Growth of Renewable Energy Sources

The increasing integration of renewable energy sources into China's power grid is a significant driver for the busbar systems market. As the country aims to diversify its energy mix, the demand for efficient and reliable power distribution systems becomes critical. Busbar systems are essential for connecting renewable energy sources, such as solar and wind, to the grid, ensuring stable and efficient energy flow. In 2025, it is anticipated that renewable energy will account for over 30% of China's total energy consumption, necessitating advanced busbar solutions to manage the complexities of distributed generation. This shift towards renewables not only supports environmental goals but also propels the busbar systems market forward.

Government Initiatives and Regulations

The busbar systems market in China is significantly influenced by government initiatives aimed at improving energy efficiency and promoting sustainable practices. Regulatory frameworks encourage the adoption of advanced electrical systems, including busbars, which are recognized for their efficiency and safety. The Chinese government has set ambitious targets for reducing carbon emissions, which indirectly boosts the demand for innovative power distribution solutions. In 2025, investments in energy-efficient technologies are expected to reach $50 billion, with a substantial portion allocated to upgrading existing electrical infrastructure. This regulatory environment fosters growth in the busbar systems market, as companies seek to comply with stringent standards while enhancing their operational capabilities.

Industrial Expansion and Urban Development

The rapid industrial expansion and urban development in China are pivotal factors driving the busbar systems market. As cities grow and industries evolve, the demand for robust electrical distribution systems rises. Busbar systems are particularly suited for large-scale applications, providing a compact and efficient solution for power distribution in factories, commercial buildings, and urban infrastructure. In 2025, the construction sector is projected to contribute approximately $1 trillion to the economy, further stimulating the need for advanced electrical systems. This industrial growth not only enhances the busbar systems market but also supports the overall development of the energy infrastructure in China.

Rising Demand for Efficient Power Distribution

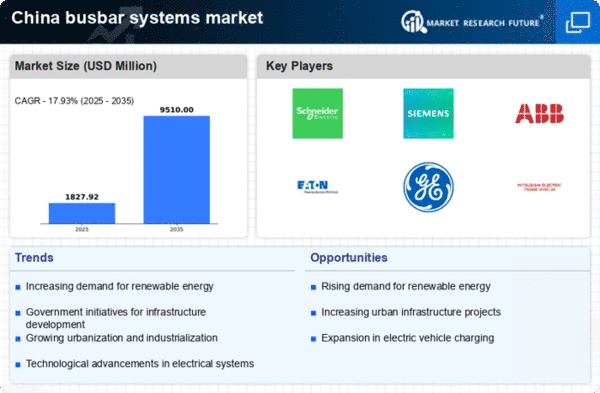

The busbar systems market in China experiences a notable surge in demand for efficient power distribution solutions. As urban areas expand and industrial activities increase, the need for reliable and effective electrical distribution systems becomes paramount. Busbar systems, known for their ability to handle high current loads with minimal losses, are increasingly favored in commercial and industrial applications. In 2025, the market is projected to grow at a CAGR of approximately 8%, driven by the necessity for enhanced energy efficiency and reduced operational costs. This trend indicates a shift towards modern electrical infrastructure, where busbar systems play a crucial role in meeting the energy demands of a rapidly developing economy.

Technological Innovations in Electrical Systems

Technological advancements in electrical systems are reshaping the busbar systems market in China. Innovations such as smart busbars, which incorporate monitoring and control technologies, enhance the efficiency and reliability of power distribution. These systems allow for real-time data analysis, enabling proactive maintenance and reducing downtime. In 2025, the market for smart busbar systems is expected to grow by 15%, reflecting the increasing adoption of digital technologies in the energy sector. This trend indicates a broader movement towards intelligent infrastructure, where busbar systems are integral to modernizing electrical grids and improving overall system performance.