Government Defense Spending

In recent years, the Chinese government has significantly increased its defense budget, which has a direct impact on the battlefield management-system market. The focus on enhancing national security and military readiness has led to substantial investments in advanced military technologies. In 2025, China's defense spending is expected to reach approximately $250 billion, with a considerable portion allocated to upgrading battlefield management systems. This trend indicates a strong commitment to modernizing military infrastructure and capabilities, thereby creating a favorable environment for market growth. The increased funding is likely to facilitate the development and deployment of innovative solutions that enhance operational effectiveness and coordination among military units.

Rising Geopolitical Tensions

The battlefield management-system market in China is also influenced by rising geopolitical tensions in the Asia-Pacific region. As regional conflicts and territorial disputes escalate, there is a growing emphasis on enhancing military preparedness and response capabilities. This situation has prompted the Chinese military to invest in advanced battlefield management systems that can provide real-time intelligence and improve operational coordination. The market is expected to benefit from this heightened focus on defense readiness, as military forces seek to leverage technology to gain a strategic advantage. Analysts suggest that the increasing complexity of modern warfare necessitates sophisticated management systems to ensure effective command and control in dynamic environments.

Focus on Modernization of Armed Forces

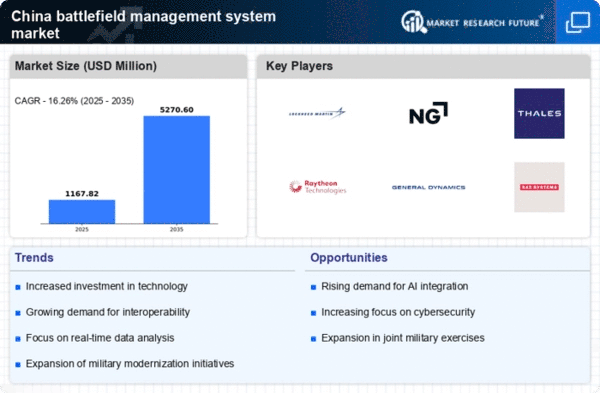

China's ongoing efforts to modernize its armed forces are significantly impacting the battlefield management-system market. The government has outlined ambitious plans to transform its military into a technologically advanced force by 2035. This modernization initiative includes the adoption of cutting-edge technologies and systems that enhance operational capabilities. As part of this strategy, investments in battlefield management systems are expected to rise, facilitating improved communication, data sharing, and situational awareness among military units. The market is likely to see a compound annual growth rate (CAGR) of around 7% as the armed forces prioritize the integration of advanced management solutions to support their modernization goals.

Increased Demand for Training and Simulation

The battlefield management-system market in China is witnessing increased demand for training and simulation solutions. As military operations become more complex, there is a growing recognition of the need for effective training programs that utilize advanced simulation technologies. These systems enable military personnel to practice and refine their skills in realistic environments, thereby enhancing operational readiness. The Chinese military is investing in simulation-based training solutions that integrate battlefield management systems, allowing for comprehensive training scenarios. This trend is expected to drive market growth, as the emphasis on preparedness and effective training becomes paramount in the face of evolving military challenges.

Technological Advancements in Defense Systems

The battlefield management-system market in China is experiencing a surge due to rapid technological advancements in defense systems. Innovations in communication technologies, sensor systems, and data analytics are enhancing situational awareness and decision-making capabilities for military operations. The integration of advanced technologies such as drones and satellite systems is expected to improve operational efficiency. According to recent estimates, the market is projected to grow at a CAGR of approximately 8.5% over the next five years, driven by the need for modernized military capabilities. This growth reflects the increasing demand for sophisticated battlefield management solutions that can provide real-time data and analytics, thereby improving strategic planning and execution in military operations.