Rising Environmental Concerns

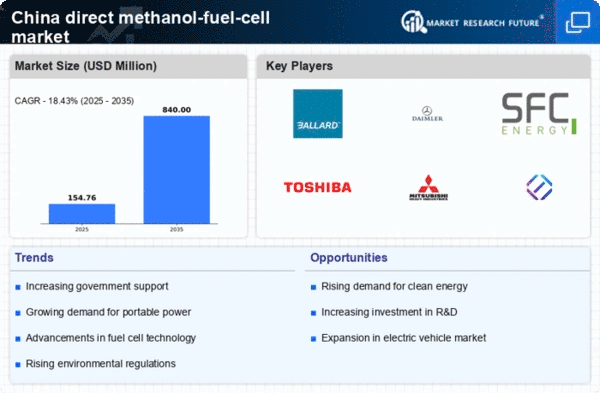

The increasing awareness of environmental issues in China is driving the direct methanol-fuel-cell market. As air pollution and greenhouse gas emissions become pressing concerns, the demand for cleaner energy solutions is rising. The Chinese government has set ambitious targets to reduce carbon emissions by 2030, which is likely to boost the adoption of fuel cell technologies. The direct methanol-fuel-cell market is positioned to benefit from this shift, as it offers a cleaner alternative to traditional fossil fuels. Furthermore, the market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the urgency to transition to sustainable energy sources. This trend indicates a strong potential for investment and innovation within the direct methanol-fuel-cell market, as stakeholders seek to align with national environmental goals.

Advancements in Fuel Cell Technology

Technological innovations are playing a crucial role in shaping the direct methanol-fuel-cell market. Recent advancements in fuel cell efficiency and durability have made these systems more attractive for various applications, including portable power and transportation. Research institutions and companies in China are investing heavily in R&D to enhance the performance of direct methanol fuel cells. For instance, improvements in catalyst materials and membrane technology have led to increased power output and reduced costs. The market is expected to witness a growth rate of around 12% annually, driven by these technological breakthroughs. As the direct methanol-fuel-cell market continues to evolve, it appears that ongoing innovations will further enhance its competitiveness against other energy solutions.

Government Incentives for Clean Energy

The Chinese government is actively promoting the adoption of clean energy technologies, which significantly impacts the direct methanol-fuel-cell market. Various incentives, such as subsidies and tax breaks, are being offered to manufacturers and consumers to encourage the use of fuel cells. In 2025, the government allocated approximately $1 billion to support research and development in fuel cell technologies. This financial backing is likely to stimulate growth in the direct methanol-fuel-cell market, as it reduces the financial burden on companies and consumers. Additionally, the establishment of favorable regulatory frameworks is expected to facilitate market entry for new players, thereby increasing competition and innovation within the industry.

Growing Applications in Transportation

The direct methanol-fuel-cell market is experiencing a surge in demand due to its potential applications in the transportation sector. With the Chinese government prioritizing the development of alternative fuel vehicles, fuel cells are becoming a viable option for public transportation and logistics. The market for fuel cell vehicles is projected to reach $10 billion by 2030, indicating a robust growth trajectory. This trend is further supported by the increasing number of partnerships between automotive manufacturers and fuel cell technology providers. As the direct methanol-fuel-cell market expands, it is likely to play a pivotal role in the transition towards sustainable transportation solutions in China.

Increased Investment in Renewable Energy

Investment in renewable energy sources is a key driver for the direct methanol-fuel-cell market in China. As the country aims to diversify its energy portfolio, there is a growing focus on integrating renewable resources with fuel cell technologies. In 2025, investments in renewable energy projects are expected to exceed $200 billion, with a portion allocated to fuel cell development. This influx of capital is likely to enhance the research and commercialization of direct methanol fuel cells, making them more accessible and affordable. The synergy between renewable energy and fuel cells could lead to a more sustainable energy landscape, further propelling the growth of the direct methanol-fuel-cell market.