Regulatory Support

The regulatory environment in China is becoming increasingly supportive of the disposable endoscope market. The National Medical Products Administration (NMPA) has implemented streamlined approval processes for medical devices, including disposable endoscopes. This regulatory support is crucial as it encourages manufacturers to innovate and bring new products to market more efficiently. Furthermore, the Chinese government has been actively promoting the use of disposable medical devices to enhance patient safety and reduce healthcare-associated infections. As a result, the disposable endoscope market is likely to benefit from favorable policies that facilitate market entry and expansion, potentially leading to a more competitive landscape.

Technological Advancements

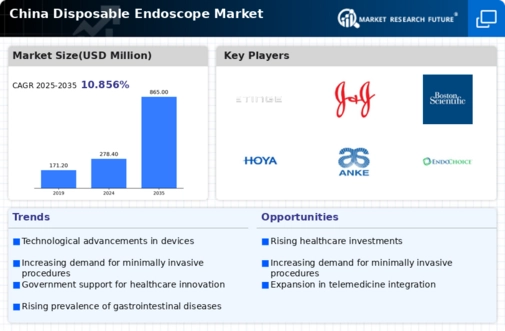

The China disposable endoscope market is experiencing rapid technological advancements that enhance the quality and efficiency of medical procedures. Innovations such as high-definition imaging, flexible designs, and improved sterilization techniques are becoming increasingly prevalent. These advancements not only improve patient outcomes but also reduce the risk of infections, which is a critical concern in healthcare settings. According to recent data, the market for disposable endoscopes in China is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is largely driven by the integration of advanced technologies that facilitate better diagnosis and treatment options, thereby attracting more healthcare providers to adopt disposable endoscopes.

Increased Healthcare Expenditure

The China disposable endoscope market is poised for growth due to increased healthcare expenditure across the nation. The Chinese government has been investing heavily in healthcare infrastructure, aiming to improve access to quality medical services. This investment includes funding for advanced medical technologies, such as disposable endoscopes, which are essential for modern diagnostic and therapeutic procedures. Recent reports indicate that healthcare spending in China is expected to reach approximately 7 trillion yuan by 2025, reflecting a commitment to enhancing healthcare delivery. As healthcare facilities upgrade their equipment and expand their service offerings, the demand for disposable endoscopes is likely to rise, further propelling market growth.

Growing Awareness of Infection Control

The growing awareness of infection control measures is significantly influencing the China disposable endoscope market. Healthcare providers are increasingly recognizing the importance of using disposable medical devices to mitigate the risk of cross-contamination and healthcare-associated infections. This awareness is particularly pertinent in the context of endoscopic procedures, where the risk of infection can be a major concern. As a result, hospitals and clinics are more inclined to adopt disposable endoscopes, which offer a safer alternative to reusable devices. Market data suggests that the adoption rate of disposable endoscopes has increased by approximately 30% in the last two years, indicating a shift towards prioritizing patient safety and infection control in medical practices.

Rising Demand for Minimally Invasive Procedures

There is a notable increase in the demand for minimally invasive procedures within the China disposable endoscope market. Patients and healthcare providers alike are increasingly favoring these procedures due to their associated benefits, such as reduced recovery times and lower risk of complications. This trend is reflected in the growing number of endoscopic procedures performed annually, which has seen a significant rise in recent years. For instance, the number of gastrointestinal endoscopic procedures has increased by over 20% in the past three years. This rising demand is likely to drive the growth of the disposable endoscope market, as healthcare facilities seek to adopt technologies that align with patient preferences and clinical best practices.