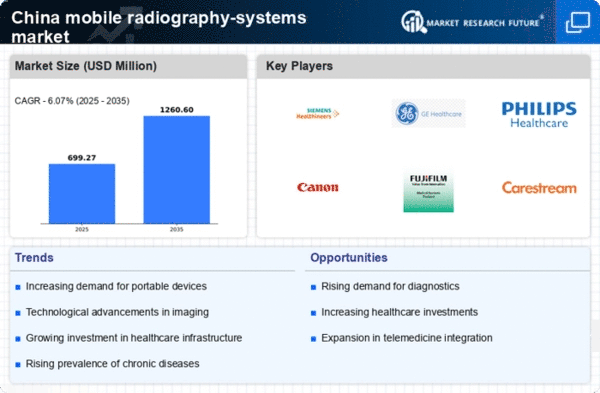

The mobile radiography-systems market in China is experiencing growth due to the increasing healthcare expenditure by both the government and private sectors. In recent years, China's healthcare spending has risen significantly, with estimates suggesting an increase to over 7% of GDP by 2025. This rise in expenditure is likely to enhance the availability of advanced medical technologies, including mobile radiography systems, in hospitals and clinics. As healthcare facilities invest in modern equipment to improve diagnostic capabilities, the demand for mobile radiography systems is expected to grow. Furthermore, the government's commitment to improving healthcare infrastructure, particularly in rural areas, may further drive the adoption of mobile radiography systems, ensuring that quality healthcare is accessible to a larger population.

Government Initiatives and Policies

Government initiatives aimed at enhancing healthcare access and quality are playing a pivotal role in the mobile radiography-systems market. Policies promoting the development of healthcare infrastructure, particularly in underserved regions, are likely to increase the demand for mobile radiography systems. The Chinese government has launched various programs to improve healthcare delivery, including investments in mobile health technologies. These initiatives may encourage healthcare facilities to adopt mobile radiography systems as a means to provide timely diagnostic services. Additionally, subsidies or financial incentives for healthcare providers to upgrade their imaging capabilities could further stimulate market growth. The alignment of government policies with healthcare needs suggests a favorable environment for the mobile radiography-systems market.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is significantly influencing the mobile radiography-systems market. Innovations such as artificial intelligence (AI) and cloud computing are being incorporated into mobile radiography systems, enhancing their functionality and efficiency. For instance, AI algorithms can assist in image analysis, potentially improving diagnostic accuracy and reducing the time required for interpretation. As hospitals and clinics in China adopt these technologies, the demand for modern mobile radiography systems is likely to increase. Furthermore, the ability to store and share imaging data through cloud platforms may facilitate better collaboration among healthcare professionals, thereby improving patient care. This technological evolution appears to be a key factor driving the growth of the mobile radiography-systems market.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in China is emerging as a significant driver for the mobile radiography-systems market. As healthcare providers shift their focus from reactive to proactive care, the demand for diagnostic imaging services is likely to rise. Mobile radiography systems facilitate early detection of diseases, enabling timely interventions that can improve patient outcomes. This trend is particularly relevant in the context of chronic disease management, where regular imaging may be necessary to monitor patient health. The increasing awareness among the population regarding the importance of preventive care may lead to higher utilization of mobile radiography systems in various healthcare settings. Consequently, this focus on prevention could substantially contribute to the growth of the mobile radiography-systems market.