Government Initiatives and Support

In China, government initiatives aimed at enhancing healthcare infrastructure are playing a crucial role in the growth of the healthcare crm market. The government has been investing heavily in digital health technologies, which includes the implementation of CRM systems in healthcare settings. Policies promoting the digitization of health records and the integration of technology in patient management are expected to drive market growth. For instance, the Chinese government has set ambitious targets for the adoption of electronic health records, which could potentially increase the demand for CRM solutions by over 20% in the coming years. This supportive regulatory environment is likely to encourage healthcare providers to invest in CRM systems, thereby fostering innovation and improving patient care.

Growing Focus on Telehealth Services

The rise of telehealth services in China is emerging as a significant driver for the healthcare crm market. As more patients seek remote healthcare options, providers are increasingly adopting CRM systems that can support telehealth functionalities. These systems enable healthcare organizations to manage virtual consultations, track patient interactions, and maintain comprehensive records of telehealth services. The telehealth market in China is projected to grow at a CAGR of around 25% over the next few years, indicating a robust demand for integrated CRM solutions that cater to this evolving landscape. This trend suggests that healthcare providers will prioritize CRM systems that enhance their telehealth capabilities, thereby contributing to the overall growth of the healthcare crm market.

Rising Demand for Patient-Centric Solutions

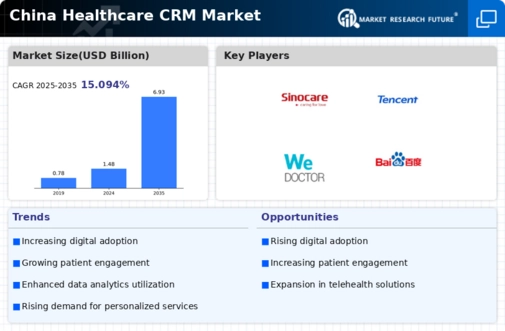

The healthcare crm market in China is experiencing a notable shift towards patient-centric solutions. This trend is driven by an increasing emphasis on personalized care and improved patient engagement. Healthcare providers are recognizing the importance of understanding patient needs and preferences, which is leading to a surge in the adoption of CRM systems that facilitate better communication and relationship management. According to recent data, the market for patient engagement solutions is projected to grow at a CAGR of approximately 15% over the next five years. This growth indicates a strong demand for healthcare CRM systems that can effectively manage patient interactions and enhance overall satisfaction. As a result, the healthcare crm market is likely to expand significantly, with providers seeking innovative solutions to meet the evolving expectations of patients.

Technological Advancements in Data Analytics

The healthcare crm market in China is being significantly influenced by advancements in data analytics technologies. The ability to analyze large volumes of patient data allows healthcare providers to gain valuable insights into patient behavior and treatment outcomes. This capability is essential for developing targeted marketing strategies and improving service delivery. As analytics tools become more sophisticated, healthcare organizations are increasingly adopting CRM systems that incorporate these technologies. Reports indicate that the market for healthcare analytics is expected to reach $5 billion by 2026, reflecting a growing recognition of the importance of data-driven decision-making. Consequently, the integration of advanced analytics into CRM systems is likely to enhance their effectiveness and drive further growth in the healthcare crm market.

Increased Competition Among Healthcare Providers

The competitive landscape among healthcare providers in China is intensifying, which is driving the adoption of CRM systems. As providers strive to differentiate themselves and improve patient retention, the need for effective customer relationship management becomes paramount. Healthcare organizations are increasingly recognizing that CRM systems can provide a competitive edge by enabling better patient engagement and streamlined operations. Market analysis suggests that the healthcare crm market could see a growth rate of approximately 18% as providers invest in these systems to enhance their service offerings. This competitive pressure is likely to spur innovation within the market, as organizations seek to leverage CRM technologies to improve patient experiences and operational efficiency.