Increasing Healthcare Expenditure

The rising healthcare expenditure in China is a pivotal driver for the drug repurposing market. As the government allocates more funds towards healthcare, the focus on innovative treatment options intensifies. In 2023, healthcare spending in China reached approximately $1.2 trillion, reflecting a growth rate of around 10% annually. This financial commitment facilitates research and development initiatives, particularly in drug repurposing, which offers a cost-effective alternative to developing new drugs from scratch. This trend allows for quicker access to therapies that can address unmet medical needs, enhancing patient outcomes and reducing overall healthcare costs.

Regulatory Framework Enhancements

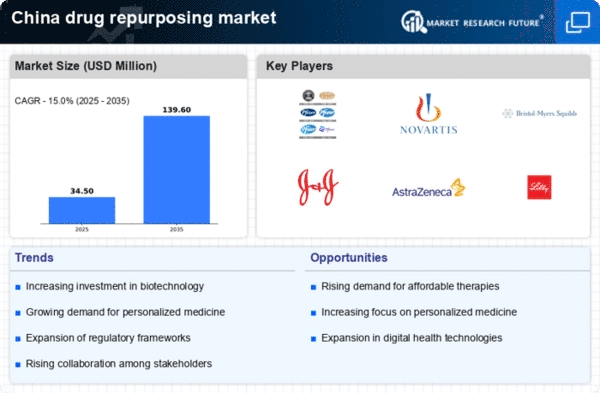

The evolving regulatory framework in China is a significant driver for the drug repurposing market. Recent reforms have streamlined the approval process for repurposed drugs, allowing for faster market entry. The National Medical Products Administration (NMPA) has introduced guidelines that prioritize the review of applications for repurposed drugs, recognizing their potential to address urgent health needs. This regulatory support is crucial, as it reduces the time and costs associated with bringing new therapies to market. As a result, the drug repurposing market is likely to experience accelerated growth, with more companies willing to invest in repurposing initiatives due to the favorable regulatory environment.

Collaborative Research Initiatives

Collaborative research initiatives among academic institutions, pharmaceutical companies, and government bodies are fostering innovation within the drug repurposing market. In China, partnerships are increasingly common, as stakeholders recognize the potential of repurposed drugs to expedite the drug development process. For instance, the Chinese Academy of Sciences has launched several projects aimed at identifying new uses for existing medications. These collaborations not only enhance research capabilities but also attract funding, with investments in drug repurposing projects exceeding $500 million in recent years. Such initiatives are crucial for advancing the drug repurposing market, as they facilitate knowledge sharing and resource pooling, ultimately leading to more effective therapies.

Aging Population and Chronic Diseases

China's demographic shift towards an aging population significantly impacts the drug repurposing market. With over 250 million individuals aged 60 and above, the prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions is on the rise. This demographic trend necessitates the development of effective treatment options, and drug repurposing emerges as a viable solution. By leveraging existing drugs for new therapeutic uses, the market can address the urgent healthcare needs of the elderly population. Furthermore, the Chinese government has recognized this challenge, implementing policies aimed at improving healthcare access and affordability, which further stimulates the drug repurposing market.

Growing Focus on Personalized Medicine

The increasing emphasis on personalized medicine in China is shaping the drug repurposing market. As healthcare providers seek to tailor treatments to individual patient profiles, the potential for repurposed drugs to meet specific therapeutic needs becomes apparent. This trend is supported by advancements in genomics and biotechnology, which enable more precise targeting of therapies. The drug repurposing market stands to benefit from this shift, as existing drugs can be adapted for new indications based on genetic and biomarker information. Furthermore, the Chinese government is promoting personalized medicine through funding and policy initiatives, which could further enhance the market's growth prospects.