Rising Health Awareness

The covid 19-diagnostics market in China experiences a notable boost due to the increasing health awareness among the population. As citizens become more informed about the importance of early detection and prevention of infectious diseases, the demand for diagnostic testing rises. This trend is particularly evident in urban areas, where access to healthcare resources is more prevalent. The Chinese government has also been promoting health education campaigns, which further enhances public understanding of the need for regular testing. Consequently, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next few years, driven by this heightened awareness and proactive health management strategies.

Emergence of New Variants

The emergence of new variants of the virus continues to impact the covid 19-diagnostics market in China. As variants evolve, the need for updated diagnostic tests becomes apparent. This situation creates a demand for more sophisticated testing methods that can accurately identify different strains. In response, manufacturers are investing in the development of advanced PCR and antigen tests that can detect multiple variants simultaneously. This trend is likely to drive market growth, with projections indicating an increase of approximately 12% in the coming years as healthcare providers seek to stay ahead of the evolving virus landscape.

Government Initiatives and Funding

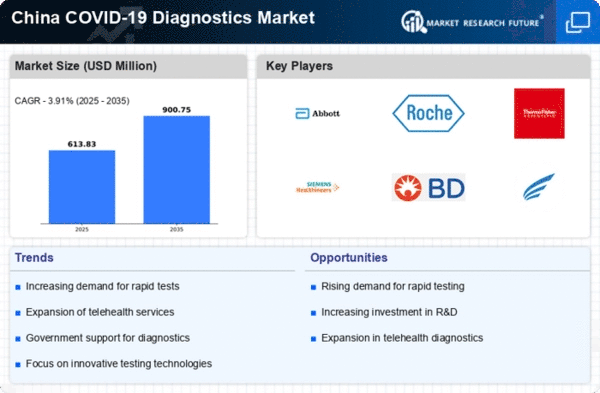

Government initiatives play a crucial role in shaping the covid 19-diagnostics market in China. The Chinese government has allocated substantial funding to enhance healthcare infrastructure and improve diagnostic capabilities. This includes investments in research and development, as well as subsidies for diagnostic manufacturers. In 2025, the government aims to increase the availability of testing kits and improve the efficiency of testing processes. Such initiatives are expected to lead to a market growth of around 15% annually, as they facilitate the development of innovative diagnostic solutions and ensure that testing remains accessible to the broader population.

Integration of Digital Health Solutions

The integration of digital health solutions into the covid 19-diagnostics market in China is transforming how diagnostic services are delivered. Telemedicine and mobile health applications are becoming increasingly popular, allowing patients to access testing services remotely. This shift not only enhances convenience but also reduces the burden on healthcare facilities. As a result, the market is witnessing a surge in demand for at-home testing kits and digital platforms that facilitate remote consultations. Analysts suggest that this trend could lead to a market expansion of around 18% as more individuals opt for digital solutions in managing their health.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a key driver in the covid 19-diagnostics market in China. Partnerships between government agencies and private diagnostic companies are fostering innovation and improving testing capabilities. These collaborations often result in shared resources, knowledge, and technology, which can accelerate the development of new diagnostic tests. In 2025, such partnerships are expected to contribute to a market growth rate of approximately 14%, as they enhance the overall efficiency and effectiveness of diagnostic services, ensuring that the population has access to timely and accurate testing.