Rising Demand for Customization

Customization is emerging as a pivotal driver in the enterprise software market in China. Businesses are increasingly seeking tailored software solutions that align with their unique operational needs and industry requirements. This trend is particularly pronounced in sectors such as manufacturing and retail, where standardized solutions may not adequately address specific challenges. The market for customizable software is projected to grow by approximately 18% over the next few years, as organizations prioritize flexibility and adaptability in their software investments. This shift towards customization is reshaping the enterprise software market, encouraging vendors to innovate and offer more personalized solutions.

Expansion of E-commerce Platforms

The rapid expansion of e-commerce platforms in China is significantly impacting the enterprise software market. As online retail continues to flourish, businesses are increasingly adopting software solutions that facilitate e-commerce operations, including inventory management, customer relationship management, and payment processing. The e-commerce software segment is expected to grow by around 25% in the next few years, reflecting the increasing reliance on digital channels for sales and customer engagement. This trend highlights the critical role of the enterprise software market in supporting the evolving needs of businesses in the e-commerce landscape.

Digital Transformation Initiatives

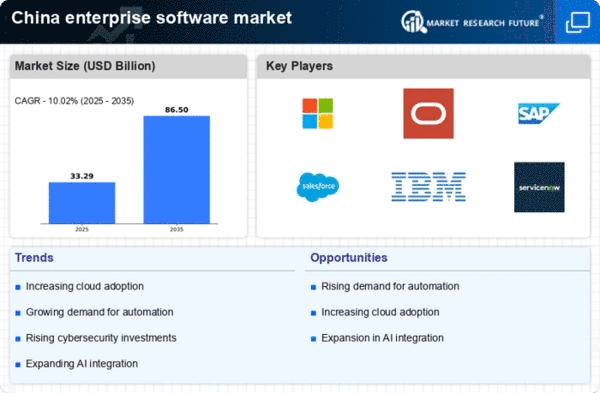

The enterprise software market in China is experiencing a robust growth trajectory, driven by the ongoing digital transformation initiatives across various sectors. Organizations are increasingly investing in software solutions to enhance operational efficiency and customer engagement. In 2025, the market is projected to reach approximately $50 billion, reflecting a compound annual growth rate (CAGR) of around 15% over the next five years. This transformation is not merely a trend but a strategic imperative for businesses aiming to remain competitive in a rapidly evolving landscape. the enterprise software market is becoming essential for companies seeking to leverage technology for improved business outcomes..

Regulatory Compliance Requirements

In China, the enterprise software market is significantly influenced by stringent regulatory compliance requirements. As businesses navigate complex legal frameworks, the demand for software solutions that ensure compliance with local laws and regulations is on the rise. This necessity is particularly evident in sectors such as finance and healthcare, where non-compliance can result in severe penalties. The market for compliance-related software is expected to grow by approximately 20% in the coming years, as organizations prioritize risk management and regulatory adherence. Consequently, the enterprise software market is adapting to provide tailored solutions that address these compliance challenges..

Increased Investment in Cybersecurity

The enterprise software market in China is witnessing a surge in investment focused on cybersecurity solutions. As cyber threats become more sophisticated, organizations are compelled to adopt advanced software tools to protect sensitive data and maintain operational integrity. In 2025, the cybersecurity software segment is anticipated to account for nearly 30% of the overall enterprise software market, underscoring the critical importance of security in software adoption. This trend indicates a growing recognition among businesses of the need to safeguard their digital assets, thereby driving innovation and development within the enterprise software market.