Growing Biopharmaceutical Sector

The biopharmaceutical sector in China is experiencing rapid growth, which is likely to drive the live cell-imaging market. With an increasing number of biopharmaceutical companies focusing on drug discovery and development, the demand for advanced imaging technologies is expected to rise. In 2025, the biopharmaceutical market in China is projected to reach approximately $150 billion, indicating a robust investment in research and development. This growth is anticipated to create a substantial need for live cell-imaging solutions, as researchers require precise imaging techniques to monitor cellular processes in real-time. The integration of live cell-imaging technologies into biopharmaceutical research could enhance the efficiency of drug development, thereby propelling the market forward.

Government Initiatives and Support

The Chinese government is actively promoting biotechnology and life sciences, which is likely to bolster the live cell-imaging market. Various initiatives aimed at enhancing research capabilities and fostering innovation in the life sciences sector are being implemented. For instance, the government has allocated substantial funding to support research institutions and universities, encouraging the adoption of advanced imaging technologies. This support is expected to facilitate collaborations between academic and industrial entities, thereby driving the development and application of live cell-imaging solutions. The commitment to advancing biotechnology in China could lead to a more robust market environment for live cell-imaging technologies.

Increased Focus on Drug Development

There is a heightened focus on drug development in China, which may serve as a catalyst for the live cell-imaging market. Pharmaceutical companies are increasingly investing in research to discover new therapies, particularly in oncology and rare diseases. The live cell-imaging market is poised to benefit from this trend, as these imaging techniques provide critical insights into cellular behavior and drug interactions. In 2025, the pharmaceutical R&D expenditure in China is projected to exceed $50 billion, indicating a strong commitment to innovation. This investment is likely to drive the demand for live cell-imaging technologies, as researchers seek to enhance their understanding of drug efficacy and safety.

Advancements in Imaging Technologies

Technological advancements in imaging modalities are expected to significantly influence the live cell-imaging market in China. Innovations such as high-resolution microscopy, fluorescence imaging, and automated imaging systems are enhancing the capabilities of researchers to visualize live cells with unprecedented clarity. These advancements are likely to improve the accuracy and efficiency of cellular studies, making live cell imaging an indispensable tool in various research fields. As the demand for more sophisticated imaging solutions grows, the live cell-imaging market is anticipated to expand, driven by the need for cutting-edge technologies that can support complex biological research.

Rising Incidence of Chronic Diseases

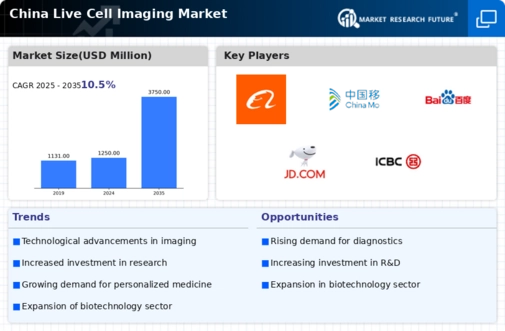

The prevalence of chronic diseases in China is on the rise, which may significantly impact the live cell-imaging market. As the population ages and lifestyle-related health issues become more common, there is an increasing need for innovative diagnostic and therapeutic solutions. Chronic diseases such as cancer, diabetes, and cardiovascular conditions necessitate advanced research methodologies, including live cell imaging, to understand disease mechanisms and develop effective treatments. The market for chronic disease management in China is expected to grow at a CAGR of around 10% through 2025, suggesting a corresponding increase in the demand for live cell-imaging technologies to support this research.