Rising E-commerce Activities

The rapid expansion of e-commerce in China is significantly influencing the electronic data interchange software market. With online retail sales projected to reach over 2 trillion USD by 2026, businesses are increasingly turning to EDI solutions to manage the complexities of digital transactions. EDI enables seamless communication between retailers, suppliers, and logistics providers, ensuring that orders are processed efficiently. The integration of EDI systems allows for automated order fulfillment, which is crucial in meeting the high consumer expectations for fast delivery. Furthermore, as e-commerce platforms continue to evolve, the demand for robust EDI solutions that can handle large volumes of transactions is expected to rise. This trend indicates a strong potential for growth within The China Electronic Data Interchange Software Market, as companies seek to enhance their operational capabilities in a competitive landscape.

Increased Focus on Data Security

As the reliance on electronic data interchange software grows, so does the emphasis on data security within The China Electronic Data Interchange Software Market. Businesses are becoming increasingly aware of the risks associated with data breaches and are seeking EDI solutions that offer robust security features. In 2025, approximately 70% of companies reported concerns regarding data protection in their EDI transactions. This heightened awareness is driving the demand for EDI systems that incorporate advanced encryption and authentication protocols. Furthermore, regulatory frameworks are evolving to address data security, compelling organizations to adopt compliant EDI solutions. The focus on safeguarding sensitive information is likely to shape the future landscape of the electronic data interchange software market in China, as companies prioritize secure data exchange to maintain customer trust and regulatory compliance.

Growing Demand for Supply Chain Efficiency

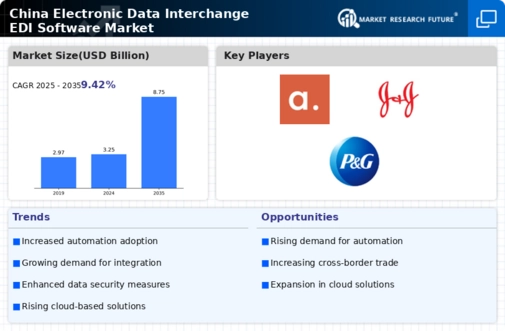

The China electronic data interchange software market is experiencing a notable surge in demand for enhanced supply chain efficiency. As businesses increasingly recognize the importance of streamlined operations, the adoption of EDI solutions has become paramount. In 2025, the market for EDI software in China was valued at approximately 1.5 billion USD, reflecting a compound annual growth rate of around 12%. This growth is driven by the need for real-time data exchange, which facilitates better inventory management and reduces operational costs. Companies are leveraging EDI to automate processes, thereby minimizing human error and improving transaction speed. The push for efficiency is further supported by government initiatives aimed at modernizing logistics and supply chain frameworks, which are likely to bolster the adoption of EDI solutions across various sectors.

Government Support for Digital Transformation

The Chinese government is actively promoting digital transformation across various industries, which is positively impacting the electronic data interchange software market. Initiatives such as the 'Made in China 2025' strategy emphasize the importance of integrating advanced technologies into manufacturing and logistics. This governmental push is likely to encourage businesses to adopt EDI solutions as part of their digital strategies. In 2025, the government allocated significant funding to support technology adoption, which is expected to continue into 2026. This financial backing not only facilitates the implementation of EDI systems but also fosters innovation within the sector. As companies align with national policies aimed at enhancing productivity and competitiveness, the demand for electronic data interchange software is anticipated to grow, reflecting a broader trend towards digitalization in China.

Integration with Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation technologies is emerging as a transformative driver within The China Electronic Data Interchange Software Market. Businesses are increasingly leveraging AI to enhance the capabilities of EDI systems, enabling smarter data processing and decision-making. In 2025, around 30% of EDI users reported utilizing AI-driven solutions to optimize their operations. This trend suggests a shift towards more intelligent EDI systems that can analyze data patterns and predict supply chain disruptions. Additionally, automation is streamlining repetitive tasks, allowing companies to focus on strategic initiatives. As organizations seek to improve efficiency and responsiveness, the demand for EDI solutions that incorporate AI and automation is expected to rise, potentially reshaping the competitive landscape of the electronic data interchange software market in China.