Rising Dental Tourism

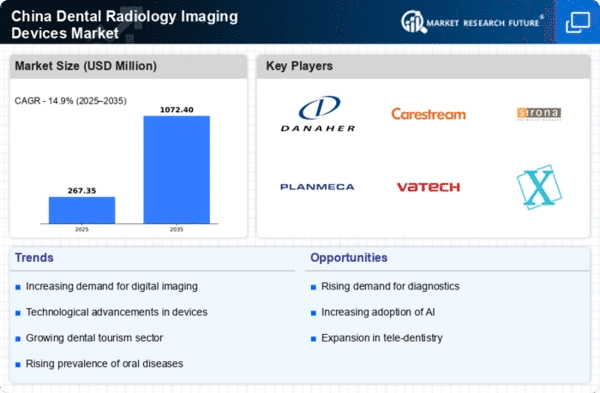

The rise of dental tourism in China is emerging as a notable driver for the dental radiology-imaging-devices market. As international patients seek affordable and high-quality dental care, many clinics are investing in advanced imaging technologies to attract this clientele. The market is anticipated to grow by 7.5% as dental practices enhance their service offerings to cater to both local and international patients. This trend is further supported by the increasing reputation of Chinese dental professionals and facilities, which encourages foreign patients to seek treatment. Consequently, the demand for state-of-the-art radiology devices is likely to rise, as clinics aim to provide comprehensive and competitive services.

Rising Oral Health Awareness

The increasing awareness of oral health among the Chinese population is a pivotal driver for the dental radiology-imaging-devices market. As more individuals recognize the importance of regular dental check-ups and preventive care, the demand for advanced imaging technologies rises. This trend is reflected in the growing number of dental clinics and practices adopting state-of-the-art radiology devices. In 2025, the market is projected to witness a growth rate of approximately 8.5%, driven by the need for accurate diagnostics and treatment planning. Enhanced public health campaigns and educational initiatives further contribute to this awareness, leading to a more informed patient base that actively seeks out advanced dental care solutions.

Government Investment in Healthcare

Government investment in healthcare infrastructure significantly impacts the dental radiology-imaging-devices market. In recent years, the Chinese government has allocated substantial funds to improve healthcare facilities, particularly in rural areas. This investment includes the procurement of modern dental imaging equipment, which is essential for accurate diagnosis and treatment. As a result, the market is expected to grow by around 7% annually, as more dental practices gain access to advanced technologies. Furthermore, initiatives aimed at enhancing healthcare accessibility and affordability are likely to drive the adoption of dental radiology devices, ensuring that a broader segment of the population benefits from improved dental care.

Aging Population and Increased Dental Needs

China's aging population is a significant driver for the dental radiology-imaging-devices market. As the demographic shifts towards an older population, the prevalence of dental issues such as periodontal disease and tooth decay increases. This trend necessitates the use of advanced imaging technologies for effective diagnosis and treatment planning. By 2025, it is estimated that the market will grow by 6.5%, largely due to the rising demand for dental services among older adults. Furthermore, the growing emphasis on maintaining oral health in later years encourages the adoption of sophisticated imaging devices, ensuring that dental professionals can meet the needs of this demographic effectively.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is a crucial driver for the dental radiology-imaging-devices market. Innovations such as digital radiography and 3D imaging systems are becoming increasingly prevalent in dental clinics across China. These technologies not only enhance diagnostic accuracy but also improve patient experience by reducing radiation exposure and providing immediate results. The market is projected to expand by approximately 9% as dental professionals increasingly adopt these technologies to stay competitive. Additionally, the rise of tele-dentistry and remote consultations further emphasizes the need for high-quality imaging devices, as practitioners seek to provide comprehensive care regardless of location.