China Fuel Convenience Store POS Market Overview

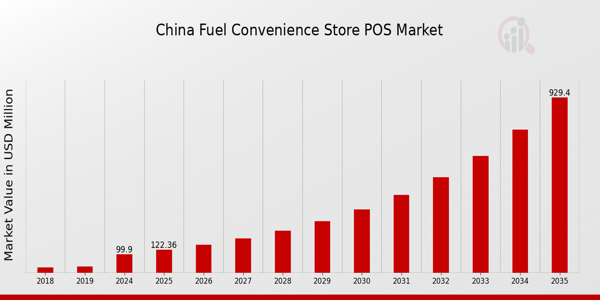

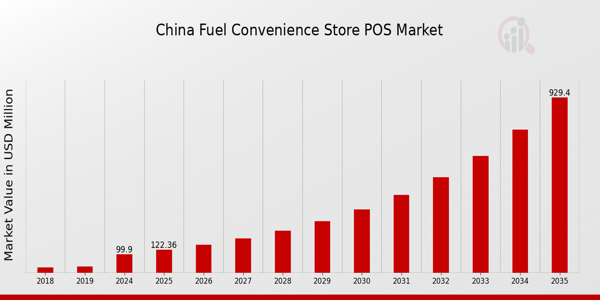

As per MRFR analysis, the China Fuel Convenience Store POS Market Size was estimated at 82.36 (USD Million) in 2023.The China Fuel Convenience Store POS Market Industry is expected to grow from 99.9(USD Million) in 2024 to 929.4 (USD Million) by 2035. The China Fuel Convenience Store POS Market CAGR (growth rate) is expected to be around 22.478% during the forecast period (2025 - 2035).

Key China Fuel Convenience Store POS Market Trends Highlighted

The growing need for digitalization and improved consumer experiences is driving notable developments in the China Fuel Convenience Store POS market. Fuel convenience businesses are using cutting-edge point-of-sale systems that include mobile payment solutions and reward programs as customers search for efficiency and convenience. The explosive growth of e-commerce in China has driven these retailers even more to embrace technology, thus enabling flawless transactions and improved inventory control. The government's drive toward smart city projects, which promotes the acceptance of smart technology in retail, is one of the main market drivers.

This fits the customer movement toward contactless payment methods, which save wait times and raise customer happiness. Furthermore, the rising number of car owners in China is driving the expansion of fuel convenience shops, which generates a need for efficient POS systems able to control huge transaction volumes. There are chances to improve consumer involvement by means of tailored services connected to point-of-sale systems. By use of data analytics, shops may get an understanding of customer behavior and so customize promotions and enhance service delivery. The market is also being shaped by the movement toward sustainability as stores want to include eco-friendly methods into their operations and attract customers who share environmental values.

Automation has lately taken the stage in the China Fuel Convenience Store POS market. Self-service kiosks and automated checkout systems let retailers simplify their operations while nevertheless satisfying the needs of a tech-savvy customer base. These patterns provide interesting opportunities for development and creativity within the Chinese market since they keep changing.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

China Fuel Convenience Store POS Market Drivers

Growing Usage of Digital Payment Solutions

In recent years, China has witnessed a significant rise in the adoption of digital payment solutions, which is expected to greatly influence the China Fuel Convenience Store Point of Sale (POS) Market Industry. According to the People's Bank of China, mobile payment transactions reached approximately 490 trillion Chinese Yuan in 2021, leading the world in digital payment adoption.

This rapid transition towards cashless transactions has facilitated faster and more efficient customer experiences in convenience store settings.Organizations like Alipay and WeChat Pay have played a pivotal role in this transformation, providing platforms that are compatible with POS systems. As convenience stores increasingly integrate these digital payment solutions into their operations, the overall efficiency and customer satisfaction are set to improve, thus accelerating growth within the China Fuel Convenience Store POS Market.

Increase in Fuel Consumption and Automobiles

China has seen a remarkable growth in fuel consumption, primarily driven by a rising number of automobiles on the road. In 2022, approximately 320 million vehicles were registered in the country, as per the Ministry of Public Security of the People's Republic of China.

This surge in vehicle ownership indicates an increasing demand for fuel, thus enhancing the need for fuel convenience stores equipped with modern POS systems that can handle high transaction volumes efficiently.The China Fuel Convenience Store POS Market Industry stands to benefit as established oil companies like Sinopec and PetroChina invest in modernizing their outlet infrastructure, thereby further driving the expansion of the market.

Government Initiatives Supporting Convenience Store Growth

The Chinese government has been actively promoting the development of convenience store chains as part of its broader strategy to improve retail efficiency and consumer access to goods and services.

The State Administration for Market Regulation announced guidelines aimed at supporting new retail formats, including convenience stores. These initiatives have contributed to a 9.6% annual increase in the convenience store sector as reported by the National Bureau of Statistics of China.This supportive legislative environment encourages investment in advanced POS technologies, fostering the growth of the China Fuel Convenience Store POS Market Industry.

Technological Advancements in POS Systems

Innovations in technology related to POS systems are rapidly evolving, significantly impacting the operations of fuel convenience stores in China. Features such as enhanced inventory management and customer relationship management are becoming standard in modern POS systems. The Chinese technology corporation Huawei has launched advanced POS systems that leverage artificial intelligence and machine learning, which are being adopted by convenience stores to streamline operations.

According to the Research and Development report published by the Ministry of Industry and Information Technology, the integration of advanced technologies in retail systems can improve efficiency by more than 30%. This trend is expected to drive considerable growth in the China Fuel Convenience Store POS Market Industry as stores seek to gain a competitive edge by enhancing operational efficiencies.

China Fuel Convenience Store POS Market Segment Insights

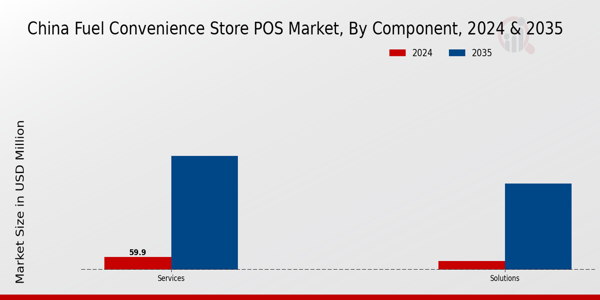

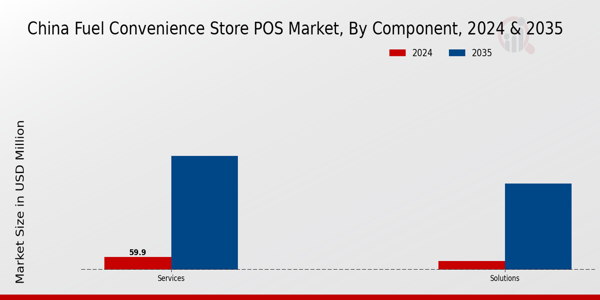

Fuel Convenience Store POS Market Component Insights

The Component segment of the China Fuel Convenience Store POS Market constitutes a critical part of the overall landscape, reflecting a substantial growth potential and increasing demand driven by evolving consumer behaviors and technological advancements. Within this segment, Solutions and Services play fundamental roles that are shaping how fuel convenience stores operate. Solutions tailored for point-of-sale systems encompass software and hardware innovations that facilitate smoother transaction processes and enhance customer experiences. This includes advanced payment processing systems, inventory management interfaces, and user-friendly customer engagement tools which streamline operations and ultimately drive profitability.

On the other hand, Services related to the POS ecosystem include ongoing support, maintenance, and training, which ensure that the systems run efficiently and adapt to changing market dynamics. Properly maintained systems are crucial for enhancing operational efficiency and minimizing downtime, which is particularly significant in an industry that is moving increasingly toward automation and digitization. Such enhancements in Solutions and Services are further correlated with a growing trend in the Chinese market, where consumers are progressively leaning towards convenience and speed in their shopping experiences.

The rapid urbanization and surge in vehicle ownership in China have amplified the importance of fuel convenience stores, making efficient POS systems an essential aspect of business operations. Moreover, regulatory policies promoting modernization in retail operations have catalyzed investments across this segment, making it a vibrant arena for innovation and growth. As consumer expectations shift towards more integrated and efficient shopping solutions, the Component segmentencompassing Solutions and Serviceswill continue to adapt and evolve, presenting significant opportunities for market players in the China Fuel Convenience Store POS Market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Fuel Convenience Store POS Market Application Insights

The Application segment of the China Fuel Convenience Store POS Market is pivotal, encompassing various functionalities that streamline operations within fuel convenience stores. Operations Management plays a critical role by enhancing operational efficiency and ensuring smooth transactions, ultimately contributing to customer satisfaction. Cash Management systems are of utmost importance, facilitating secure and efficient handling of cash transactions, which is a key area for fuel retailers. Inventory Management contributes significantly to minimizing losses from stockouts and overstock situations, enabling businesses to maintain optimal stock levels and reduce costs.

Reporting and Analytics provides essential insights, equipping store operators with data-driven decisions that can lead to improved sales strategies and performance analysis. The Others category encapsulates diverse functionalities that also support the operational framework, highlighting the adoption of advanced technologies within the sector. As fuel convenience stores increasingly embrace digital solutions, the significance of these applications becomes more pronounced, aligning with the growing trends in automation and data analytics in China’s retail landscape.With the rapid growth of the Chinese economy and an increase in fuel consumption, these applications are vital for optimizing profitability and responding promptly to market demands.

Fuel Convenience Store POS Market End-Use Insights

The End-Use segment of the China Fuel Convenience Store POS Market holds significant importance as it addresses the unique needs of both Fuel Stations and Convenience Stores. Fuel Stations are critical, serving as primary hubs for refueling and often integrating convenience retailing to enhance customer service and increase revenues. On the other hand, Convenience Stores complement the Fuel Stations, providing a wide array of products, making them an essential part of the retail landscape in China. With urbanization and increased vehicle ownership in China, convenience stores associated with fuel stations have witnessed rising foot traffic.

This rise is driven by changing consumer habits, where customers now look for multifunctional shopping experiences while fueling their vehicles. Moreover, technological advancements in Point of Sale (POS) systems help streamline operations and improve service efficiency within both segments. The emphasis on improving customer experience creates opportunities for innovation in the POS solutions tailored for each end-user, thus contributing to overall market growth. As China continues to enhance its transportation infrastructure, the synergy between Fuel Stations and Convenience Stores remains pivotal in catering to the evolving demands of consumers in an ever-competitive and dynamic market landscape.

China Fuel Convenience Store POS Market Key Players and Competitive Insights

The competitive insights of the China Fuel Convenience Store POS Market reveal a rapidly evolving landscape shaped by advancements in technology, consumer preferences, and market demands. The use of point-of-sale systems in fuel convenience stores plays a crucial role in facilitating transactions, managing inventory, and enhancing customer experiences. With increasing competition among fuel retailers, companies are investing in advanced POS systems that ensure seamless operations and better service delivery while also incorporating loyalty programs and targeted marketing strategies.

The need for efficiency and reliability in transaction processing is driving the adoption of sophisticated software and hardware solutions tailored specifically for the fuel convenience sector. As consumer behavior shifts toward digital and mobile payment options, players in the market are focusing on integrating modern technologies to streamline operations and improve service delivery, thus enhancing their competitive edge.Shengli Oilfield has established a robust presence within the China Fuel Convenience Store POS Market by leveraging its extensive network and brand reputation. As one of the prominent players in the industry, the strengths of Shengli Oilfield lie in its operational efficiency and experience in managing fuel distribution and retail. The company has successfully integrated advanced POS systems into its convenience store operations, enabling quick and efficient transactions that cater to the evolving needs of consumers.

By focusing on customer satisfaction and innovative retail solutions, Shengli Oilfield stands out in a competitive market, consistently improving customer engagement and loyalty.PetroChina is a key player in the China Fuel Convenience Store POS Market, known for its wide reach and extensive product offerings that complement its fuel retail operations. The company provides a range of services, including efficient fueling solutions, convenience store product sales, and customer-centric initiatives that enhance user experience.

PetroChina has made significant investments in technology to modernize its POS systems, allowing for effective transaction management and customer interaction. With a strong emphasis on expansion through mergers and acquisitions, PetroChina continues to strengthen its market position by incorporating new technologies and enhancing service capabilities across its nationwide network. This strategic approach, bolstered by its established brand power and comprehensive service portfolio, enables PetroChina to maintain a leading role in the fuel convenience sector in China.

Key Companies in the China Fuel Convenience Store POS Market Include:

- Shengli Oilfield

- PetroChina

- Zhongjin Lingnan Nonfemet Company

- TotalEnergies

- BP

- Hong Kong and China Gas Company

- China National Offshore Oil Corporation

- Sinochem International

- Repsol

- Sinopec Limited

- China Resources Petrol

- China National Petroleum Corporation

- Royal Dutch Shell

- ExxonMobil

- China Petroleum and Chemical Corporation

China Fuel Convenience Store POS Market Industry Developments

In recent developments within the China Fuel Convenience Store POS Market, several companies are witnessing significant shifts. Shengli Oilfield and Sinopec Limited have been enhancing their digital payment solutions, reflecting a broader trend toward modernization in retail petrol sales. The collaboration between PetroChina and TotalEnergies is noteworthy, as both companies are focusing on integrating advanced technology in their POS systems to improve customer experience and operational efficiency.

Additionally, the growth of the market has been influenced by rising consumer demand, with China National Petroleum Corporation and China Resources Petrol actively expanding their network of convenience stores to capitalize on this trend. Recent mergers and acquisitions have shaped this landscape; in July 2023, China National Offshore Oil Corporation announced a strategic partnership with Sinochem International, aimed at consolidating their positions in the fuel sector.

Furthermore, ExxonMobil has been exploring joint ventures in the Chinese market, particularly enhancing fuel distribution capabilities through strategic alliances with local firms. Over the last two years, the market has seen enhanced investments in digital innovations and customer engagement strategies, crucial for maintaining competitiveness in a rapidly evolving retail environment.

China Fuel Convenience Store POS Market Segmentation Insights

Fuel Convenience Store POS Market Component Outlook

Fuel Convenience Store POS Market Application Outlook

- Operations Management

- Cash Management

- Inventory Management

- Reporting & Analytics

- Others

Fuel Convenience Store POS Market End-Use Outlook

- Fuel Station

- Convenience Stores

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

82.36(USD Million) |

| MARKET SIZE 2024 |

99.9(USD Million) |

| MARKET SIZE 2035 |

929.4(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

22.478% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Shengli Oilfield, PetroChina, Zhongjin Lingnan Nonfemet Company, TotalEnergies, BP, Hong Kong and China Gas Company, China National Offshore Oil Corporation, Sinochem International, Repsol, Sinopec Limited, China Resources Petrol, China National Petroleum Corporation, Royal Dutch Shell, ExxonMobil, China Petroleum and Chemical Corporation |

| SEGMENTS COVERED |

Component, Application, End-Use |

| KEY MARKET OPPORTUNITIES |

Mobile payment integration, Increased demand for loyalty programs, Expansion of delivery services, Advanced analytics adoption, Enhanced security solutions |

| KEY MARKET DYNAMICS |

growing fuel consumption, increasing adoption of technology, competitive pricing strategies, consumer demand for convenience, integration of payment solutions |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ):

The China Fuel Convenience Store POS Market is expected to be valued at 99.9 million USD in 2024.

The market is anticipated to reach 929.4 million USD by 2035.

The market is projected to grow at a CAGR of 22.478% from 2025 to 2035.

The Solutions segment is expected to reach 400.0 million USD in 2035.

The Services segment is valued at 59.9 million USD in 2024.

Key players include Shengli Oilfield, PetroChina, TotalEnergies, and BP among others.

There are significant opportunities driven by technological advancements and increasing fuel consumption.

Challenges include intense competition and the need for constant innovation in services and solutions.

Growing urbanization in China is expected to positively influence the market by increasing demand for fuel convenience services.

The market is forecasted to experience significant growth leading up to 2035, driven by rising consumer demand.