Increasing Surgical Procedures

The rising number of surgical procedures in China is a pivotal driver for the biosurgery market. As the population ages and the prevalence of chronic diseases escalates, the demand for surgical interventions is likely to increase. In 2025, it is estimated that the number of surgical procedures could reach approximately 20 million annually, reflecting a growth rate of around 5% from previous years. This surge in surgical activity necessitates advanced biosurgical products, which are designed to enhance recovery and minimize complications. Consequently, the biosurgery market is poised to benefit from this trend, as healthcare providers seek innovative solutions to improve patient outcomes and operational efficiency.

Supportive Government Policies

Supportive government policies aimed at enhancing healthcare delivery are instrumental in shaping the biosurgery market. The Chinese government has introduced various initiatives to promote the development and adoption of innovative medical technologies, including biosurgical products. By 2025, policies encouraging research and development in the healthcare sector are expected to yield a favorable environment for market expansion. These initiatives may include funding for clinical trials and incentives for manufacturers to produce advanced biosurgical solutions. As a result, the biosurgery market is likely to thrive under these supportive frameworks, fostering innovation and improving patient care.

Rising Incidence of Trauma Cases

The rising incidence of trauma cases in China is a critical factor impacting the biosurgery market. With urbanization and increased road traffic, the number of traumatic injuries has surged, necessitating effective surgical interventions. In 2025, trauma cases are expected to account for a significant portion of surgical procedures, with estimates suggesting that over 30% of surgeries may be trauma-related. This trend underscores the need for biosurgical products that can facilitate rapid healing and minimize complications. As healthcare providers respond to this growing demand, the biosurgery market is likely to experience substantial growth.

Investment in Healthcare Infrastructure

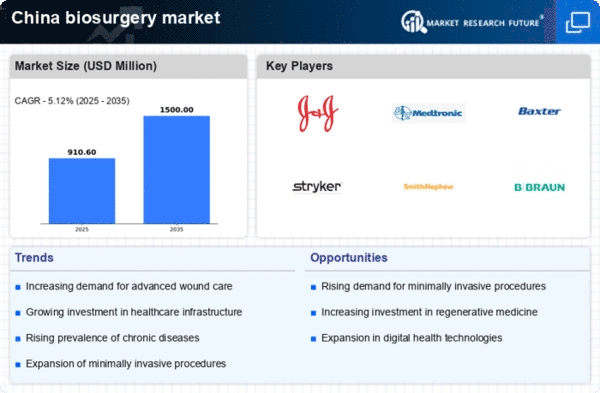

China's ongoing investment in healthcare infrastructure significantly influences the biosurgery market. The government has committed substantial resources to enhance healthcare facilities, aiming to improve access to advanced medical technologies. By 2025, healthcare expenditure is projected to exceed $1 trillion, with a notable portion allocated to surgical services and biosurgical innovations. This investment is expected to facilitate the adoption of cutting-edge biosurgical products, thereby driving market growth. Enhanced infrastructure not only supports the implementation of new technologies but also fosters an environment conducive to research and development, ultimately benefiting the biosurgery market.

Growing Awareness of Advanced Surgical Techniques

The increasing awareness of advanced surgical techniques among healthcare professionals and patients is a significant driver for the biosurgery market. Educational initiatives and training programs are being implemented to promote the benefits of biosurgical products, which are often associated with reduced recovery times and lower complication rates. As of 2025, it is estimated that approximately 60% of surgeons in China are familiar with biosurgical options, a figure that has risen steadily over the past few years. This growing knowledge base is likely to lead to higher adoption rates of biosurgical products, thereby propelling the market forward.