Focus on Cost Reduction

The focus on cost reduction within the biopharmaceutical sector is driving innovations in the downstream processing market. Companies are increasingly seeking ways to minimize production costs while maintaining product quality. In 2025, it is estimated that the cost of biopharmaceutical production could decrease by up to 20% due to advancements in downstream processing technologies. This trend encourages the adoption of more efficient purification methods and process intensification strategies within the downstream processing market. As competition intensifies, organizations are likely to invest in technologies that streamline operations and reduce waste, ultimately enhancing profitability and sustainability in biopharmaceutical manufacturing.

Growing Regulatory Framework

The evolving regulatory framework in China is shaping the downstream processing market. Regulatory bodies are increasingly emphasizing the need for stringent quality control and compliance in biopharmaceutical production. This trend is likely to drive investments in advanced downstream processing technologies that ensure adherence to regulatory standards. In 2025, it is anticipated that the market for regulatory compliance solutions within the downstream processing market could exceed $5 billion. Companies are compelled to adopt innovative purification and separation techniques to meet these regulatory requirements, thereby enhancing the overall efficiency and safety of biopharmaceutical products. This regulatory landscape is expected to create both challenges and opportunities for stakeholders in the downstream processing market.

Rising Demand for Biopharmaceuticals

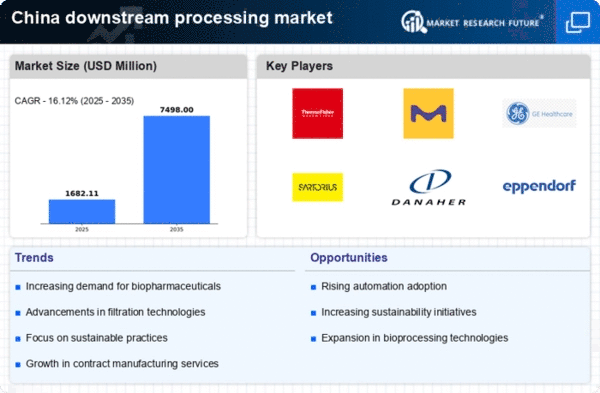

The increasing demand for biopharmaceuticals in China is a primary driver for the downstream processing market. As the healthcare sector expands, the need for effective drug production processes intensifies. In 2025, the biopharmaceutical market in China is projected to reach approximately $100 billion, indicating a robust growth trajectory. This surge necessitates advanced downstream processing techniques to ensure the efficient purification and formulation of biologics. The downstream processing market must adapt to these demands by enhancing its capabilities in areas such as chromatography and filtration. Furthermore, the growing prevalence of chronic diseases in China amplifies the need for innovative therapeutic solutions, thereby propelling the downstream processing market forward.

Investment in Research and Development

Investment in research and development (R&D) within the biopharmaceutical sector is significantly influencing the downstream processing market. In recent years, China has seen a substantial increase in R&D spending, with estimates suggesting that it could reach $60 billion by 2025. This investment fosters innovation in downstream processing technologies, enabling the development of more efficient and cost-effective methods for drug production. The downstream processing market is likely to benefit from advancements in automation and process optimization, which are critical for meeting the growing demands of biopharmaceutical manufacturing. As companies strive to enhance their competitive edge, the focus on R&D is expected to drive the evolution of downstream processing techniques.

Expansion of Manufacturing Capabilities

The expansion of manufacturing capabilities in China is a crucial driver for the downstream processing market. As domestic and international companies seek to establish or enhance their production facilities, the demand for efficient downstream processing solutions is likely to increase. In 2025, the biomanufacturing capacity in China is projected to grow by approximately 30%, necessitating advanced downstream processing technologies to support this expansion. The downstream processing market must respond to this growth by providing scalable and flexible solutions that can accommodate varying production volumes. This trend not only supports the local economy but also positions China as a key player in the global biopharmaceutical supply chain.