China Freight Forwarding Market

China Freight Forwarding Market Research Report By Delivery Mode (Roadways, Airways, Railways, Seaways), By Services (Transportation, Warehousing, Packaging, Documentation, Other Services), and By Application (Retail, Food & Beverages, Healthcare, Industrial and Manufacturing, Military, Oil & Gas, Other Application)- Forecast to 2035

China Freight Forwarding Market Trends

Rapid changes in customer needs and technical improvements are driving a number of significant trends in the China freight forwarding sector at the moment. China's e-commerce industry is still expanding rapidly, which is driving up need for effective freight forwarding services. Logistics companies are concentrating on supply chain optimization as more customers choose to shop online.

Traditional freight forwarding methods are changing as a result of the emergence of digital platforms, which allow businesses to provide real-time tracking and analytics, improving customer happiness and operational effectiveness.

The growth of China's Belt and Road Initiative (BRI), which intends to improve trade connections and infrastructure investments across numerous areas, continues to be a major market driver in this sector. China's appeal as a worldwide commerce hub is increased by this strategy, which expands trade channels and facilitates smooth logistics operations.

Furthermore, in order to lower their carbon footprint and adhere to legal requirements, businesses are increasingly investigating eco-friendly methods and solutions, like green logistics, as sustainability becomes a more pressing issue.

Furthermore, there are prospects to investigate due to the cold chain logistics segment's potential for expansion. Advanced cold chain solutions are required as the demand for perishable commodities increases, particularly as customer preferences for fresh meals grow.

In order to increase productivity and satisfy changing market demands, Chinese businesses are also investing in technology, such as automation and data analytics. Together, these patterns show that China's freight forwarding market is dynamic and evolving, influenced by both conventional and cutting-edge methods used by logistics companies.

Market Segment Insights

China Freight Forwarding Market Segment Insights

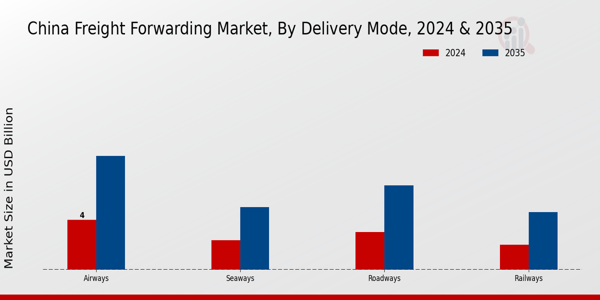

Freight Forwarding Market Delivery Mode Insights

The Delivery Mode segment of the China Freight Forwarding Market has emerged as a critical component in facilitating logistics and trade both domestically and internationally. As the country continues to bolster its infrastructure and transportation networks, the demand for efficient delivery methods has become paramount.

Roadways play a significant role due to their extensive network, enabling timely last-mile deliveries and providing access to rural and urban areas alike. Meanwhile, airways have gained traction among businesses that prioritize speed, particularly in industries such as electronics and pharmaceuticals, where time-sensitive deliveries are crucial.

Railways present an appealing option for bulk shipments, offering a balance between cost-effectiveness and efficiency, and making them significant in connecting key industrial hubs across China. Seaways remain a backbone of international trade because China's vast coastline allows for significant cargo movement to global markets, facilitating exports and imports efficiently.

Each of these delivery methods supports the broader goal of enhancing China's trading capabilities and addresses the rising consumer and business demands for quick and reliable freight services. Market growth is driven by advancements in technology, increasing e-commerce activities, and the growing need for complex supply chain solutions.

However, challenges such as high operational costs and regulatory compliance remain. Opportunities abound for innovation, particularly in integrating technology to streamline operations across all Delivery Mode methods. Understanding these modes is essential as they collectively define the logistics framework that supports the China Freight Forwarding Market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Freight Forwarding Market Services Insights

The Services segment of the China Freight Forwarding Market plays a critical role in ensuring efficient transportation and logistics operations within the region. This segment encompasses various essential elements, including Transportation, Warehousing, Packaging, Documentation, and Other Services, which together form the backbone of freight forwarding activities.

Transportation is vital for the timely delivery of goods, as it involves managing both domestic and international routes, highly influenced by China's extensive trade practices. Warehousing supports inventory management and plays a significant role in optimizing supply chains, particularly amidst the increasing demand for e-commerce and retail logistics.

Packaging, while often overlooked, is crucial for protecting goods during transit and meets the regulatory requirements that safeguard both products and consumers. Documentation ensures compliance with customs regulations, which is increasingly important given China's trade agreements and policies.

Finally, Other Services round out the offering by providing specialized logistics solutions, further enhancing flexibility and customization for clients. The growing complexity of trade and logistics in China presents significant opportunities for these services, driven by rising import-export activities and advancements in technology, underscoring their central role in the overall industry dynamics.

Freight Forwarding Market Application Insights

The Application segment of the China Freight Forwarding Market plays a crucial role in supporting various industries that drive the nation's economy. The Retail sector benefits significantly from efficient freight forwarding services, facilitating timely deliveries and inventory management, which is essential in the rapidly evolving e-commerce landscape.

The Food and Beverages category requires specialized logistics due to perishability, making reliable freight forwarding vital for maintaining quality and compliance with health standards. Healthcare logistics demands precision, ensuring that medical supplies and pharmaceuticals reach their destinations without delay, driven by China's expanding healthcare infrastructure.

Meanwhile, the Industrial and Manufacturing sectors rely heavily on freight forwarding solutions to maintain supply chain efficiency and manage production schedules effectively. The Military segment's importance lies in secure and swift transportation for defense-related goods, reflecting China's strategic priorities.

Additionally, the Oil and Gas industry necessitates advanced logistics to transport heavy and hazardous materials safely. Each of these applications contributes to shaping the freight forwarding landscape, highlighting the need for industry-specific expertise and adaptation to regulations, which collectively underpins the growth trajectory of the China Freight Forwarding Market.

Key Players and Competitive Insights

The competitive landscape of the China Freight Forwarding Market is characterized by a dynamic interplay of various players, each striving to enhance their service offerings and capture market share. With China's strategic positioning as a global manufacturing powerhouse and a critical link in international supply chains, the demand for freight forwarding services has surged.

This has attracted both local and international freight forwarders, resulting in a diversified market filled with innovative logistics solutions. Key factors such as e-commerce growth, technological advancements, and the ongoing developments in trade agreements continue to shape the competitive environment, driving players to adapt and refine their strategies to meet unprecedented logistical challenges.

China Ocean Shipping Company has established a formidable presence within the China Freight Forwarding Market, leveraging its extensive network and strong reputation in maritime shipping. Known for its robust fleet and global reach, China Ocean Shipping Company can efficiently facilitate intermodal transport, integrating maritime, rail, and road services to optimize freight solutions.

The company's strengths lie in its vast operational capabilities, enabling it to manage large volumes of cargo effectively, coupled with a commitment to sustainability and technological integration. This has positioned the company favorably in a rapidly evolving market, allowing it to enhance customer satisfaction while maintaining competitiveness.

Panalpina, now more closely integrated with the DSV Panalpina Group, also holds a significant position in the China Freight Forwarding Market. The company offers a broad range of logistics services encompassing air, sea, and road freight forwarding, supplemented by contract logistics and specialized services tailored to various industries.

With a strong emphasis on innovation and technology, Panalpina has adopted advanced digital solutions to streamline operations and provide enhanced visibility to clients. The company's strengths in project logistics, high-quality customer service, and extensive network ensure efficient supply chain management.

Furthermore, the strategic mergers and acquisitions undertaken by Panalpina have solidified its market presence, allowing for expanded capabilities and a more comprehensive service portfolio catering specifically to the unique demands of the Chinese market.

Industry Developments

Recent developments in the China Freight Forwarding Market have shown a notable emphasis on efficiency and adaptation to changing global trade dynamics. Companies such as China Ocean Shipping Company, COSCO Shipping Logistics, and Hanjin Shipping continue to strengthen their positions, leveraging advanced technologies for improved logistics performance.

UPS Supply Chain Solutions and DHL Supply Chain are focusing on expanding their e-commerce logistics capabilities, responding to the growing demand for online retail services. In September 2023, Panalpina announced a strategic partnership with local firms to enhance its operational footprint in China, aiming to streamline air freight processes significantly.

In October 2023, ZIM Integrated Shipping Services completed an acquisition of a minority stake in a Chinese logistics startup, reinforcing its commitment to the Asia-Pacific region. The overall market valuation has seen growth, driven by increased demand for efficient freight forwarding services, which has positively impacted revenue streams for major players like Kuehne + Nagel and Expeditors International.

Additionally, recent trends indicate a shift towards sustainability in logistics practices, with companies prioritizing greener transport solutions in response to regulatory changes and consumer expectations.

Market Segmentation

Freight Forwarding Market Services Outlook

- Transportation

- Warehousing

- Packaging

- Documentation

- Other Services

Freight Forwarding Market Application Outlook

- Retail

- Food & Beverages

- Healthcare

- Industrial and Manufacturing

- Military

- Oil & Gas

- Other Application

Freight Forwarding Market Delivery Mode Outlook

- Roadways

- Airways

- Railways

- Seaways

Report Scope

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2023 | 10.7(USD Billion) |

| MARKET SIZE 2024 | 11.35(USD Billion) |

| MARKET SIZE 2035 | 25.45(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 7.614% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | China Ocean Shipping Company, Panalpina, Expeditors International, Hanjin Shipping, Kintetsu World Express, COSCO Shipping Logistics, Kuehne + Nagel, UPS Supply Chain Solutions, Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services, Sinotrans, DB Schenker, Nippon Express, DHL Supply Chain, Geodis |

| SEGMENTS COVERED | Delivery Mode, Services, Application |

| KEY MARKET OPPORTUNITIES | E-commerce logistics expansion, Enhanced technology integration, Sustainability-focused services, Increased demand for cold chain, Last-mile delivery innovations |

| KEY MARKET DYNAMICS | Technological advancements, Regulatory changes, Growing e-commerce demand, Increased competition, Sustainability initiatives |

| COUNTRIES COVERED | China |

FAQs

What is the expected market size of the China Freight Forwarding Market by 2024?

The China Freight Forwarding Market is expected to be valued at 11.35 USD Billion in 2024.

What will the market size reach by the year 2035?

By 2035, the overall market size of the China Freight Forwarding Market is projected to reach 25.45 USD Billion.

What is the compound annual growth rate (CAGR) of the market from 2025 to 2035?

The expected CAGR for the China Freight Forwarding Market from 2025 to 2035 is 7.614%.

Which delivery mode segment holds the largest market share in 2024?

In 2024, the Airways segment holds the largest market share, valued at 4.0 USD Billion.

Which key players dominate the China Freight Forwarding Market?

Major players in the market include China Ocean Shipping Company, Panalpina, Expeditors International, and DHL Supply Chain.

What is the projected market size for the Roadways segment by 2035?

The Roadways segment is expected to reach a market size of 6.75 USD Billion by 2035.

What market size is predicted for the Railways segment in 2035?

The Railways segment is projected to achieve a market size of 4.6 USD Billion by 2035.

What is the expected value of the Seaways segment in 2024?

The Seaways segment is expected to be valued at 2.35 USD Billion in 2024.

What emerging trends are influencing the China Freight Forwarding Market?

Emerging trends include increased digitalization and the growing demand for efficient logistics solutions.

How has the global shipping scenario impacted the China Freight Forwarding Market?

The current global shipping conflicts have created both challenges and opportunities for the China Freight Forwarding Market.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”