Shift Towards Sustainable Practices

The growing awareness of environmental issues among consumers and industries is driving a shift towards sustainable practices within the china diesel engine catalyst market. Companies are increasingly adopting eco-friendly technologies and materials in their manufacturing processes to align with global sustainability goals. This trend is reflected in the rising demand for catalysts that not only meet regulatory requirements but also contribute to lower carbon footprints. In 2025, it is projected that the market for sustainable diesel engine catalysts will account for over 30% of the total market share, indicating a significant shift in consumer preferences. Additionally, partnerships between manufacturers and environmental organizations are fostering the development of innovative solutions that promote sustainability. This evolving landscape suggests that the china diesel engine catalyst market is poised for transformation as it adapts to the demands of a more environmentally conscious society.

Export Opportunities in Global Markets

The expansion of the china diesel engine catalyst market is not limited to domestic demand; it also presents significant export opportunities. As global markets increasingly prioritize emission control technologies, Chinese manufacturers are well-positioned to capitalize on this trend. The competitive pricing and advanced technological capabilities of Chinese catalyst producers make them attractive suppliers for international markets. In 2025, it is estimated that exports of diesel engine catalysts from China could reach USD 500 million, driven by demand from regions such as Europe and North America, where stringent emission regulations are in place. This potential for growth in exports not only enhances the profitability of manufacturers but also solidifies China's position as a key player in The china diesel engine catalyst market. The interplay between domestic and international demand is likely to shape the future trajectory of the china diesel engine catalyst market.

Increasing Demand for Heavy-Duty Vehicles

The robust growth of the heavy-duty vehicle segment in China is a crucial driver for the china diesel engine catalyst market. As urbanization and infrastructure development continue to accelerate, the demand for heavy-duty trucks and buses is on the rise. This trend is further supported by government initiatives aimed at enhancing transportation efficiency and reducing logistics costs. In 2025, the heavy-duty vehicle market in China is expected to grow by approximately 15%, leading to a corresponding increase in the need for effective diesel engine catalysts. These vehicles require advanced catalytic solutions to meet stringent emission standards while maintaining performance. Consequently, manufacturers are focusing on developing specialized catalysts tailored for heavy-duty applications, thereby expanding their product offerings within the china diesel engine catalyst market.

Regulatory Influence on Emission Standards

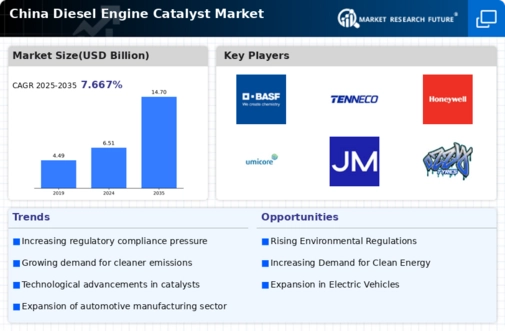

The stringent emission regulations imposed by the Chinese government significantly drive the china diesel engine catalyst market. The Ministry of Ecology and Environment has established increasingly rigorous standards, such as the National VI emission standards, which necessitate the use of advanced catalytic solutions. These regulations compel manufacturers to adopt diesel engine catalysts that can effectively reduce harmful emissions, including nitrogen oxides and particulate matter. As a result, the market is witnessing a surge in demand for high-performance catalysts that comply with these standards. In 2025, the market for diesel engine catalysts in China was valued at approximately USD 1.5 billion, reflecting the growing emphasis on environmental sustainability and compliance with regulatory frameworks. This trend is likely to continue, further propelling the growth of the china diesel engine catalyst market.

Technological Advancements in Catalytic Solutions

Innovations in catalytic technology are pivotal in shaping the china diesel engine catalyst market. The development of new materials, such as advanced precious metal catalysts and non-precious metal alternatives, enhances the efficiency and effectiveness of diesel engine catalysts. These advancements not only improve the conversion rates of harmful emissions but also extend the lifespan of the catalysts, thereby reducing overall operational costs for manufacturers. In 2025, the introduction of novel catalytic formulations is expected to increase the market share of high-performance catalysts by approximately 20%. Furthermore, the integration of digital technologies, such as IoT and AI, into catalyst monitoring systems is anticipated to optimize performance and maintenance schedules. This technological evolution is likely to create a competitive edge for companies operating within the china diesel engine catalyst market.